- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Breakpoints on number of cards w/balance?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Breakpoints on number of cards w/balance?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Breakpoints on number of cards w/balance?

I'm just curious if there is any data on breakpoints for the percentage of cards reporting a balance besides the typical less than 50% or just 1 card reporting?

I recently moved my balances to one card. I had 5 of 16 reporting a balance so 31.25%. The first of the zero balances reported today and my EQ & EX spiked 5 points. At this point, that would be 25% of my cards showing a balance. It was a small Apple promo balance so it wasn't enough to put me in another tier with utlization and there's no apps or aging milestones to be a triggering event although I realize it is not always evident what causes a change.

It has made me curious if there are breakpoints that same way there are aggregate UT ones.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Breakpoints on number of cards w/balance?

I too am curious whether there has been any repeated studies done by multiple persons (and hailing from a variety of profile types).

If there is indeed a breakpoint at < 25% then the best advice for any person building credit is to get at least four cards, rather than the usual advice we give of at least three.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Breakpoints on number of cards w/balance?

@Anonymous wrote:I too am curious whether there has been any repeated studies done by multiple persons (and hailing from a variety of profile types).

If there is indeed a breakpoint at < 25% then the best advice for any person building credit is to get at least four cards, rather than the usual advice we give of at least three.

That is exactly what I was thinking. If there are even more breakpoints, then the optimal amount of cards could be even higher. I wish I was able to see how it affects my score as each one reports, but the card retaining my balance will report before 3 of the 4 remaining 0 balances and it will be 47% so that's another variable that throws off my ability to test is fully. I'd love to see some data though!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Breakpoints on number of cards w/balance?

I would be interested to know the real answer to this test as well.

When we speak of these break points, are we talking less than that percentage or less than OR equal to?

For example, someone with exactly 4 cards... reporting 1 balance compared to reporting 2 balances... if it's less than or equal to 50% then such an individual in theory could let 2 cards report a balance and still possess an equal score to what they would have if they only let 1 report. However, if it's LESS than (but not equal to) 50%, they would have to let only 1 report to achieve maximum points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Breakpoints on number of cards w/balance?

I have looked at impact of # cards reporting relative to EQ which appears to tweak the Fico models to be more sensitive to # (%) of cards reporting balances. See below table.

My profile is rather stable with all AAoA, oldest and youngest account thresholds having been exceeded years ago. I maintain Ag UT in the 1% to 6% range and don't believe UT% is influencing scores. The lone INQ may have an effect (note EQ 04 score difference with 3 cards reporting with/without INQ).

Edit Correction: The EQ Bankcard scores are Bankcard Fico 08, I had a mental lapse and originally listed them as Bankcard Fico 04. (my EQ Bankcard 04 scores swing - just like the EQ Classic 04 scores. I added the BC 04 scores to the left of the BC 08 scores).

For my profile, EQ Fico 04 score is affected by % of cards reporting once the 50% level is exceeded (greater than 50%).

a) 2 of 6 => 3 of 6, 0 point drop [33% to 50%]

b) 3 of 6 => 4 of 6, 5 point drop [50% to 67%]

c) 4 of 6 => 5 of 6, 17 point additional drop [67% to 83%]

d) 5 of 6 => 6 of 6, 23 (or 10) point additional drop ... - INQ likely influencing drop by up to 13 points [83% to 100%]

- score 796 at 3 of 6 reporting with 1 INQ vs 809 at 3 of 6 reporting with 0 INQ

Side note AU card not counting in # reporting for Fico 08. However, this card faithfully reports a balance every month. So, for Fico 08 subtract one from # reporting and total count (example, Oct-16 would be 3 of 5)

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Breakpoints on number of cards w/balance?

On my file for FICO 8 I haven't seen a breakpoint on either EX or TU lower than 50%.

I do have one on EQ FICO 8 at either 25% or 33%; never did go back to firmly nail that one down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Breakpoints on number of cards w/balance?

@Thomas_Thumb wrote:I have looked at impact of # cards reporting relative to EQ which appears to tweak the Fico models to be more sensitive to # (%) of cards reporting balances. See below table.

My profile is rather stable with all AAoA, oldest and youngest account thresholds having been exceeded years ago. I maintain Ag UT in the 1% to 6% range and don't believe UT% is influencing scores. The lone INQ may have an effect (note EQ 04 score difference with 3 cards reporting with/without INQ).

