- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- FICO From 755 to 690..

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO From 755 to 690..

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

In this specific case it was a mere "who cares" moment, following his/her profile, that was expressed mostly just to relieve OP's concern... Not general advice.

Kudos to OP for utilizing as many credit monitoring services as possible without an SSN/ITIN👍

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

Thanks guys for all your insight!

Now what do you guys think i should do? Not apply for anything for 1 year or 2 years? or keep adding a new useful line per year?

Like what should be my strategic move haha.

![Citi Double Cash [Sockdrawered] | $10,000 | 2018](https://i.imgur.com/4j0HDwU.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

i'd say pick up a couple useful cards in a rather short time period simply because in a year or two the SD'ed Citi card wont hold so much weight to its tradeline, me personally adding only 1 card a year and denting AAoA every year as oppose to picking up 2-3 in a few months eating the dent firsthand and then growing from there is what im doing personally. Im going for a thicker profile in the beginning so that all those lines are built with time (at the same time). These are infrastructure cards that are going to be kept indefinitely so i want my history to be there with them (for me earlier the better)

This can be problematic or simply not efficient for individuals truly using 1 (or just a couple) card/s for that year for ease of mind OR to be able to get more potential value year 2 on from other cards.. Maybe the spend doesn't line in. It's really about you in this space, how you utilize each or don't is to your value.. nobody elses. Determine where you fit best and rock it IMO🤙

You're pretty much in a good position to (and this is what the peak of "credit" leads up to) pick any card you like, ultimately what will work best for you at that time should be the main factor in your decisions. That's the 1 and only "strategy" ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

@Deuter wrote:I hope this is temporal

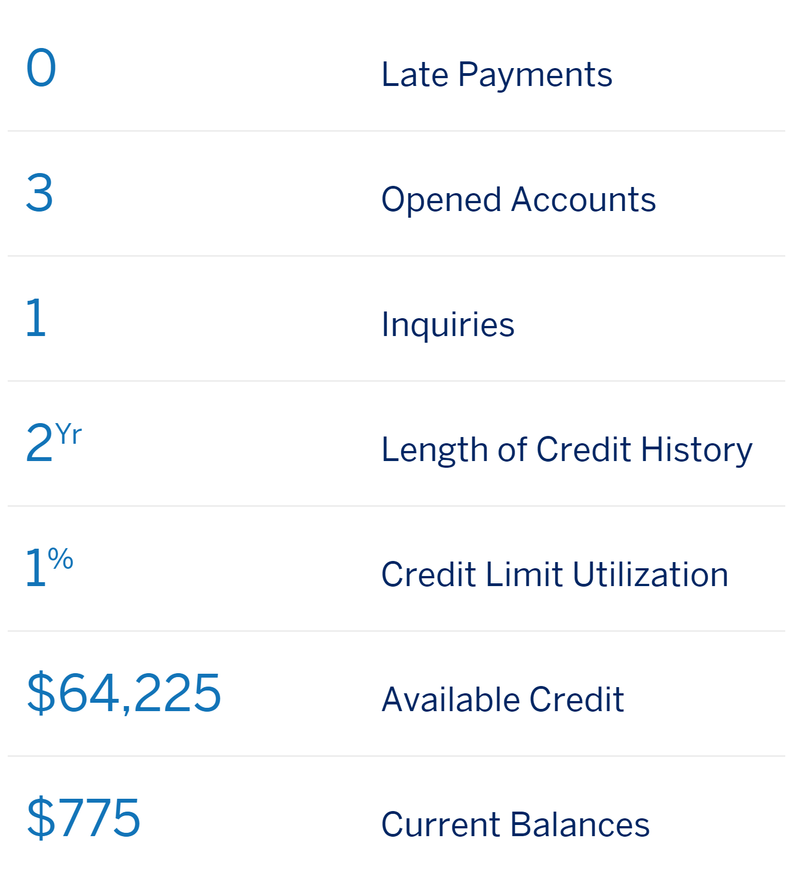

So i am going through a PC with Citibank.. this is my EQ Bankcard 8 score, I only did a credit reallocation and a product change and my score dropped like never a bomb. My utilization has always been 0% across all my cards, no late payments, i PIF and even pay sometimes before the statement.

When i checked why.... new info appeared that i haven't had before... that the age of my accounts is too young. What i think is because i am going through a Product Change is that Citi has not yet incorporated my oldest account that is the one going through the PC so my Average age of accounts dropped too much.

I only have these cards:

Amex Hilton Honors: $30,000 - Opened January 2020.

Citi Prestige: $25,000 - Opened March 2019

(Oldest Acct) Citi AAdvantage Plat: $10,000 - Opened May 2018. Has gone through different account numbers, and right now is in the process of product changing to Citi Double Cash.

I couldn't believe this PC,credit reallocation is impacting my score so much. ?.? Clueless on whatsup? I think this in an internal Citi score as i don't have SSN/ITIN and my reporting to credit bureaus could be flawed.

This might be why that others missed. Never have all your cards report 0% usage and/or $0 balance. One card has to report a balance each month between 1-8%. As we call AZEO. All zero except one. That can whack you for the point loss each month. So. Never have all cards not report a balance. And never have all cards report a balance.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

@elixerin wrote:i'd say pick up a couple useful cards in a rather short time period simply because in a year or two the SD'ed Citi card wont hold so much weight to its tradeline, me personally adding only 1 card a year and denting AAoA every year as oppose to picking up 2-3 in a few months eating the dent firsthand and then growing from there is what im doing personally. Im going for a thicker profile in the beginning so that all those lines are built with time (at the same time). These are infrastructure cards that are going to be kept indefinitely so i want my history to be there with them (for me earlier the better)

Mmm so you are basically recommending me that i apply to a few useful cards right now in a batch. Hmmm

The only problem is i don't know what to apply for as i think i'm already covered with what i got? Given that i can only choose Citi or AMEX

Well next time i apply to another one (that i don't know when that will be), i'll try to grab 2 (if they are useful) at the same time instead of adding a new one per year. Hmmmmm...

