- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Average Age of Accounts

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Average Age of Accounts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Average Age of Accounts

Is there a point where the average age of accounts goes from hurts to helps? My average age is 6 years because for the longest time I didn't use credit after getting myself in trouble financially with it.

I'm trying to get all 3 of ny FICO8 scores over 800. I'm at 802 with Experian. The other two are in the 770's.

June of 2022 they were around 615 all three. I've cleaned up a hell of a lot of baddies from the past and I've gotten a few cards under my belt. March 2022 I bought a house. Wish I had this new score back then! ![]()

Just last week I've payed all cards off except one which is at 3% utilization. Before the end of the month, I should be able to pay my auto loan down to 9%. Hoping this helps out, but it left me wondering about credit age. Preparing to purchase a newer used car in June of this year.

Thanks all. I've learned a ton here, and still learning!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts

@JasonK94Z wrote:Is there a point where the average age of accounts goes from hurts to helps? My average age is 6 years because for the longest time I didn't use credit after getting myself in trouble financially with it.

I'm trying to get all 3 of ny FICO8 scores over 800. I'm at 802 with Experian. The other two are in the 770's.

June of 2022 they were around 615 all three. I've cleaned up a hell of a lot of baddies from the past and I've gotten a few cards under my belt. March 2022 I bought a house. Wish I had this new score back then!

Just last week I've payed all cards off except one which is at 3% utilization. Before the end of the month, I should be able to pay my auto loan down to 9%. Hoping this helps out, but it left me wondering about credit age. Preparing to purchase a newer used car in June of this year.

Thanks all. I've learned a ton here, and still learning!

Yes there is such a point.

6 years didn't cut it for me. I imagine it's at 8 or 9 years, or in that neighborhood.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts

@SouthJamaica wrote:

@JasonK94Z wrote:Is there a point where the average age of accounts goes from hurts to helps? My average age is 6 years because for the longest time I didn't use credit after getting myself in trouble financially with it.

I'm trying to get all 3 of ny FICO8 scores over 800. I'm at 802 with Experian. The other two are in the 770's.

June of 2022 they were around 615 all three. I've cleaned up a hell of a lot of baddies from the past and I've gotten a few cards under my belt. March 2022 I bought a house. Wish I had this new score back then!

Just last week I've payed all cards off except one which is at 3% utilization. Before the end of the month, I should be able to pay my auto loan down to 9%. Hoping this helps out, but it left me wondering about credit age. Preparing to purchase a newer used car in June of this year.

Thanks all. I've learned a ton here, and still learning!Yes there is such a point.

6 years didn't cut it for me. I imagine it's at 8 or 9 years, or in that neighborhood.

That figures. Hopefully paying the car loan down below 9% and AZEO gets my other two scores to 800. Big goal for me!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts

@JasonK94Z wrote:Is there a point where the average age of accounts goes from hurts to helps? My average age is 6 years because for the longest time I didn't use credit after getting myself in trouble financially with it.

I'm trying to get all 3 of ny FICO8 scores over 800. I'm at 802 with Experian. The other two are in the 770's.

June of 2022 they were around 615 all three. I've cleaned up a hell of a lot of baddies from the past and I've gotten a few cards under my belt. March 2022 I bought a house. Wish I had this new score back then!

Just last week I've payed all cards off except one which is at 3% utilization. Before the end of the month, I should be able to pay my auto loan down to 9%. Hoping this helps out, but it left me wondering about credit age. Preparing to purchase a newer used car in June of this year.

Thanks all. I've learned a ton here, and still learning!

"My average age is 6 years because for the longest time I didn't use credit after getting myself in trouble financially with it. " Usage has nothng to do with AAOA's. The years you can put between your oldest credit card account, the more your score will benefit. As you add new credit, however, your average will drop. While there is no golden number to aim for, getting your average age of credit to between six and 10 years is probably a good goal. Under 2 yrs is a hit its been said.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts

@JasonK94Z, are your reports completely clean? I ask because a year ago at this time the only lines of credit showing up on my reports were three credit cards and an SSL and my AAoA was about 2 years, even still I had all of my FICO scores up between 810 and 850. Since then I've payed off the SSL and added two credit cards as well as a car loan; those three new lines have hurt my scores by lowering my AAoA, the associated hard pulls for credit, and of course the high percentage balance of the car loan; even still my scores range between 770 and 820. I would think your scores should be even higher than mine were with your much longer AAoA.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts

@Horseshoez wrote:@JasonK94Z, are your reports completely clean? I ask because a year ago at this time the only lines of credit showing up on my reports were three credit cards and an SSL and my AAoA was about 2 years, even still I had all of my FICO scores up between 810 and 850. Since then I've payed off the SSL and added two credit cards as well as a car loan; those three new lines have hurt my scores by lowering my AAoA, the associated hard pulls for credit, and of course the high percentage balance of the car loan; even still my scores range between 770 and 820. I would think your scores should be even higher than mine were with your much longer AAoA.

