- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Does Credit Utilization of 30% Represent 255 point...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

@Thomas_Thumb wrote:If the OP is on a dirty scorecard, impact of utilization is given a lower signal strength than on clean scorecards. Dirty scorecards assign a large portion of scorecard points toward status of derogatory attributes. There may be a smaller upside on optimizing utilization for profiles with derogatories.

It would be nice to get before/after score data points from the OP on the drop in utilization.

I have total revolving debt of $2,950 in total out of $3,000 available credit which puts me roughly at 98%. I will pay down $2,920 leaving about $30 bucks on my secured Discover card. I have a limit of $1,200 on Discover so my balance would be .025% of my limit. The Capital One secured card and PendFed overdraft line of credit will be at $0 balance. Overall debt to available credit will be 1% ($30 balance out of $3,000). I will start paying this debt in its entirety starting tomorrow and I will report the difference in scoring when going down from 98% to 1% utilization. I hope 1% utilization isn't too low.

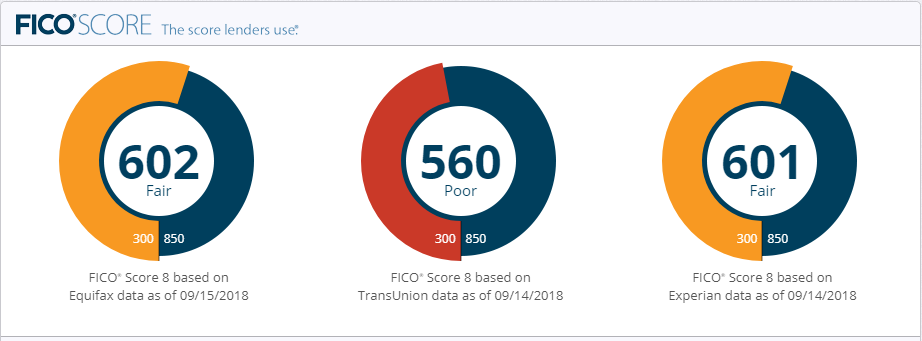

Current FICO 8 scores as of now before debt paydown:

Fico 8 Scores [Nov 2018]: Equifax 677 | TransUnion 667 | Experian 668

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

I think 100 points is a stretch for the median.

I have gone from 1% to over 30% including 90% on a card (0%) and dropped maybe 12 points.

Of course, MMV but 100 is hard to imagine as a median drop.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

@Shooting-For-800 wrote:I think 100 points is a stretch for the median.

I have gone from 1% to over 30% including 90% on a card (0%) and dropped maybe 12 points.

Of course, MMV but 100 is hard to imagine as a median drop.

It seems that you only did this with one card though, we are talking overall utilization on all cards combined. I can almost guarantee you that maxing out all your cards at the same time will result in more than just a 12 point drop.

Fico 8 Scores [Nov 2018]: Equifax 677 | TransUnion 667 | Experian 668

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

@Shooting-For-800

@Shooting-For-800I think 100 points is a stretch for the median.

I have gone from 1% to over 30% including 90% on a card (0%) and dropped maybe 12 points.

Of course, MMV but 100 is hard to imagine as a median drop.

It shouldn't be. Revolving utilization makes up the largest portion of the second largest sector (amounts owed) of the FICO pie. That slice of the pie comprises 30% of your score, so revolving utilization easily constitutes 20% of that, maybe even up to 25%. So, you do the math. It's not hard to see that 100 points is perfectly normal in going from a best case to worst case revolving utilization scenario, or vice versa.

As TT explained earlier, signal strength with respect to utilization is different for dirty vs clean files. Is it out of the question to see only 50 points of movement in going from best case to worst case utilization? Maybe not, but for every person that falls into that range you'll have 9-10 others that come in somewhere around 100 points. You can find references all over this forum from members stating their change from the utilization change described above... 84 points, 110 points, 93 points, etc. I can't say personally that I've ever seen anyone reference only 50 points from such a change. 100 points without question is more of a median than 50 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

ok.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

Alright, I paid down all of my revolving debt down to 0 balance with the exception of 1 credit card (Discover Secured card) in which I left a small balance just so it would report overall utilization percentage between 1% and 3%. I will report on the outcome in scores once my credit report updates.

Fico 8 Scores [Nov 2018]: Equifax 677 | TransUnion 667 | Experian 668

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

@Carlosjb3 wrote:Alright, I paid down all of my revolving debt down to 0 balance with the exception of 1 credit card (Discover Secured card) in which I left a small balance just so it would report overall utilization percentage between 1% and 3%. I will report on the outcome in scores once my credit report updates.

