- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- FICO scoring on installment loans is anal

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO scoring on installment loans is anal

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

Just a quick note here to add to the discussion. From what I've seen, maximum scoring benefit from having a current installment loan is realized (or nearly realized) far sooner than the loan reaching 9% utilization. This number could be somewhere in the 75%-80% utilization range. Once my installment loan utilization hit in the upper 70s percentage wise, I started getting positive reason codes stating, "substantial installment loan repayment."

My EQ FICO 08 score sits at 841 currently and that's with my AAoA being 7 years, AoYA of less than 1 year and 2 scoreable inquiries (less than a year old). I'm at 74% installment loan utilization right now. I would think with AAoA passing 7 years 8 months, AoYA crossing 1 year and scoreable inquiries dropping off that there's a chance I could hit 850... and that would be with 74% installment loan utilization.

I know it's difficult to try and quantify these things, but if going from having no installment loan present to having one appear on your report at 9% or less utilization (SSL technique) results in a 30 point gain, I'd venture to guess that paying down utilization to 75% or so may yield around 20 of those points.

What data points do we have out there on someone going from no installment loan present to having one report at 100%... or 99% (one payment made for example)? I would think the presence of the installment loan at 99% would yield a better score than no loan present at all, maybe 10 points gained? I wasn't into score tracking back when my installment loans first hit so I honestly have no idea about this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Anonymous wrote:Hi Dave! A few quick thoughts:

(1) Part of your concern is purely practical. That is, you want to make sure that you are getting the full scoring benefit for your TU score (since you have no open installment loan on the TU report).

Happily that is easy to solve. Just take out a Share Secure loan with Alliant, pay almost all of it off, and keep it open for five years. The first three posts in this thread will tell you all you need to know about that:

http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Adding-an-installment-loan-the-Share-Secure-technique/m-p/4506756

(2) You may be under the impression that you get no scoring benefit unless your installment utilization is < 9%. This is not so. You almost certainly get some benefit far earlier than that.

Furthermore, contributor Thomas Thumb speculates that the thresholds for benefit may be quite a bit higher if a person has been making payments on a loan in good standing for a while. What constitutes a "while" is uncertain, but I think TT doubts it is longer than 24 months.

(3) Remember that there isn't a single way that FICO handles installment utilization (how much of one's open debt has been paid off). FICO 8 cares about that. The mortgage model for TU and EQ (FICO 04) does not care at all. The mortgage model for EX (FICO 98) cares but perhaps not as much as FICO 8. And I don't think we have much hard evidence for exactly how much FICO 9 cares, though I have been trying to get people on the SS loan thread to provide that.

Future FICO models may very well track and reward the successful management and gradual payoff of loans that are 24+ months in length. Certainly someone with a history of five such loans (say) on his report (but no open debt) deserves more scoring benefit than someone with no such history but who is exploiting the SS loan trick.

But until the models arrive that you'd like, the good news is that you can certainly take practicial steps to prevent yourself from being penalized by the successful payoff of your open debt. Just make sure you have implemented the SS loan technique and you will be set.

(4) You write: "I just do what's bestfor me financially, and while my FICO scores are important, I don't let that dictate my financial decisions." Good for you! Great way to think.

Not to pick a fight but speculation based on what? It certainly doesn't appear to be calculated differently than aggregate revolving utilization, I'm not really thrilled with the top breakpoint data in terms of nailing that down, but the pretty metric is certainly well characterized.

In general it's just analytics, and even the 20ish point swing I took when originally testing it, other than mortgages 700 vs 720 vs 740 is pretty irrelevant in today's market, and speaking of mortgages in particular, FICO 04 ignores installment utilization so end of the day I consider it mostly to be a non-issue.

Sure, I would like my FICO 8 scores to be 750 or even 760 now than the 740 or less they have been stuck at for the last several years, but in practical terms from my consumer perspective, it matters almost not at all. When the GSE's change their UW standards, I'll be right up there complainin' about it as well, by my "rational" view (yeah yeah I know ![]() ) a mortgage shouldn't penalize me, but it did on FICO 8... but to be fair I gimmicked the algorithm with that installment utilization testing anyway heh, though that's really no different than paying before the statement cuts to report $0 on tradelines.

