- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Effect of High Utilization on One Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Effect of High Utilization on One Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Effect of High Utilization on One Card

@Revelate wrote:

@Kforce wrote:Have a real Fico 850 with 1 card report < 1% utilty.

Drops to 845 from 3 cards reporting 1% utility each.

Drops to 840 with all cards reporting 0 balance.

Drops to 835 from one card with 85% utility, and one with < 1% utilty.

Which bureau, which score version, and how many revolving tradelines?

TU - Fico 8 : 1-Mortgage : 2- Car : 7-CC, 80K - total avaliable credit

85% on one card, less than 1% of total utilization, < 1% on a second card

Drops to 835 from 850

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Effect of High Utilization on One Card

@Kforce wrote:

@Revelate wrote:

@Kforce wrote:Have a real Fico 850 with 1 card report < 1% utilty.

Drops to 845 from 3 cards reporting 1% utility each.

Drops to 840 with all cards reporting 0 balance.

Drops to 835 from one card with 85% utility, and one with < 1% utilty.

Which bureau, which score version, and how many revolving tradelines?

TU - Fico 8 : 1-Mortgage : 2- Car : 7-CC, 80K - total avaliable credit

85% on one card, less than 1% of total utilization, < 1% on a second card

Drops to 835 from 850

Thanks for the datapoint - good information. You must have a low limit card in the mix which is a great situation for card UT% testing without worring about Ag UT%.

Many people have reported a score drop in the 15 to 20 point range with all cards reporting zero balance. Your hit is less than typical.

It is widely believed that a threshold exists at 70% utilization for individual cards. I hold that belief even though my score went unchanged when a card reported at 75% [impact on score is profile dependent and my Fico 08 score is rather unresponsive - not that I'm complaining].

If your card was truely flagged as "maxed out" - which I believe is above 90%, I would anticipate a 20 point plus drop in score.

Any willingness to test a few other thresholds with that card? - [while reporting balance on 2 cards with the 2nd card reporting in the under 10% range and Ag UT in the 1% to 3% range] such as:

1) 92%

2) 85% (85% to 92% => to test 90%) - datapoint at 85% exists

2) 74% (74% to 85% => to test 80%)

3) 54% (54% to 74% => to test 70%)

4) 48% (48% to 54% => to test 50%)

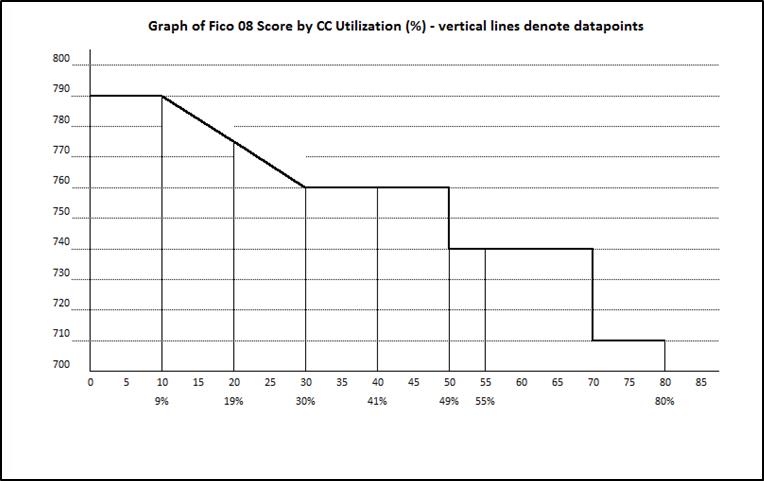

The below illustration was put together based on illustrative data but I can't say if the data was real and if it was how other factors were isolated. The last data point was at 80% and the prior one was at 55%. I arbitrarily put a "step down" at 70% based on popular belief but it could just as easily have been at 80%.

I suspect the below might be more representative of a one card profile where individual card UT% and Ag UT% are one in the same. That could help explain the rather dramatic score drops.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Effect of High Utilization on One Card

(The Good)

Yes I have a co-signed card with my teenage daughter that has a CL of $500.

It's only use is to help with her getting credit history. It is now 2 years old.

I can use it to just play with numbers. It has no real need in my CC line up

It is easy for me to use and pay down to a set % to report

I am willing to use it for testing

(The Bad) I just had all my cards report with 0 and 1 with < 1 (My Norm)

This will delay any test an extra month.

(The Ugly): I get the TU FICO-8 score from my Sallie-Mae / Barclay Card, which updates about every other month.

Changes need to be kept for two billing cycles and results are slow to receive.

This time warp makes it a slow process. You will need to be patient for results !

Is there a most important threshold to test first ??

The 92% or 72% or ??. Just let me know and I will let that report for the

next two billing cycles. and get back to you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Effect of High Utilization on One Card

Hello Kforce:

Thanks for the willingness to test. I would be most interested in 92% as a 1st data pont. However, if you only get updates every 2 months will be a rather long, drawn out process.

Alternatively, you can get free monthly updates on EX Fico 08 by signing up for the Discover credit scorecard. It's free and you donot have to have an account with Discover. I signed up even though I get free monthly EX Fico 08 updates with AMEX and TU Fico 08 updates with my Discover card. The scorecard gives you some additional information above just a score.

If you go the scorecard route, the existing 85% baseline won't correlate as it is based on data from a different CRA. I really don't anticipate your score will be affected much, if any, by 2 cards reporting balances vs just one so long as the 2nd card UT% is trivial and has negligible impact on Ag UT%. Thus, if you have a situation where only the test card reports without a trivial balance on a 2nd card, the data point should still be good.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950