- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Deed in lieu how does it affect my score

Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Deed in lieu how does it affect my score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2015

07:08 PM

09-02-2015

07:08 PM

Deed in lieu how does it affect my score

Me and my ex husband purchased a time share in 2010 and were making payments of 150 per month. We filed for divorce in November 2012 and I was making the payments until November 2014 we finally got the divorce in May 2015. The divorce letters say he was supposed to take my name off the deed with in 30 days after the divorce and he would take over the payments and pay him half of what I owed which was 500.00 from me. I received a deed in lieu of forclosure notice in June that my debt would be satisfied, not really knowing what it was we both signed it. As of August 27th they sent out the paper work. I am reading that this could effect my credit. At this point I really don't know where I stand and I need advice as to how can I get this to not reflect on my credit report. I've worked so hard trying to fix it and now this. I am trying to get a home for me and the kids and from what I'm hearing now that seems impossible

Message 1 of 2

0

Kudos

1 REPLY 1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-04-2015

01:50 AM

09-04-2015

01:50 AM

Re: Deed in lieu how does it affect my score

@Anonymous wrote:

Me and my ex husband purchased a time share in 2010 and were making payments of 150 per month. We filed for divorce in November 2012 and I was making the payments until November 2014 we finally got the divorce in May 2015. The divorce letters say he was supposed to take my name off the deed with in 30 days after the divorce and he would take over the payments and pay him half of what I owed which was 500.00 from me. I received a deed in lieu of forclosure notice in June that my debt would be satisfied, not really knowing what it was we both signed it. As of August 27th they sent out the paper work. I am reading that this could effect my credit. At this point I really don't know where I stand and I need advice as to how can I get this to not reflect on my credit report. I've worked so hard trying to fix it and now this. I am trying to get a home for me and the kids and from what I'm hearing now that seems impossible

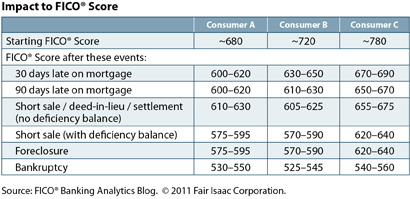

According to FICO, below is an estimated damage report on what your credit score will look like. If you want a real world experience on scores, I have documented my experience located here at this thread: http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/From-800-to-Foreclosure-How-Negatives-Effect-Your-Score/td-p/3760423

Message 2 of 2

† Advertiser Disclosure: The offers that appear on this site are from third party advertisers from whom FICO receives compensation.