- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Another closed loan causing another small decrease...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Another closed loan causing another small decrease in FICO8

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Another closed loan causing another small decrease in FICO8

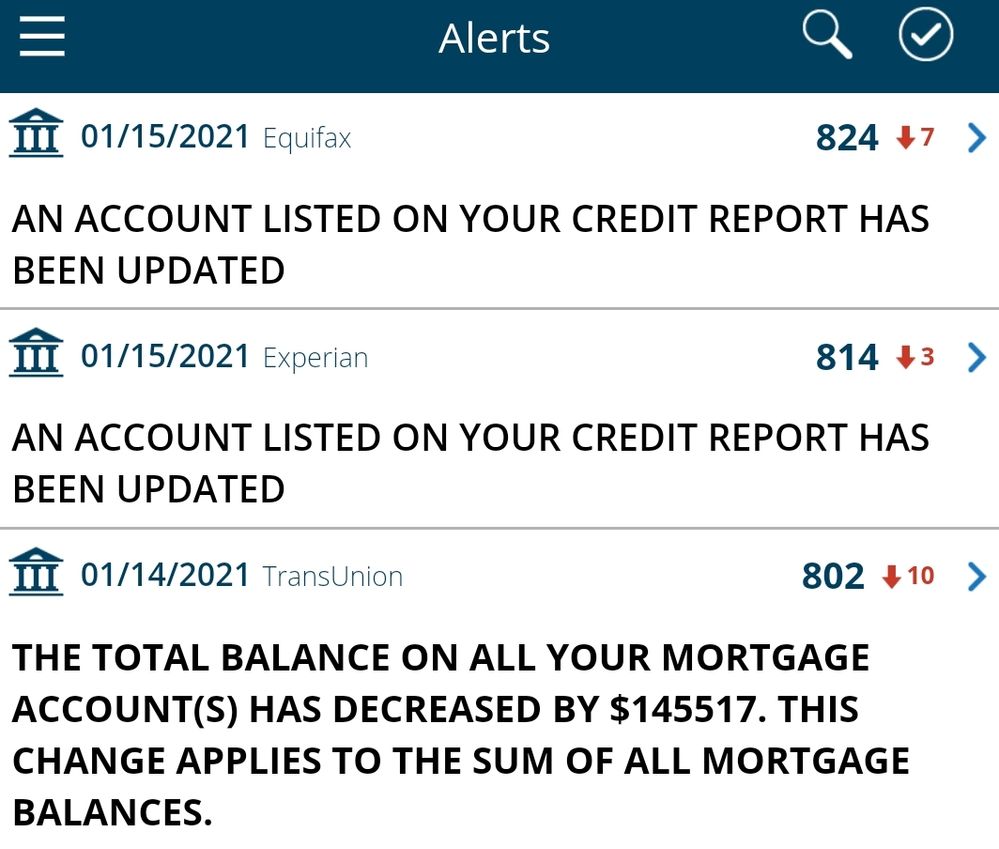

So I recently sold my rental property resulting in the mortgage being reported as paid/closed. As circumstances would happen I received notification of the closed loan well away from the reporting of any of my cards.

Contrary to popular belief my FICO 8 decreased a few points. I still have an open mortgage, auto loan and 2 personal loans. Original amount for the now closed mortgage was 161k

Don't ask about reason codes as myFICO doesn't supply them when your score is >800.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another closed loan causing another small decrease in FICO8

@dragontears wrote:So I recently sold my rental property resulting in the mortgage being reported as paid/closed. As circumstances would happen I received notification of the closed loan well away from the reporting of any of my cards.

Contrary to popular belief my FICO 8 decreased a few points. I still have an open mortgage, auto loan and 2 personal loans. Original amount for the now closed mortgage was 161k

Don't ask about reason codes as myFICO doesn't supply them when your score is >800.

Sorry I don't know what "popular belief" you feel you have challenged here.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another closed loan causing another small decrease in FICO8

@SouthJamaica wrote:

@dragontears wrote:So I recently sold my rental property resulting in the mortgage being reported as paid/closed. As circumstances would happen I received notification of the closed loan well away from the reporting of any of my cards.

Contrary to popular belief my FICO 8 decreased a few points. I still have an open mortgage, auto loan and 2 personal loans. Original amount for the now closed mortgage was 161k

Don't ask about reason codes as myFICO doesn't supply them when your score is >800.

Sorry I don't know what "popular belief" you feel you have challenged here.

Popular belief I am referring to is that closing loans have no effect on FICO 8 unless there is a change in total loan utilization. You have posted that belief before....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another closed loan causing another small decrease in FICO8

Are you saying that there was no shift at all in your aggregate installment loan utilization with the closure of the one loan?

Also as you are well aware, alert reasons aren't always tied to score changes and other things can be going on outside of reported balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another closed loan causing another small decrease in FICO8

@Anonymous wrote:Are you saying that there was no shift at all in your aggregate installment loan utilization with the closure of the one loan?

Also as you are well aware, alert reasons aren't always tied to score changes and other things can be going on outside of reported balances.

The shift was miniscule, I have a >300k mortgage that is less than a year old which overshadows all other loans.

Yes, I am fully aware that alerts and score changes are not always tied to each other. But my profile is pretty stable and there was no other changes that I can see.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another closed loan causing another small decrease in FICO8

The next thing I would look to then is your loan to revolver ratio before/after the loan closure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another closed loan causing another small decrease in FICO8

@Anonymous wrote:The next thing I would look to then is your loan to revolver ratio before/after the loan closure.

What is this loan to revolver ratio of which you speak, @Anonymous? I don’t think I've read about this yet and I'm curious -- you have a thread ink handy?

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another closed loan causing another small decrease in FICO8

Here's a thread that discusses revolver to loan ratio from a couple of months back:

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Ratio-of-loans-revolvers/td-p/6160271

My understanding is that it is believed that somewhere in the range of 3:1 or 4:1 is considered to be ideal. How much that may impact Fico scores I doubt anyone really knows at this point, especially across different scorecards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another closed loan causing another small decrease in FICO8

@Anonymous wrote:Here's a thread that discusses revolver to loan ratio from a couple of months back:

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Ratio-of-loans-revolvers/td-p/6160271

My understanding is that it is believed that somewhere in the range of 3:1 or 4:1 is considered to be ideal. How much that may impact Fico scores I doubt anyone really knows at this point, especially across different scorecards.

TY!

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another closed loan causing another small decrease in FICO8

@Anonymous wrote:The next thing I would look to then is your loan to revolver ratio before/after the loan closure.

Ok so 12 open cards

Before: 12 cards:5 loans = 2.4:1

After: 12 cards:4 loans = 3:1