- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- FICO score dropped by 60 points - how do i get it ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO score dropped by 60 points - how do i get it back up in the next 3 months?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO score dropped by 60 points - how do i get it back up in the next 3 months?

Hi Everyone -

Until recently, I had a 780 FICO score built over 4 years with only a mortgage and one airline credit card. Without much thought, last October, I decided to close my airline credit card (3+ year history) and got a new charge card (Amex Gold) as better suited for my needs. This change caused me to lose a little over 60 points.

In the next few months, wife and I are thinking to:

Refinance mortgage on rental property

Buy our primary residence (we are currently renting)

I'd like to initiate conversations with lenders with the best score possible. Questions:

- How realistic is for me to get back in the 760+ club in less than 6 months? What actions would you take?

- Do I stick with current charge card (and make consistent payments) or open a new credit card and keep utilization below 20% to rebuild credit faster?

- Would it be dangerous for my FICO score to open a new credit card account now if in the next 6 months I will be getting a mortgage?

- Would you recommend refinancing our rental + getting mortgage on primary residence with the same bank at the same time to maximize FICO (and get best pricing)?

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score dropped by 60 points - how do i get it back up in the next 3 months?

@Anonymous wrote:Hi Everyone -

Until recently, I had a 780 FICO score built over 4 years with only a mortgage and one airline credit card. Without much thought, last October, I decided to close my airline credit card (3+ year history) and got a new charge card (Amex Gold) as better suited for my needs. This change caused me to lose a little over 60 points.

In the next few months, wife and I are thinking to:

Refinance mortgage on rental property

Buy our primary residence (we are currently renting)

I'd like to initiate conversations with lenders with the best score possible. Questions:

- How realistic is for me to get back in the 760+ club in less than 6 months? What actions would you take?

- Do I stick with current charge card (and make consistent payments) or open a new credit card and keep utilization below 20% to rebuild credit faster?

- Would it be dangerous for my FICO score to open a new credit card account now if in the next 6 months I will be getting a mortgage?

- Would you recommend refinancing our rental + getting mortgage on primary residence with the same bank at the same time to maximize FICO (and get best pricing)?

Thank you so much!

I think the very first thing you have to do is get a 3 bureau report from MyFICO and see what your 3 mortgage scores are. Not all FICO scores are alike. I just have a strong hunch that your mortgage scores are better than you think they are.

None of the moves you're thinking about would be good, but first we need to see where your mortgage scores are.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 684 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score dropped by 60 points - how do i get it back up in the next 3 months?

It sounds like OP closed their only revolver. A charge card is not a revolver, so no doubt he's being hit with no revolving credit use among other things. I'd be curious to see the negative reason codes for his file.

This may be one of those rare instances where scoring wise it might make sense for him to open a revolver in the months leading up to a potential mortgage app. I agree with SJ that looking at mortgage scores are a start and if they're where they need to be let them hang out there. But, if they're lower than ideal, opening a revolver could help restore some points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score dropped by 60 points - how do i get it back up in the next 3 months?

Thanks for your response.

Where do i find the negative reasons for my file? Do i need to purchase myFico report here for $59 to get at the bottom of this?

If i open a new revolver, i plan to keep it forever this time. Ill get a no annual fee card and maintain utilization of 10-20% each month.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score dropped by 60 points - how do i get it back up in the next 3 months?

First off...

To get the best FICO scores you need to have a minimum of 3 credit cards. You are leaving points on the table every month that you don't have at least three credit cards.

We would normally recommend that a person shouldn't make any credit moves for 1 year prior to making a mortgage application. Lenders like to see this 1 year quiet period and will usually question you about credit moves made in this prior year.

You however, have screwed up by cancelling your credit card so I would recommend applying for a credit card from one of the major banks. You will boost your scores in the next 6 months at least a little compared to where you stand now. I doubt you will be able to get all your points back in that timeframe but you never know.

And yes, for sure refinance your rental and get approved for a mortgage with the same lender at the same time. Having more than one mortgage is a bit special and having a lender doing both mortgages at the same time will go much smoother.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score dropped by 60 points - how do i get it back up in the next 3 months?

@Anonymous wrote:Thanks for your response.

Where do i find the negative reasons for my file? Do i need to purchase myFico report here for $59 to get at the bottom of this?

If i open a new revolver, i plan to keep it forever this time. Ill get a no annual fee card and maintain utilization of 10-20% each month.

Thanks!

Back in the day there was no Fico 8. When Fico 8 score initially became available, a number of "loan only profiles" voiced concern over their low Fico 8 scores relative to the Fico 04 and Fico 98 version counterparts. Fico 8 and Fico 9 algorithms absolutely want to see an open, active revolving account on file.

A 3B report will provide you with a complete suite of 28 scores. That will allow you to see the older version Ficos used for mortgage loans as well as Fico 8 and Fico 9. Some auto loan decisioning is also based on the older Fico models, such as the Auto industry option counterpart. I do think it is a good idea to get a full report at some point in time prior to your loan application. Unfortunately a single report only gives you results for the present time with no prior comparison.

Opening a new account will result in a new account penalty - probably 20 points given your limited file thickness. However, for Fico 8, having an open/active revolver will more than offset the new account penalty - after your 1st statement with a balance and payment is reported. Not sure how all this will balance out with the older Fico "mortgage" algorithms. My guess is the net impact on mortgage score could be -20 points to +30 points - assuming the card reports a low utilization.

Check your mortgage Fico scores now - if the middle score is 760 or above, hold off on opening any new revolvers until the loan is processed. If it is 731 - 759, consider getting a card now. If score is 700 to 730 hold off on a card.