Awesome!

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

@Carlosjb3Alright, I paid down all of my revolving debt down to 0 balance with the exception of 1 credit card (Discover Secured card) in which I left a small balance just so it would report overall utilization percentage between 1% and 3%. I will report on the outcome in scores once my credit report updates.

Congratulations. That's a great accomplishment and your new FICO scores will give you a nice pat on the back once they update.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

@Carlosjb3 wrote:

@Thomas_Thumb wrote:If the OP is on a dirty scorecard, impact of utilization is given a lower signal strength than on clean scorecards. Dirty scorecards assign a large portion of scorecard points toward status of derogatory attributes. There may be a smaller upside on optimizing utilization for profiles with derogatories.

It would be nice to get before/after score data points from the OP on the drop in utilization.

I have total revolving debt of $2,950 in total out of $3,000 available credit which puts me roughly at 98%. I will pay down $2,920 leaving about $30 bucks on my secured Discover card. I have a limit of $1,200 on Discover so my balance would be .025% of my limit. The Capital One secured card and PendFed overdraft line of credit will be at $0 balance. Overall debt to available credit will be 1% ($30 balance out of $3,000). I will start paying this debt in its entirety starting tomorrow and I will report the difference in scoring when going down from 98% to 1% utilization. I hope 1% utilization isn't too low.

Current FICO 8 scores as of now before debt paydown:

FYI - $30/$1200 = 2.5% which is still top tier for utilization.

As far as being too low even a utilization of 0.1% to 0.5% on a personal credit card is not a problem as that is still being reported as recent revolving activity.

Look forward to your after posting with updated scores.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Credit Utilization of 30% Represent 255 points lost/gained?? I need Help!!

Thanks for the knowledge guys! It has helped tremendousy! Before I found out about this forums it was like I was driving blindfolded in regards to credit management.

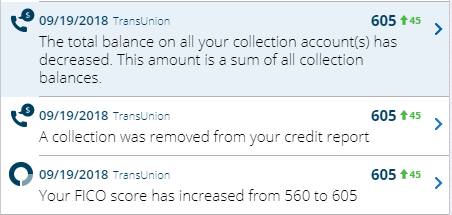

Just a quick sidenote on Transunion. On 9/19/2018 I woke up to a pleasent surprise. A collection account from AT&T Uverse had just fallen off from the face of the Earth! I don't understand though. I burned AT&T Uverse 4 years ago so it hasnt been nowhere close to 7 years yet. The amount of the collection was for $320 and the collection agency is/was ERC. Anyhow, as a result Transunion jumped 45 points! As for Experian I didn't see no score change from those bastards when the collection fell off.

I did contact AT&T about 10 days ago before the collection fell off letting them know that I want to pay them what I owe at the end of this month contingent on them recalling the collection back. The AT&T rep didn't make me any promises and simply advised to call them back at the end of the month. Do you guys think they recalled the collection back? I just can't explain why the collection fell off well under the 7 year mark and now I'm wondering if it will sneak back up on me in the future after paying AT&T!

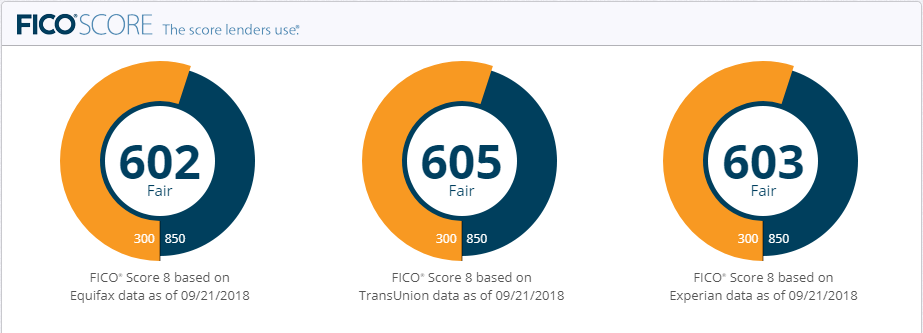

So below are my updated FICO scores now before my utilization on revolving balances are updated:

I wonder if once my overall utilization / card balances updates to optimal range if I will break into the 700's accross all 3 bureaus or at least on one of them? I have not seen 700 scores for over 10 years now. That is how irresponsible I've been with credit management. It has been almost 3 years now since I really started to take a hard look at my finances and making the decision at a disciplined approach towards better financial management.

Thanks once again guys!

Fico 8 Scores [Nov 2018]: Equifax 677 | TransUnion 667 | Experian 668