- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- DP - Maxing out one card with aggregate under 9%

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DP - Maxing out one card with aggregate under 9%

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

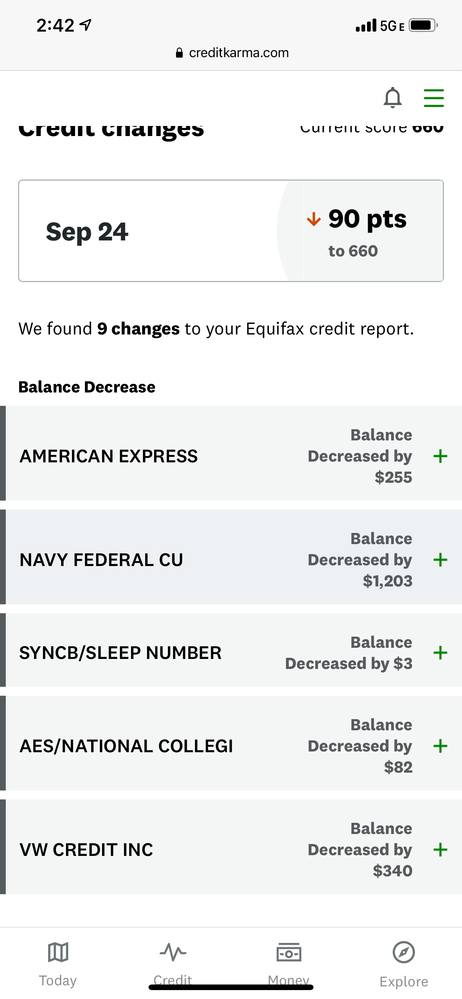

I had a recent emergency and I maxed out my wells Fargo card two days before the statement cut. My 780 Experian score dropped 23 points. Just for laughs, my Credit Karma TransUnion score dipped by 91 points!!![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

@REDBOYYY56 wrote:I had a recent emergency and I maxed out my wells Fargo card two days before the statement cut. My 780 Experian score dropped 23 points. Just for laughs, my Credit Karma TransUnion score dipped by 91 points!!

VantageScore 3 might be the most flawless credit scoring model I have ever seen! ![]() More lenders should start using it...

More lenders should start using it... ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

@REDBOYYY56 wrote:I had a recent emergency and I maxed out my wells Fargo card two days before the statement cut. My 780 Experian score dropped 23 points. Just for laughs, my Credit Karma TransUnion score dipped by 91 points!!

Vantage scores are notorious for being verrrrry utilization sensitive.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

Utilization dropped from 91% - 71% and Experian shows a 10 point increase. Over half the points originally lost.

This was the only card reporting and my aggregate utilization is 6%. I don't think the number of cards reporting impacted the score because the two other balances disappeared at the beginning of August with no change to the score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

Util is now just above 50% and gained...one...whole....point. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

@Anonymous wrote:

@REDBOYYY56 wrote:I had a recent emergency and I maxed out my wells Fargo card two days before the statement cut. My 780 Experian score dropped 23 points. Just for laughs, my Credit Karma TransUnion score dipped by 91 points!!

VantageScore 3 might be the most flawless credit scoring model I have ever seen!

More lenders should start using it...

You know you're absolutely right 😂. I paid some balances down and was soundly rewarded.

For reference, this was before I applied for a few new accounts and EQ wasn't pulled anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

I've just had one card with a balance for the last few months and my score hasn't budged. I try to keep the utilization on that card to under 9% (overall utilization is under 3%). I slipped last month and had 16% utilization on that one card, but there was no effect on my score. Just a data point. I have a dirty file with a BK if that's relevant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

I often don't see score changes with higher utilization on individual cards, as long as it's under 29% and my total util is low-ish. I'm very curious to see if I'll regain all the points when I'm under 29% or if I have to wait 'til under 9%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

Paid the card down further to a utilization of just over 30% and all the points I lost have now been recovered. I didn't expect that to happen until until 30%, so it's very possible there's some other noise in there that prevented complete isolation.

I'll keep going to see what happens under 29% and 9%, just for kicks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP - Maxing out one card with aggregate under 9%

Okay, so got utilization down to 11% and gained 3 points. So now I've gained back more than I lost, which I guess shows how difficult it is to isolate activities and draw correlations.