That's mostly it i shouldn't apply for a new card every year with such short AAoA. Haha, i am already confused what would be ideal? 1 new card per every 2 years, don't get any new card at all for years or get right now or the next time i get card a few that i would use instead of a single 1. This no ITIN affair has me handcuffed more limited in useful prepositions, and also spending all my time outside of USA complicates things a bit in what to add to the Portofolio. heh

@FireMedic1 wrote:This might be why that others missed. Never have all your cards report 0% usage and/or $0 balance. One card has to report a balance each month between 1-8%. As we call AZEO. All zero except one. That can whack you for the point loss each month. So. Never have all cards not report a balance. And never have all cards report a balance.

Thanks! I am still new to cards, i will try the AZEO technique... i am just in the newbie stage where i am still like in "trial and error" sometimes i leave a balance randombly in the card to see what happens, other times are all left just in $0... and then i check my reports of each month and see what was better for my score because i'm still distinguishing the changes or how payment affects my score.

So regarding your recommendation.. .. i will start reporting 1% instead of 0% and leave a balance not greater than 1% on one of my cards and then the rest of them all in $0 balance.

![Citi Double Cash [Sockdrawered] | $10,000 | 2018](https://i.imgur.com/4j0HDwU.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

@Deuter wrote:

@elixerin wrote:i'd say pick up a couple useful cards in a rather short time period simply because in a year or two the SD'ed Citi card wont hold so much weight to its tradeline, me personally adding only 1 card a year and denting AAoA every year as oppose to picking up 2-3 in a few months eating the dent firsthand and then growing from there is what im doing personally. Im going for a thicker profile in the beginning so that all those lines are built with time (at the same time). These are infrastructure cards that are going to be kept indefinitely so i want my history to be there with them (for me earlier the better)

Mmm so you are basically recommending me that i apply to a few useful cards right now in a batch. Hmmm

The only problem is i don't know what to apply for as i think i'm already covered with what i got? Given that i can only choose Citi or AMEX

Well next time i apply to another one (that i don't know when that will be), i'll try to grab 2 (if they are useful) at the same time instead of adding a new one per year. Hmmmmm...

That's mostly it i shouldn't apply for a new card every year with such short AAoA. Haha, i am already confused what would be ideal? 1 new card per every 2 years, don't get any new card at all for years or get right now or the next time i get card a few that i would use instead of a single 1. This no ITIN affair has me handcuffed more limited in useful prepositions, and also spending all my time outside of USA complicates things a bit in what to add to the Portofolio. heh

@FireMedic1 wrote:This might be why that others missed. Never have all your cards report 0% usage and/or $0 balance. One card has to report a balance each month between 1-8%. As we call AZEO. All zero except one. That can whack you for the point loss each month. So. Never have all cards not report a balance. And never have all cards report a balance.

Thanks! I am still new to cards, i will try the AZEO technique... i am just in the newbie stage where i am still like in "trial and error" sometimes i leave a balance randombly in the card to see what happens, other times are all left just in $0... and then i check my reports of each month and see what was better for my score because i'm still distinguishing the changes or how payment affects my score.

So regarding your recommendation.. .. I will start reporting 1% on one card instead [edit] and then the rest of them all in $0 balance.

Your chart goes up and down. Thats why the one month it reports 1% and it goes up. None report it goes down. The last sentence I rearrainged so you see how the games played. FICO is a numbers game. Let us know how the AZEO work on your next statement for others to see. Good Luck!

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

Hey my profile has changed!! Citibank fixed my file and now they added an extra year to my length of history ![]() Just showed on Vantage TU.

Just showed on Vantage TU.

![Citi Double Cash [Sockdrawered] | $10,000 | 2018](https://i.imgur.com/4j0HDwU.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

nice! yeah the history must have went from 1y11mo to 2 but only show 1/2/3 years etc.. (i think)

when you say they fixed your profile was that meaning that your score went back to its original 750s with this update? with 1% uti it better haha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

No i didn't meant about the score but that i had a problem with my Last Name, and my 1st card never reported in these two years. It was issued with my second last name instead of the first so i guess it was never attached to the credit bureau registry i already had from my 2nd card. I talked with Citibank about this and they fixed my name so the wrongly issued name card could be the same as my other cards. So what happened here is that my oldest account is now on my credit bureau file ![]()

I had a $23,500 AAdvantage card that was not reporting to the bureaus ![]() . As this was my oldest acct i thought it would be more beneficial to me that it would report instead of living the stealth life. My FICO 8 scores have yet not updated, not even a month has passed to see the results! This is only pulled from my weekly Vantage.

. As this was my oldest acct i thought it would be more beneficial to me that it would report instead of living the stealth life. My FICO 8 scores have yet not updated, not even a month has passed to see the results! This is only pulled from my weekly Vantage.

![Citi Double Cash [Sockdrawered] | $10,000 | 2018](https://i.imgur.com/4j0HDwU.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO From 755 to 690..

OH, true that. How much older is it then your DC? not gonna lie i'd love an invisible trade to play with the money however i want without affecting scores for the month. Even a charge card just excludes the utilization scoring aspect which is just 30% but the rest is still there

pet peeve is the Overall Credit won't increase either xD and your history either simply isn't being recorded or recorded incorrectly, Cant decide Lol.

Glad you managed to get it fixed anywho