I have 4 hard pulls on record during the last 15 months. 3 cards, one mortgage pull. 2 of the card pulls and the mortgage pull are now a year old or a little more.

Everything else is squeaky clean.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts

@JasonK94Z wrote:

@Horseshoez wrote:@JasonK94Z, are your reports completely clean? I ask because a year ago at this time the only lines of credit showing up on my reports were three credit cards and an SSL and my AAoA was about 2 years, even still I had all of my FICO scores up between 810 and 850. Since then I've payed off the SSL and added two credit cards as well as a car loan; those three new lines have hurt my scores by lowering my AAoA, the associated hard pulls for credit, and of course the high percentage balance of the car loan; even still my scores range between 770 and 820. I would think your scores should be even higher than mine were with your much longer AAoA.

I have 4 hard pulls on record during the last 15 months. 3 cards, one mortgage pull. 2 of the card pulls and the mortgage pull are now a year old or a little more.

Everything else is squeaky clean.

Hmmm, I'm surprised your scores are so low (relatively speaking).

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts

@Horseshoez wrote:@JasonK94Z, are your reports completely clean? I ask because a year ago at this time the only lines of credit showing up on my reports were three credit cards and an SSL and my AAoA was about 2 years, even still I had all of my FICO scores up between 810 and 850. Since then I've payed off the SSL and added two credit cards as well as a car loan; those three new lines have hurt my scores by lowering my AAoA, the associated hard pulls for credit, and of course the high percentage balance of the car loan; even still my scores range between 770 and 820. I would think your scores should be even higher than mine were with your much longer AAoA.

Two years and five years are important milestones for AAoA and AoOA. My daughter has 2 cards only opened 1 month apart. She saw a nice spike up in score at 2 & 5 years. Unfortunately, she did not isolate AoYA, AAoA and AoOA because they are so close together.

Side note: This may be a bit surprising but, AoYA is viewed negatively until it reaches 5 years. It was not until 5 years that it stopped showing up as a negative reason statement on my Fico reports. So, what does that mean for AAoA and AoOA? I would surmize they would require greater aging. Perhaps 7.5 or 8 years for AAoA.

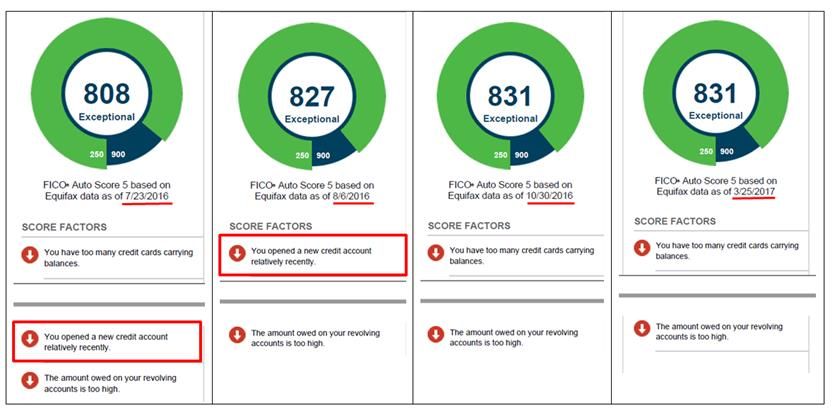

See below for AoYA - most recent account opened 9/2011. Note date when the "new account recently" reason statement stopped showing up.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts

@Horseshoez wrote:

@JasonK94Z wrote:

@Horseshoez wrote:@JasonK94Z, are your reports completely clean? I ask because a year ago at this time the only lines of credit showing up on my reports were three credit cards and an SSL and my AAoA was about 2 years, even still I had all of my FICO scores up between 810 and 850. Since then I've payed off the SSL and added two credit cards as well as a car loan; those three new lines have hurt my scores by lowering my AAoA, the associated hard pulls for credit, and of course the high percentage balance of the car loan; even still my scores range between 770 and 820. I would think your scores should be even higher than mine were with your much longer AAoA.

I have 4 hard pulls on record during the last 15 months. 3 cards, one mortgage pull. 2 of the card pulls and the mortgage pull are now a year old or a little more.

Everything else is squeaky clean.Hmmm, I'm surprised your scores are so low (relatively speaking).

I am not...I mean thats a lot of activity and 4 new accounts...My AAOA is 4 years 3 months and have been in the garden for 3+ years 1% debt across all 3 and only Ex is 801, while EQ & TU are at 797

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts

You're probably right. I have had a good bit of activity over the past 15 months. I have not had any activity in about 10 months though. I had to settle things down after the mortgage and the last card I got.

Hoping that paying the auto loan down to 9% gets my equifax and transunion a good boost to get me to 800+. I have no choice in having to buy a new used car this summer unfortunately.