As a long term strategy, it is very important for credit purposes to have and maintain revolving credit. Loans come and go but, with revolving credit cards you can maintain continuity by keeping a card open and in use indefinitely. When you do get a credit card, have it report a balance in the 1% to 9% range (as opposed to 10% to 20%). You would experience a non trivial score penalty if utilization reports in the 10% to 20% range. Note: For a single card aggregate utilization = individual utilization.

As Jamie suggests, having multiple credit cards it better than just one. It provides added safety and flexibility. In the event one card is closed for whatever reason, you would still have a revolver available for use and showing on your profile to boost credit score. That being said, I would recommend opening one revolving account, at most, until after your loan has been processed.

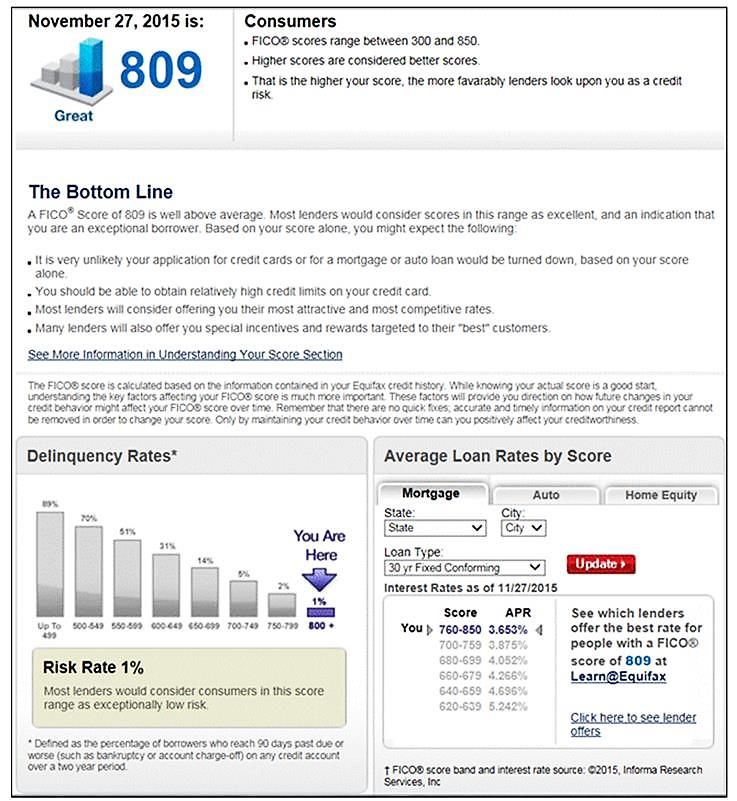

Edit Add paste below: This table is from 5 years ago. The rates have come down but, the score thresholds should still be ok.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score dropped by 60 points - how do i get it back up in the next 3 months?

@Anonymous wrote:Thanks for your response.

Where do i find the negative reasons for my file? Do i need to purchase myFico report here for $59 to get at the bottom of this?

If i open a new revolver, i plan to keep it forever this time. Ill get a no annual fee card and maintain utilization of 10-20% each month.

Thanks!

1. Unfortunately, in order to find out what your mortgage scores are, getting an up to date 3-bureau report from MyFICO, at their super-high prices, is the only method I know.

2. If I were applying for a mortgage in 6 months, I would be going for the $40 month monitoring package so that I could get updates on the mortgage scores monthly, or experian.com's $25 month package which gives you daily updates on the Experian mortgage score.

I think the $240 + tax you would spend on the MyFICO product, or the $150 + tax you would spend on the Experian product, are pocket change compared to the difference you could save in mortgage interest.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 684 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score dropped by 60 points - how do i get it back up in the next 3 months?

@SouthJamaica wrote:I think the $240 + tax you would spend on the MyFICO product, or the $150 + tax you would spend on the Experian credit, are pocket change compared to the difference you could save in mortgage interest.

This ^^^ . I think all of the above responses are spot on, but this here that @SouthJamaica mentioned about the reports vs interest is key in the beginning. You want to see where things stand first to set things straight and go from there. Plus the benefit if this can save you a bunch in interest as pointed out, which would be a huge benefit to you.

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score dropped by 60 points - how do i get it back up in the next 3 months?

@jamie123 wrote:

To get the best FICO scores you need to have a minimum of 3 credit cards. You are leaving points on the table every month that you don't have at least three credit cards.

While you aren't wrong in what is stated above, it's not a necessity. The score gain the OP would see in adding 1 revolver would be significant. The score gain from adding 2 more would be minor and arguably near net zero when you factor in the inquires and the age of accounts drop from 2 more. I agree that as a long term goal this is a good suggestion, but for the OP we're looking at more of the short term with a mortgage app on the horizon. As for the benefit of having more than 1 card, I honestly don't even put the Fico scoring gain in the top 5 reasons to have more than 1.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO score dropped by 60 points - how do i get it back up in the next 3 months?

@Anonymous wrote:

@jamie123 wrote:

To get the best FICO scores you need to have a minimum of 3 credit cards. You are leaving points on the table every month that you don't have at least three credit cards.

While you aren't wrong in what is stated above, it's not a necessity. The score gain the OP would see in adding 1 revolver would be significant. The score gain from adding 2 more would be minor and arguably near net zero when you factor in the inquires and the age of accounts drop from 2 more. I agree that as a long term goal this is a good suggestion, but for the OP we're looking at more of the short term with a mortgage app on the horizon. As for the benefit of having more than 1 card, I honestly don't even put the Fico scoring gain in the top 5 reasons to have more than 1.

Yes, I should have been more clear. OP should only get one credit card now. He could potentially lower his score if he tried to get more than one at this time.

And I know we have debated the benefits of have more than one credit card in this forum before BBS, but this is a perfect example of how having more than one credit card wouldn't have put OP in this situation in the first place.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20