- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- FICO AMA Discussion Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO AMA Discussion Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:Notice my language: I said "Looks as if the thresholds are 10, 30, 50, 70, 90 and 100% with typical rounding." I never said those thresholds were confirmed, but if 8.99% worked, 9.4% seems to be the highest percentage before crossing into the next interval.

8.99 worked in the same way that less than 8.98 or less than 8.999995 (as I found via test), since the real threshold was less than 9.5% the whole time.

I'm going to put "under 10% after truncating all your balances and rounding percentage to the nearest integer" in a macro.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

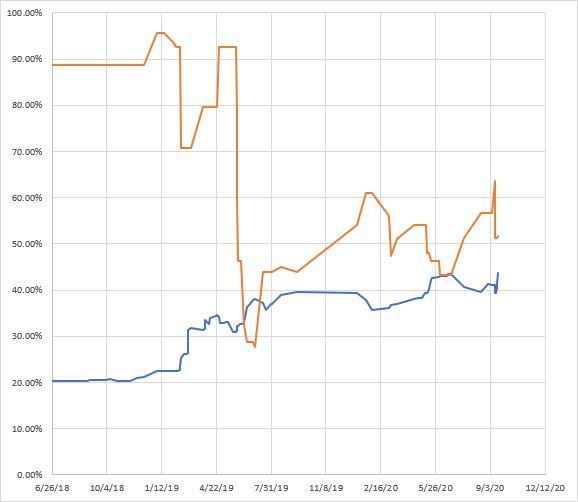

@coreysw12 wrote:Since there's discussion about how util% affects scores, and to what extent, I've put together this datapoint as an example. Here's a chart showing my util% (orange) compared to my score (average of 15 different scoring models, expressed as percentile ranking) over the last 2 years or so:

Of course, over those 2 years there were a lot of changes besides just my util%, but it's pretty clear to see that util% and score were pretty tightly correlated. Thought some of you might be interested to see how util% played out, at least for me, in the real world.

Nice chart, @coreysw12 !

I tracked changes to my 28 scores across the (0,9]% range, over 13 months with full 3B reports here. 9 to 8 to 7 to 6 to 5 is nothing for me. Under 5 to above 0 and I get +3/+1/+3 on EQ/TU/EX 8.

It might just be that only having 4 open revolving accounts is reducing the weighting on the percentage part of the utilization calculation to virtually zero - in that range - compared to someone with a lot more accounts.

Even though they said balances play at least a small part, maybe the score changes @SouthJamaica observes - in the same range I tested - have nothing to do with balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:

@Anonymous wrote:Notice my language: I said "Looks as if the thresholds are 10, 30, 50, 70, 90 and 100% with typical rounding." I never said those thresholds were confirmed, but if 8.99% worked, 9.4% seems to be the highest percentage before crossing into the next interval.

8.99 worked in the same way that less than 8.98 or less than 8.999995 (as I found via test), since the real threshold was less than 9.5% the whole time.

I'm going to put "under 10% after truncating all your balances and rounding percentage to the nearest integer" in a macro.

If you look at summary reports and use the third party published utilization from reports, then utilization is shown in whole numbers. For example, 9% or 10% would be listed. A listing of 10% represents a different tier than 9%. My vote would be to show the ceiling for the best tier at 9% even if up to but not including 9.5% were included. The same rationale would apply to ceilings associated with higher level tiers.

Experian in the past mentioned utilization max out at 90%. Someone at 89.7% might assume they have avoided max out as they are under 90% but after rounding up they get placed in the max out tier. As a general guide the table should err on the conservative side. In a like manner, point penalties are quite severe in the 69% to 89% aggregate utilization range. That tier is, IMO, better placed in the severe category along with the 90% and above as shown in the table.

The table with general categories and tiers is a useful visual aide. Don't add too much complexity or descriptive footnotes.