For my profile, EQ Fico 04 score is affected by % of cards reporting once the 50% level is exceeded (greater than 50%).

a) 2 of 6 => 3 of 6, 0 point drop

b) 3 of 6 => 4 of 6, 5 point drop

c) 4 of 6 => 5 of 6, 17 point additional drop

d) 5 of 6 => 6 of 6, 23 (or 10) point additional drop ... - INQ likely influencing drop by up to 13 points

- score 796 at 3 of 6 reporting with 1 INQ vs 809 at 3 of 6 reporting with 0 INQ

Side note AU card not counting in # reporting for Fico 08. However, this card faithfully reports a balance every month. So, for Fico 08 subtract one from # reporting and total count (example, Oct-16 would be 3 of 5)

You really need to determine whether that is counting or not my forum friend, myFICO interface isn't sufficient when it comes to data analysis.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Breakpoints on number of cards w/balance?

@Anonymous wrote:I too am curious whether there has been any repeated studies done by multiple persons (and hailing from a variety of profile types).

If there is indeed a breakpoint at < 25% then the best advice for any person building credit is to get at least four cards, rather than the usual advice we give of at least three.

Which is why I've historically suggested getting 5 cards is better than 3 ![]() .

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Breakpoints on number of cards w/balance?

@Thomas_Thumb wrote:I have looked at impact of # cards reporting relative to EQ which appears to tweak the Fico models to be more sensitive to # (%) of cards reporting balances. See below table.

My profile is rather stable with all AAoA, oldest and youngest account thresholds having been exceeded years ago. I maintain Ag UT in the 1% to 6% range and don't believe UT% is influencing scores. The lone INQ may have an effect (note EQ 04 score difference with 3 cards reporting with/without INQ).

For my profile, EQ Fico 04 score is affected by % of cards reporting once the 50% level is exceeded (greater than 50%).

a) 2 of 6 => 3 of 6, 0 point drop

b) 3 of 6 => 4 of 6, 5 point drop

c) 4 of 6 => 5 of 6, 17 point additional drop

d) 5 of 6 => 6 of 6, 23 (or 10) point additional drop ... - INQ likely influencing drop by up to 13 points

- score 796 at 3 of 6 reporting with 1 INQ vs 809 at 3 of 6 reporting with 0 INQ

Side note AU card not counting in # reporting for Fico 08. However, this card faithfully reports a balance every month. So, for Fico 08 subtract one from # reporting and total count (example, Oct-16 would be 3 of 5)

T_T, thank you for that amazing and valuable chart, showing a swing of 45 points in your mortgage score depending on whether it's 2, 3, 4, 5, or 6 cards reporting.

Question: how come you haven't tried:

1 out of 6 reporting

0 out of 6 reporting

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Breakpoints on number of cards w/balance?

I had only an AU card and a charge card report one month. The AU card was not included in Fico 08 card count but, the charge card was included in count. Neither were included in utilization which was pegged at 0% although $1997 reported on AMEX and something like $560 on the AU card.

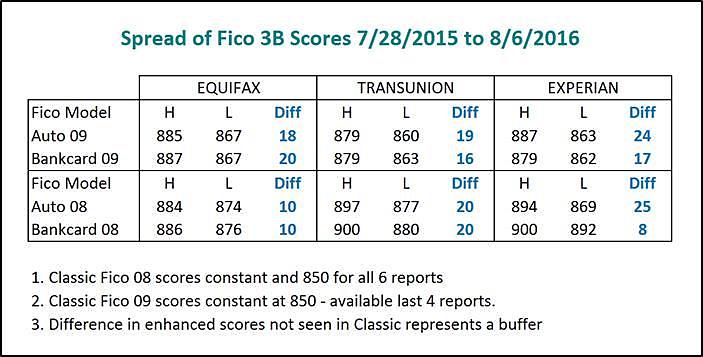

My Fico 08 bankcard and Auto scores took a hit at 0% UT but, Fico 08 classic held at 850 across the board. I posted the below previously as an attempt to look at Classic Fico 08 and Fico 09 buffers. My conclusion was Fico 08/Fico 09 appears to have 20 points worth of buffer on EQ, TU and 25 points worth on EX

My wife controls the card I am AU on and strongly believes this forum is a waste of my time as credit is not an issue. She as I believe in PIF after balances report. She allows all charges to report naturally and that's the way it always has been and always will be. So, no chance of that not reporting.

As for my cards, I did have a month with only the AMEX charge reporting (no revolvers) - that was when Ag UT reported at 0%. Again, I am not a pre-pay before statement cuts advocate, and therefore may not ever be at zero cards with balances.

However, I am mildly curious if I could reach 817 on Classic EQ Fico 04 with only the AU card reporting.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950