) a mortgage shouldn't penalize me, but it did on FICO 8... but to be fair I gimmicked the algorithm with that installment utilization testing anyway heh, though that's really no different than paying before the statement cuts to report $0 on tradelines.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Revelate wrote:

@Anonymous wrote:

Furthermore, contributor Thomas Thumb speculates that the thresholds for benefit may be quite a bit higher if a person has been making payments on a loan in good standing for a while. What constitutes a "while" is uncertain, but I think TT doubts it is longer than 24 months.Not to pick a fight but speculation based on what?

TT believes there is a difference, but you'd have to ask him what he bases that on. Though no doubt fallible he seems pretty reasonable so he must be basing it on something.

It's certain that the 9-10% breakpoint is indeed well characterized -- when one is opening a loan and then promptly paying it down in the first 60 days.

The question I have heard TT raise is whether the breakpoints might be different for open debt that has been open for a while, and there doesn't seem to be a wealth of test evidence for that.

I certainly don't hold to the syllogism ""TT speculates, therefore it is the case" which is why I called it speculation. But yeah, good question for him on your part; it'd be interesting to hear what he says.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

There is zero likelihood that thresholds for installment loan B/L above 9% do not exist. Poster reporting non trivial score increases when thresholds above 50% are crossed are not uncommon. Links to those posts have been provided in prior threads. Frankly, I have yet to see anyone report a score increase when an open mortgage with multi-year payments is part of aggregate B/L and the aggregate B/L crosses below 9%.

Pasted below is my thought on how payment history may come into play for Fico 8 non mortgage installment loans. The point changes are for representation only. The takeaway is rapid paydown of a loan is a shortcut to gaining points that may otherwise come from a prolonged payment history.

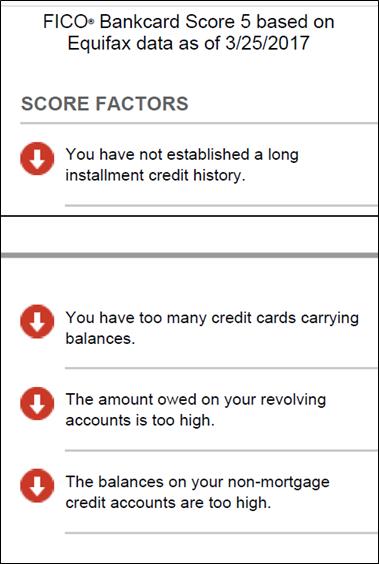

It is also clear that installment loans are differentiated by type as indicated by specific reason codes and on 3B reports where there is a mortgage accounts section separate from the installment accounts section. [I have a 15 year mortgage with 11 years payment history but NO installment category credit history due to not having any other type installment loans. Also of interest is balance on your NON-MORTGAGE credit accounts is too high. I pretty sure the 3rd and 4th reasons relate to my AMEX B/HB and my AU card.]

More than a few posters have reported 850 scores with open mortgages & aggregate B/L above 50%, myself included. This again supports the presence of higher thresholds.

Here is what I see based on MyFico posts and other sources of data:

1) The presence of an open mortgage influences scoring associated with crossing aggregate B/L thresholds.

2) Open loans with "long term" payment history impact points available relating to B/L thresholds. In other words, if someone had only one loan - say a 5 year Auto or SSL loan with 3 years payment history, paying outstanding B/L to below 9% would garner substantially fewer points than if the loan had 3 months payment history and were paid down to below 9%. Two years of payment history could be a milestone.

In the James Rickards book: THE ROAD TO RUIN, Rickards discusses using behavioral psychology, complexity theory and Bayesian statistics to formulate and refine hypothesis when limited data is available. The below quote speaks to how I like to evaluate Fico related information/data.

" Bayesian probability posits that certain events are path dependent. This means some future events are influenced by what precedes them.... Bayesian probability is solid science, not mere guesswork, because the prior hypothesis is tested by subsequent data This approach begins with a prior hypothesis formed inductively from a mixture of scarce data and common sense. Then new data is used to either confirm or to repute the hypothesis. The ratio of the two types of data is updated continually as new data arrive. Based on the updated ratios, the hypothesis is either discarded (and a new hypothesis formed) or accepted with greater confidence".

- James Rickards

The interaction of attributes on Fico score are more complex than readily apparent looking at data sets in a linear fashion and provide opportunities for casual inference.. See below example of casual inference.

- X can cause Y even if there is no “causal path” connecting X and Y.

