- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Big drop due to util increase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Big drop due to util increase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Big drop due to util increase

My util was at 12% and socres remained unchanged. I had some items to buy and that put my util to 15%

20 points drop with everything else staying the same.

The 30% of the FICO factor killed me. Time to pay down the card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Big drop due to util increase

Sept 2024: EX8: 847; EQ8: 850; TU8: 848 -- Middle Mortgage Score: 821

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Big drop due to util increase

I don't believe that all the points lost will be gained right away when utiliz returns to where it was.

If I run up $10k in debt and lose 20 pts, and then 35 days later I pay off the full $10k, from past experience, I might get half of the points back right away.

Seems it always takes more time to get back what was lost.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Big drop due to util increase

And that's a bummer. My hard earned FICO points and I lose 20.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Big drop due to util increase

I experienced a 20 point drop across the board due to the addition of a Discover it that was used for a balance transfer. Although my overall utilization and credit balances remained the same, but the utilizaton on the Discover it card was 96%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Big drop due to util increase

@EW800 wrote:

Sorry to hear that. Thankfully, Util has no memory, therefore easily fixable once your get the balances down again. ![]()

@racer-x wrote:I don't believe that all the points lost will be gained right away when utiliz returns to where it was.

If I run up $10k in debt and lose 20 pts, and then 35 days later I pay off the full $10k, from past experience, I might get half of the points back right away.

Seems it always takes more time to get back what was lost.

I'm on the reverse end. Util has been horrible, working to get it better. I've never paid my 'everyday use' cards to zero, I've paid last month's statement. I hadn't realized there was a difference to my credit. Now I know better.

I feel a push to payoffeverythingallatoncetheskyisfalling. But there's no reason I need my score to be super RIGHT NOW. I'm trying to position myself to do a refi in a few months, maybe. So I'm trying to convince myself it's better to leave more in savings and not scurry to pay down more on my 0% this month. If I keep working on getting my util lower and lower over the next couple months, that'll be good enough. And safer to keep a bit more cash on hand.

Am I thinking this through correctly?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Big drop due to util increase

@Anonymous wrote:@EW800 wrote:

Sorry to hear that. Thankfully, Util has no memory, therefore easily fixable once your get the balances down again.

@racer-x wrote:I don't believe that all the points lost will be gained right away when utiliz returns to where it was.

If I run up $10k in debt and lose 20 pts, and then 35 days later I pay off the full $10k, from past experience, I might get half of the points back right away.

Seems it always takes more time to get back what was lost.

I'm on the reverse end. Util has been horrible, working to get it better. I've never paid my 'everyday use' cards to zero, I've paid last month's statement. I hadn't realized there was a difference to my credit. Now I know better.

I feel a push to payoffeverythingallatoncetheskyisfalling. But there's no reason I need my score to be super RIGHT NOW. I'm trying to position myself to do a refi in a few months, maybe. So I'm trying to convince myself it's better to leave more in savings and not scurry to pay down more on my 0% this month. If I keep working on getting my util lower and lower over the next couple months, that'll be good enough. And safer to keep a bit more cash on hand.

Am I thinking this through correctly?

That's one way to think about it, another way is your probably paying a lot of $$ interest each month, that's how I felt so I paid my util down from 80% to 9% on one card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Big drop due to util increase

@tonyjones wrote:

@Anonymous wrote:@EW800 wrote:

Sorry to hear that. Thankfully, Util has no memory, therefore easily fixable once your get the balances down again.

@racer-x wrote:I don't believe that all the points lost will be gained right away when utiliz returns to where it was.

If I run up $10k in debt and lose 20 pts, and then 35 days later I pay off the full $10k, from past experience, I might get half of the points back right away.

Seems it always takes more time to get back what was lost.

I'm on the reverse end. Util has been horrible, working to get it better. I've never paid my 'everyday use' cards to zero, I've paid last month's statement. I hadn't realized there was a difference to my credit. Now I know better.

I feel a push to payoffeverythingallatoncetheskyisfalling. But there's no reason I need my score to be super RIGHT NOW. I'm trying to position myself to do a refi in a few months, maybe. So I'm trying to convince myself it's better to leave more in savings and not scurry to pay down more on my 0% this month. If I keep working on getting my util lower and lower over the next couple months, that'll be good enough. And safer to keep a bit more cash on hand.

Am I thinking this through correctly?

That's one way to think about it, another way is your probably paying a lot of $$ interest each month, that's how I felt so I paid my util down from 80% to 9% on one card.

Nope. No interest. There was one card with interest that is being partially paid off this week and partially transferred to a Discover 0%. Just need to balance paying the every day cards down to zero (rather than last month's statement, which avoids interest) and staying ahead of 0% offers ending.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Big drop due to util increase

@CS800 wrote:My util was at 12% and socres remained unchanged. I had some items to buy and that put my util to 15%

20 points drop with everything else staying the same.

The 30% of the FICO factor killed me. Time to pay down the card.

Look at the bright side. You have new items and Fico has absolute no memory for utilization. Enjoy your new items now and once the cards are paid down enjoy the new Fico scores ...like this you have double joy...lol.

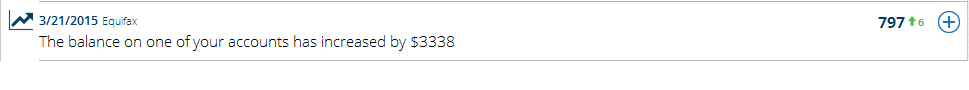

Sometimes alerts do not really match or are delayed and therefore the reason of the alerts do not make any sense as in my example. I managed to generate a score increase with a balance increase ![]() ..but I can see why Fico was confused.

..but I can see why Fico was confused.