Side note: Credit Karma has a similar utilization table for use with VantageScore. I found the tiers to be helpful even though the TU VS 3.0 simulator outputs a score shift for almost every single % changes in aggregate utilization. For the table's sake, follow the KISS principle.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@UncleB wrote:We would like to thank Tom Quinn, Tommy Lee, Elizabeth Warren, Paul Panichelli, @Elizabeth_FICO, and all the other folks over at FICO who helped make the AMA a success.

For anyone who missed it, the AMA thread can be found here: https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/We-re-Tom-Quinn-amp-Tommy-Lee-FICO-Score...

The AMA is now over and the AMA thread is locked, but feel free to continue the discussion in this thread.

Here's where I embarrassingly betray my ignorance: what does "AMA" stand for?

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

You can "ask me anything," except don't ask me what AMA stands for ![]()

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:

@coreysw12 wrote:Since there's discussion about how util% affects scores, and to what extent, I've put together this datapoint as an example. Here's a chart showing my util% (orange) compared to my score (average of 15 different scoring models, expressed as percentile ranking) over the last 2 years or so:

Of course, over those 2 years there were a lot of changes besides just my util%, but it's pretty clear to see that util% and score were pretty tightly correlated. Thought some of you might be interested to see how util% played out, at least for me, in the real world.

Nice chart, @coreysw12 !

I tracked changes to my 28 scores across the (0,9]% range, over 13 months with full 3B reports here. 9 to 8 to 7 to 6 to 5 is nothing for me. Under 5 to above 0 and I get +3/+1/+3 on EQ/TU/EX 8.

It might just be that only having 4 open revolving accounts is reducing the weighting on the percentage part of the utilization calculation to virtually zero - in that range - compared to someone with a lot more accounts.

Even though they said balances play at least a small part, maybe the score changes @SouthJamaica observes - in the same range I tested - have nothing to do with balances.

@Anonymous while utilization weighting may change, I think revolving utilization is always weighted heavier than revolving balances per the responses. However the thin profile may cause your revolvers with the balance metric to be number rather than percentage, or if both, weighted more heavily on number.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

With profiles having lower total credit limits; I suspect $ balance rarely is high enough to influence score given utilization levels are kept in single digits.

Not a fan of aggregating model and CRA scores together. Big differences in how they react - between CRAs and between models. See example below.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@SouthJamaica wrote:

@UncleB wrote:We would like to thank Tom Quinn, Tommy Lee, Elizabeth Warren, Paul Panichelli, @Elizabeth_FICO, and all the other folks over at FICO who helped make the AMA a success.

For anyone who missed it, the AMA thread can be found here: https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/We-re-Tom-Quinn-amp-Tommy-Lee-FICO-Score...

The AMA is now over and the AMA thread is locked, but feel free to continue the discussion in this thread.

Here's where I embarrassingly betray my ignorance: what does "AMA" stand for?

Not sure in this case. I always heard/saw AMA used when referring to the American Medical Association.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@SouthJamaica wrote:

@UncleB wrote:We would like to thank Tom Quinn, Tommy Lee, Elizabeth Warren, Paul Panichelli, @Elizabeth_FICO, and all the other folks over at FICO who helped make the AMA a success.

For anyone who missed it, the AMA thread can be found here: https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/We-re-Tom-Quinn-amp-Tommy-Lee-FICO-Score...

The AMA is now over and the AMA thread is locked, but feel free to continue the discussion in this thread.

Here's where I embarrassingly betray my ignorance: what does "AMA" stand for?

Ask Me Anything. It was popularized on Reddit, where celebrities and other VIPs would let any user ask them questions.

From Presidents & Presidential candidates to Bill Gates to Snoop Dogg lol

https://mashable.com/2014/02/11/amazing-reddit-amas/

(The Woody Harrelson AMA is now Reddit-infamous because so many people asked him about things other than his then current movie "Rampart". He kept posting "Can we talk about Rampart?" and "focus on the film", which just encouraged the opposite behavior.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content