- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Credit Gurus who are good at "the game" - I need a...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Gurus who are good at "the game" - I need advice re: a good standing item aging off soon

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gurus who are good at "the game" - I need advice re: a good standing item aging

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gurus who are good at "the game" - I need advice re: a good standing item aging

@Anonymous wrote:

I'm not sure what impact it will actually have. My student loans when paid and off the CR had zero effect my scores. Just my two cents.

They've been paid off for years. I mean they will age off my report totally.

At least I think that's how it works

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gurus who are good at "the game" - I need advice re: a good standing item aging

@calyx wrote:

@moosemoney wrote:

@calyx wrote:Completely unhelpful comment, but thanks for sharing that spreadsheet/chart. I always love seeing how other members track their information and like to see if maybe it's something I want to incorporate.

I've become somewhat obsessed with my credit and have many spreadsheets to track changes and how they affect my score, along with things upcoming and things I want to do at certain timeframes. This is my "master sheet" that just lists everything in my report and I refer back to it all the time.

I, too, have a ridiculous number of spreadsheets tracking things and changes and what I'd like to do upcoming.

Spreadsheet nerds, unite!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gurus who are good at "the game" - I need advice re: a good standing item aging

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gurus who are good at "the game" - I need advice re: a good standing item aging

@moosemoney wrote:I have a student loan on my report that will be aging off in January that is reporting to both TU and EQ but not EX. It was paid in full with perfect payment history, so it's a pretty important item. I think the reason my EX score is my lowest is because the loan is not reporting to them (but that's just a theory).

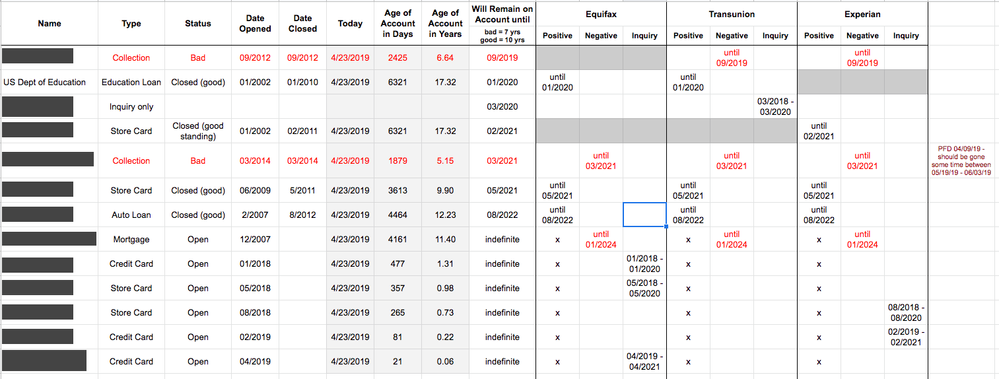

Below is a quick spreadsheet of everything in my report (as of today my AAoA is 6.94 years):

(the red "negative" items on my mortgage are late payments up to 12/2016 - perfect payments since then)

I'm pretty sure I'm gonna take a hit when this ages off, in both my AAoA and I assume in my Credit Mix as well. What is something I can do to lessen the blow? Now that I am at a good place credit-wise, I'm willing to play the "credit game."

In my opinion there's nothing you can do to lessen the blow of an account aging off.

There is something you can refrain from doing, which is applying for new credit of any kind.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 684 EX 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gurus who are good at "the game" - I need advice re: a good standing item aging

Slightly off topic.

Regarding your two collections. Have you confirmed that the "Date Opened" is the "DOFD"?

You can contact TU for an early deletion 6 month prior to the fall off date and Experian about 3 months prior.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 813 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gurus who are good at "the game" - I need advice re: a good standing item aging

@sjt wrote:Slightly off topic.

Regarding your two collections. Have you confirmed that the "Date Opened" is the "DOFD"?

You can contact TU for an early deletion 6 month prior to the fall off date and Experian about 3 months prior.

Yes, I have. That actually isn't the "date opened" on them, that is the DOFD for the collections.

I was considering going for EE on the oldest collection but I've heard horror stories of not only the item not being removed early, but the clock resetting (not sure how true that is but I don't want to risk it), so I'm just going to let them age off naturally.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gurus who are good at "the game" - I need advice re: a good standing item aging

@moosemoney wrote:

@sjt wrote:Slightly off topic.

Regarding your two collections. Have you confirmed that the "Date Opened" is the "DOFD"?

You can contact TU for an early deletion 6 month prior to the fall off date and Experian about 3 months prior.

Yes, I have. That actually isn't the "date opened" on them, that is the DOFD for the collections.

I was considering going for EE on the oldest collection but I've heard horror stories of not only the item not being removed early, but the clock resetting (not sure how true that is but I don't want to risk it), so I'm just going to let them age off naturally.

The clock ticks from the DOFD and that will NOT change. Id call TU and get an early deletion now and call Experian 3-4 month prior.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 813 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gurus who are good at "the game" - I need advice re: a good standing item aging

When it isn’t reported, a dispute if it updates the tradeline can make it look “new” to the algorithm: that was the horror stories I remember seeing especially on older algorithms; that said the data is better now than it used to be.

I don’t think an EE is a dispute though, I could be wrong on that but I can’t recall failures in the process.

Anyway if one doesn’t need a credit check anytime soon I would just let it fall off naturally, but on the flip side there is no penalty if you don’t need to leverage your credit as any update would still fall off at the same 7.5 years or whatever in this case... so there is little impact to taking the shot.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content