Sometimes we think of causal chains of the form: A causes Z by causing B which in turn causes C which causes D and so on, where each pair of elements in the chain are connected to each other in time and space. You can gain confidence that A causes Z by seeing the effects on B, C, and D along the way. . . This way of thinking can however be very misleading. Consider an example given in [2]. Person A is planning some action Y; Person B sets out to stop them; person C intervenes and prevents person B from stopping person A. In this case Person A may complete their action, producing Y, without any knowledge that B and C even exist; in particular B and C need not be anywhere close to the action. Nevertheless, C caused Y since without C, Y would not have occurred. And this despite the fact that there is no “spatiotemporally continuous sequence of causal intermediates” between C and Y

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Thomas_Thumb wrote:

It is also clear that installment loans are differentiated by type as indicated by specific reason codes and on 3B reports where there is a mortgage accounts section separate from the installment accounts section. [I have a 15 year mortgage with 11 years payment history but NO installment category credit history due to not having any other type installment loans.

Here is what I see based on MyFico posts and other sources of data:

1) The presence of an open mortgage influences scoring associated with crossing aggregate B/L thresholds.

2) Open loans with "long term" payment history impact points available relating to B/L thresholds. In other words, if someone had only one loan - say a 5 year Auto or SSL loan with 3 years payment history, paying outstanding B/L to below 9% would garner substantially fewer points than if the loan had 3 months payment history and were paid down to below 9%. Two years of payment history could be a milestone.

That's interesting. I'm curious how many 850 club folks have no mortgage open and no displayed history of a mortgage ever. I've never had a mortgage, never will, owned real estate outright since I was 18 and I'm wondering if the lack of one would put me under a ceiling below 850 when the time comes. According to my own forecasting, I'm easily 43 months away from any likelihoo of 800 scores let alone above that, but I know a mortgage would never be on my reports regardless of credit worthiness.

The Alliant SSL is a huge benefit because I will never need a mortgage or auto loan, have enough residual income to never need a personal loan (or home equity loan), so the only thing I can ever foresee for maximum FICO effect would be a secured personal loan just for the helluvit. Or I guess an unsecured personal loan that I pay down 91% off right away just for the tradeline.

That being said, if I can qualify for top tier insurance price breaks, that's all I care about, and I'd be surprised if there's an insurance price tier above the mid-700s.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Anonymous wrote:

That's interesting. I'm curious how many 850 club folks have no mortgage open and no displayed history of a mortgage ever. I've never had a mortgage, never will, owned real estate outright since I was 18 and I'm wondering if the lack of one would put me under a ceiling below 850 when the time comes. According to my own forecasting, I'm easily 43 months away from any likelihoo of 800 scores let alone above that, but I know a mortgage would never be on my reports regardless of credit worthiness.

Hi ABCD! There's been more than one person who reported (on the SS Loan thread) going to 850 with the $500 SSL as his sole installment loan. So it is quite possible.

There are scorecards you can be assigned to that preclude you from reaching 850. E.g. a given scorecard might have a maximum possible score of 760 say, or 720, or 800. FICO 8 has twelve such scorecards, four of them for dirty profiles and eight for clean.

The three factors that are used in scorecard assignment (for clean profiles) are:

Age of Oldest Account

Age of Youngest Account

Total Number of Accounts (closed and open together)

Presence or absence of a mortgage is not one.

You don't seem to care much about the "perfect 850" as a goal in itself (you and I are alike that way) so in practice this might not matter anyway. I kinda like being able to be in the 830s/840s just so I have a buffer to fall back on, but for me personally there would be no difference in whether I had an 848 or an 850.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

@Anonymous wrote:

Well my final opinion on this thread which has been helpful to me also. Is when I added a installment loan to mix with my 3 CCs my EQ score went from 768 to 715 and all other 27 FICO scores dropped by a minimum 40 points and if FICO scoring suggests I have to wait 60 months to get my 53 points back then I might as well pay off the loan and get my points back now. Because I don't see the loan now as anywhere helpful at all. It's almost acting like a derogatory in some ways. Which is stupid

Post the data points for the loan you got.

1. Who did you get it with? CU, bank, finance company?

2. How does it report on your credit reports?

3. How large was the loan and what is the balance left?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

Installment loan

Was 7500.00 60 months at 12,993

Balance is 12,734 left

Paid 2 months so far

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO scoring on installment loans is anal

FICO unfortunately tends to penalize those companies because they're commonly payday loan or subprime interest companies.

Might want to see if others had a similar hit and if anyone can confirm they're a consumer finance company.