- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Credit mix - what am I missing?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit mix - what am I missing?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

@Remedios wrote:@Anonymous I did not interpret it as disrespect. While i really meant what I said about SJ, rest was a joke involved abundant use of the word "excellent", mainly because I find those descriptors useless.

While they do tell you that everything is not optimized, they offer very little guidance on why.

Hope that clarifies it.

Your use of the word "excellent" is exceptional ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

@Anonymous wrote:

Over the next few years as I slowly rebuild, I will continue to check my, "Credit mix," rating.

There's nothing wrong with that. Just know that it's completely possible (and likely probable) that moving from a "very good" to an "exceptional" rating on this from fluff summary software likely won't impact your FICO score a single point. While I know it feels good to see a bunch of "exceptional" tags from a CMS, it's important to understand their irrelevance at times.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

@Anonymous wrote:ITD and BBS, thank you for the responses. Just wanted to ensure I had all of the bases covered.

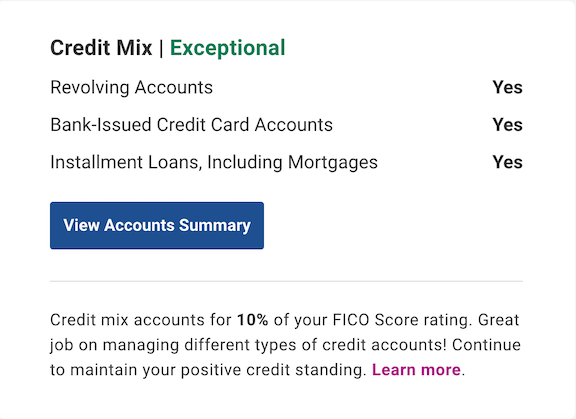

Within the requirements backlog of Experian's website content product manager, there had to be some method to attain Exceptional in Experian's category rating? Despite the fluff of their made-up descriptions, I would agree with the assignment of their ratings to my other categories. I wonder if anyone out there in MyFico land has Exceptional in this category, and would be curious to learn about their credit mix.

Mine is Exceptional; and I don't have a mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

My mix is exceptional and I’ve got 10 open accounts that are all revolvers (9 CCs, 1 CLOC) and 1 closed installment that was a personal loan for $2500 from 8/2017 to 1/2019.

I think its a bunch of hogwash. 🤷♂️

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

No "exceptional" for me ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

@Anonymous wrote:My mix is exceptional and I’ve got 10 open accounts that are all revolvers (9 CCs, 1 CLOC) and 1 closed installment that was a personal loan for $2500 from 8/2017 to 1/2019.

I think its a bunch of hogwash. 🤷♂️

This data above proves that the whole "rating" system is BS. With no open installment loan, we know that Saeren is missing out on FICO points and that from a credit mix standpoint there are opportunities.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

Hi BBS! The closed installment loan contributes towards Credit Mix as much as an open one does. What an open loan does for you (that a closed loan cannot) is give you the ability to have a 1-9% installment utilization. That scoring factor is part of the much larger "Amounts Owed" category -- rather than Credit Mix.

But of course you are still right that the front-end summary page of pretty much every credit monitoring service is typically worthless in its assessment of how good a person is being (Excellent, Fair, whatever).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

1 closed installment loan and 2 open revolving accounts also equals 'Very Good'.

With 1 open installment loan and 0 revolving accounts it was 'Fair' (only 1 account on file). That was 4 months ago - 12/23/18.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

@Anonymous wrote:I'mTheDevil made an interesting guess (post #2) which was that the front-end software might be including "number of accounts" as a scoring factor -- and if so, it might well be parking this in the Credit Mix category.

Although as BBS and others have observed, the programmers of any front-end summary page often invent scoring factors that do not exist at all inside the back-end algorithm that generates the score (or if they do exist, have a very different weight), there is in this case some evidence that "number of accounts" does in fact matter. Contributor Thomas Thumb and others have discussed this based on explicit negative reason statements that they see. Last I remember the guess was that a small penalty exists when you have only (say) 4-5 open accounts or if your total number of closed and open accounts together was fewer than (say) 9.

Curiously there also appears to be a small penalty (detected from an analysis of reason codes by Revelate) when you have too many accounts as well. The sweet spot may be something like at least 8 open accounts and at least 10 total accounts, but no more than 17 open accounts.

PS. When a person's "number of accounts" is quite small (e.g. 1-3 accounts) then it can have a far more pronounced effect on that person's score, by shunting him into a scorecard reserved for very "thin" profiles. Our OP has enough accounts to not be considered thin in that sense.

If there is a "too many accounts" penalty, I am certainly getting it, having around 60 open and closed accounts in my report, but it's not reflected in the "credit mix" reason code on EX, where I am designated by the front end software as "exceptional" in the "credit mix" department.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit mix - what am I missing?

@Anonymous wrote:Hi BBS! The closed installment loan contributes towards Credit Mix as much as an open one does. What an open loan does for you (that a closed loan cannot) is give you the ability to have a 1-9% installment utilization. That scoring factor is part of the much larger "Amounts Owed" category -- rather than Credit Mix.

But of course you are still right that the front-end summary page of pretty much every credit monitoring service is typically worthless in its assessment of how good a person is being (Excellent, Fair, whatever).

Good to know. I always thought that for credit mix to be satisfied that an open installment loan had to be present. Is the same true of a revolver? What if a person has only open installment loans and no open revolvers, but has 1 closed revolver on their file... would that still satisfy "credit mix?"