- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Auto Insurance Score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Auto Insurance Score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Score

Our myFICO contributor Thomas Thumb posted the following over at Credit Karma back in Nov 2015. You'll see that an 810 is classified as Poor. It would be interesting to hear TT chime in on this thread now. Does he think that the interpretative range he received in Nov 2015 is likely to be roughly accurate today?

https://www.creditkarma.com/question/what-is-a-good-auto-insurance-score

Credit Karma's free credit based Auto insurance score comes directly from TransUnion (TU). I purchased my score direct from TU and it matches what CK lists. Listed below is an approximate rating breakdown by category [score range 150 to 950].

TU Auto insurance score .... Category Rating

895 and above .........................Very Good

860 to 894 ............................... Good

825 to 859 ................................ Fair

760 to 824 ................................ Poor

759 and below .......................... Very Poor

My Auto insurance score is 902 (from CK and direct from TU). For comparison my TU Fico 8 Auto enhanced score was 897 [range 250 to 900] and TU VantageScore 3.0 is 833 [range 300 to 850]

Note: credit based Auto insurance scores do not consider driving record or prior claim history. Insurance companies look at those factors and your zip code location to develop a composite risk score for determining insurability and premiums.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Score

@Anonymous wrote:Our myFICO contributor Thomas Thumb posted the following over at Credit Karma back in Nov 2015. You'll see that an 810 is classified as Poor. It would be interesting to hear TT chime in on this thread now. Does he think that the interpretative range he received in Nov 2015 is likely to be roughly accurate today?

https://www.creditkarma.com/question/what-is-a-good-auto-insurance-score

Credit Karma's free credit based Auto insurance score comes directly from TransUnion (TU). I purchased my score direct from TU and it matches what CK lists. Listed below is an approximate rating breakdown by category [score range 150 to 950].

TU Auto insurance score .... Category Rating

895 and above .........................Very Good

860 to 894 ............................... Good

825 to 859 ................................ Fair

760 to 824 ................................ Poor

759 and below .......................... Very Poor

Note: credit based Auto insurance scores do not consider driving record or prior claim history. Insurance companies look at those factors and your zip code location to develop a composite risk score for determining insurability and premiums.

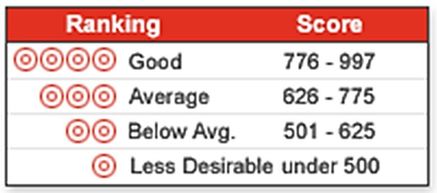

As one would expect rating classification for a given CBIS score ties to the model used to generate the score. No such thing as a universal score rating across CBIS models. Pasted below are CBIS ratings direct from the model creators.

The above table, culled from looking at CK summaries, remains a reasonable approximation of TU's official rating for Good and Very Good. However, it is overly harsh when assigning ratings of Fair, Poor and Very Poor based on letter grades from TU assuming [A = Very Good, B = Good, C = Fair, D= Poor, F = Very Poor]

For more discussion on CBIS look at posts in the below link

TransUnion CBIS (uses TransUnion CRA data and other info):

LexisNexis CBIS (uses Equifax CRA data and other info):

The above from LexisNexis lacks granularity.

Ultimately insurance companies segment score into finer increments such as done by West Bend insurance in the below chart:

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Score

@Anonymous wrote:Our myFICO contributor Thomas Thumb posted the following over at Credit Karma back in Nov 2015. You'll see that an 810 is classified as Poor. It would be interesting to hear TT chime in on this thread now. Does he think that the interpretative range he received in Nov 2015 is likely to be roughly accurate today?

https://www.creditkarma.com/question/what-is-a-good-auto-insurance-score

Credit Karma's free credit based Auto insurance score comes directly from TransUnion (TU). I purchased my score direct from TU and it matches what CK lists. Listed below is an approximate rating breakdown by category [score range 150 to 950].

TU Auto insurance score .... Category Rating

895 and above .........................Very Good

860 to 894 ............................... Good

825 to 859 ................................ Fair

760 to 824 ................................ Poor

759 and below .......................... Very Poor

My Auto insurance score is 902 (from CK and direct from TU). For comparison my TU Fico 8 Auto enhanced score was 897 [range 250 to 900] and TU VantageScore 3.0 is 833 [range 300 to 850]

Note: credit based Auto insurance scores do not consider driving record or prior claim history. Insurance companies look at those factors and your zip code location to develop a composite risk score for determining insurability and premiums.

Your auto insurance score is not correct. Please see below...

Smart Credit’s auto credit score range is between 350 and 850:

Great or Excellent

775-850

Good or Very Good

685-774

Normal or Average

615-684

Below Normal or Poor

515-614

Bad or Very Bad

350-514

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Insurance Score

@Medic981 wrote:

Your auto insurance score is not correct. Please see below...Smart Credit’s auto credit score range is between 350 and 850:

Great or Excellent

775-850

Good or Very Good

685-774

Normal or Average

615-684

Below Normal or Poor

515-614

Bad or Very Bad

350-514

You appear to be quoting from this page:

https://blog.smartcredit.com/2010/05/01/what-is-an-auto-credit-score/

...which is about Auto Credit Scores, not Auto Insurance Scores. Not the same thing. The ranges listed by CGID and TT are correct for the Transunion Auto Credit-Based Insurance Score (TU Auto CBIS). LexisNexis also has their own Auto Insurance Score product, with a different range.

Also, that page has several issues - it correctly mentions FICO Auto Industry Option Scores, but then proceeds to show a score range table based on 350-850. (But FICO Industry Options are on a 900-point scale.) It also tries to imply that their (paid!) service will provide those scores, when it fact it only supplies VantageScores and their own "house-brand" internal scores.

See section 7.1 here: https://www.smartcredit.com/help/terms-and-privacy/service-agreement.htm

7.1. Our Scores

When you become a Member, we will receive your VantageScore® Credit Score from one or more credit bureaus. However, we reserve the right to use our own internally developed score if necessary depending on the ability of a given credit report to generate a normal credit score.

All of our Scores may not be used to grant credit. They are estimates and are for educational purposes only.

It's basically creditkarma.com (EQ/TU) plus credit.com (EX), but with a monthly fee!

Looking at the rest of the "smartcredit" site... don't take them as a credible source for anything, and certainly don't pay them for anything!

The TU Auto CBIS from CreditKarma is at least a real insurance score, and CK doesn't charge for it (or for the EQ/TU VantageScores).

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06