- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Curious 25 point rise in EQ Vantage

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Curious 25 point rise in EQ Vantage

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Curious 25 point rise in EQ Vantage

My Vantage points rarely move more than a few points in either direction. Today my EQ Vantage 3.0 shot up 25 points but I can't for the life of me figure out why.

Can't detect any change in accounts or significant change in utilization over last week.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curious 25 point rise in EQ Vantage

Some other yet built-in or undiscovered threshold related to time period? Duration or length of a card's history maybe?

Grabbing at straws here (as is usual for me) but that would be my first uneducated guess.

As wonky as I've found Vantage Score for my profile, a first reported and later removed PR was worth a full 100 point swing for me.

I try to draw some useful criteria from the usual Guru's efforts in here on this particular scoring measure myself, but I don't dare make any determinations on my own without reading their opinions and estimations first ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curious 25 point rise in EQ Vantage

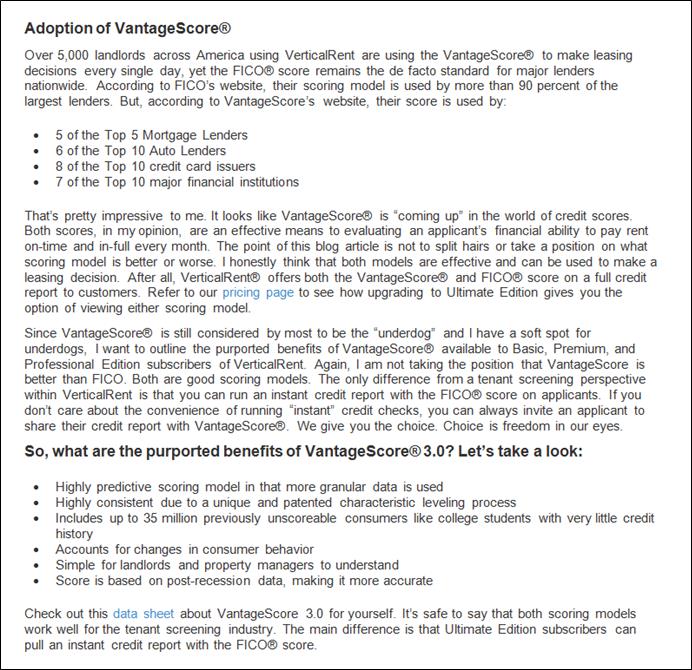

mine's all over the place, here's a couple years worth of both v3 n fico...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curious 25 point rise in EQ Vantage

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curious 25 point rise in EQ Vantage

After studying the Credit Karma "credit factors" I noticed that it's calling my utilization 0% based on a figure of $911 in revolving debt, while previously it was calling my utilization 1% based on around $2600 in revolving debt.

That's the closest thing to a change I can detect.

But interestingly in looking at the "accounts" it shows the balances totalling $2600 rather than $911.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curious 25 point rise in EQ Vantage

@elim wrote:mine's all over the place, here's a couple years worth of both v3 n fico...

Thanks.

Nice chart ![]()

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curious 25 point rise in EQ Vantage

@SouthJamaica wrote:My Vantage points rarely move more than a few points in either direction. Today my EQ Vantage 3.0 shot up 25 points but I can't for the life of me figure out why.

Can't detect any change in accounts or significant change in utilization over last week.

Vantage means squat.

Ignore it and move on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curious 25 point rise in EQ Vantage

@dlm0820 wrote:

@SouthJamaica wrote:My Vantage points rarely move more than a few points in either direction. Today my EQ Vantage 3.0 shot up 25 points but I can't for the life of me figure out why.

Can't detect any change in accounts or significant change in utilization over last week.

Vantage means squat.

Ignore it and move on.

You do have a point there ![]()

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curious 25 point rise in EQ Vantage

@dlm0820 wrote:

@SouthJamaica wrote:My Vantage points rarely move more than a few points in either direction. Today my EQ Vantage 3.0 shot up 25 points but I can't for the life of me figure out why.

Can't detect any change in accounts or significant change in utilization over last week.

Vantage means squat.

Ignore it and move on.

My credit union uses Vantage 3. I have to monitor V3.

and there's this new thread... Auto Loans based on VANTAGE score!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curious 25 point rise in EQ Vantage

@elim wrote:

@dlm0820 wrote:

@SouthJamaica wrote:My Vantage points rarely move more than a few points in either direction. Today my EQ Vantage 3.0 shot up 25 points but I can't for the life of me figure out why.

Can't detect any change in accounts or significant change in utilization over last week.

Vantage means squat.

Ignore it and move on.

My credit union uses Vantage 3. I have to monitor V3.

and there's this new thread... Auto Loans based on VANTAGE score!

^ Yes VS3 has been and will continue to gain traction. One of their target areas is the rental market.

It is in one's interest to understand factors behind ALL various credit scoring models being used in the marketplace [even if they treat your profile badly]. This includes the somewhat convoluted LexisNexis models used for Auto and Home/Property insurance.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950