- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fico confusion

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fico confusion

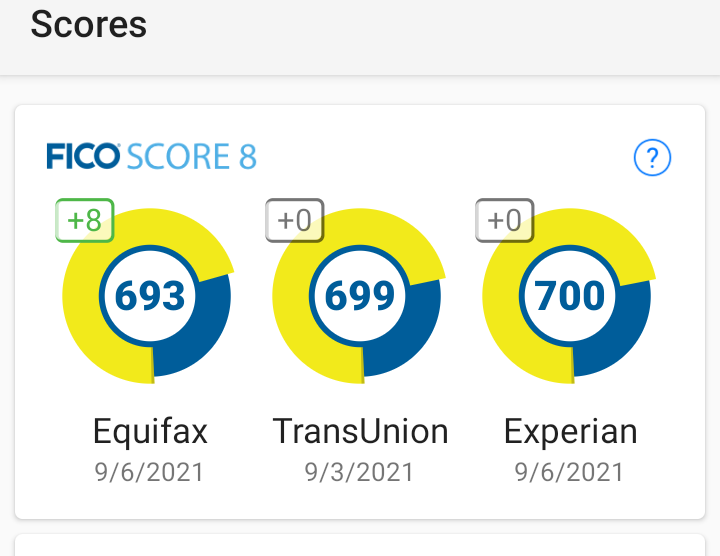

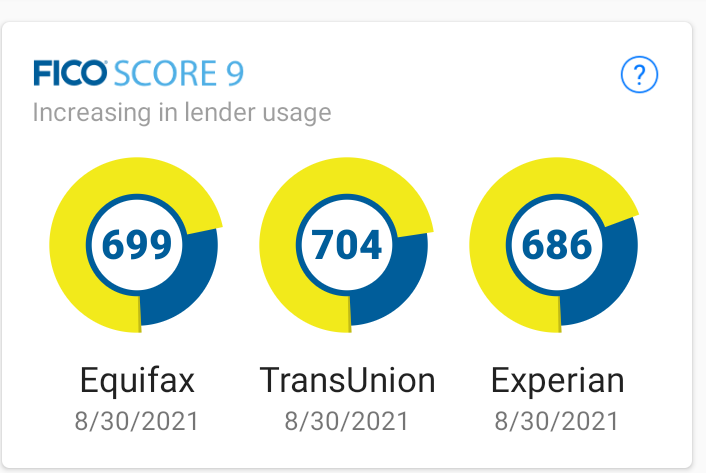

So I am paying down my cards to get my utilization lower...one payment reported amount on the cards dropped $160... And my scores went up eq+7 ..tu +8 and ex +13 the ex went to 713..and my utilization went to 36%. Now my NFCU reported a decrease of $563 and my score on ex went down -13 to 700 utilization on the card went from 53% to 34%...

So why

A small amount increase

A larger amount decrease???

Depending on who it is my overall credit amount is dependent on if they count the card I am an AU on.. but with it $13,300.

So I just don't get it at all.

Any thoughts??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico confusion

Unfortunately your post is not quite concise enough to fully understand the changes that took place and what caused the score change. I can tell you for certain that paying down your balances did not cause a drop in your scores. The only time this happens is when you pay all revolving accounts to $0. Dig deep into your profile and compare things line by line before and after so you are able to fully understand what's going on. Are these FICO 8 scores we are talking about here?

FICO 8 EX 836 EQ 838 TU 831

TCL $223,100

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico confusion

@Anonymous wrote:So I am paying down my cards to get my utilization lower...one payment reported amount on the cards dropped $160... And my scores went up eq+7 ..tu +8 and ex +13 the ex went to 713..and my utilization went to 36%. Now my NFCU reported a decrease of $563 and my score on ex went down -13 to 700 utilization on the card went from 53% to 34%...

So why

A small amount increase

A larger amount decrease???

Depending on who it is my overall credit amount is dependent on if they count the card I am an AU on.. but with it $13,300.

So I just don't get it at all.

Any thoughts??

Keep on paying down your cards.

The score decreases to which you refer are unrelated to the payments you made.

Where, when, and how are you getting your information?

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico confusion

It is from fico app...I have no late payments, 0 derogs and no new inquiries.

I have gone from 68% utilization to 36%

Before the NFCU payment and -$250 on my HUGHES fcu card to $1400

My credit one card did as of today post a $467 balance from $117 payment is not due until Sept 7th. But they sent me a new card because of odd charges from Amazon for $0.10 and Google play for same..I wonder if they reported early because of new card???. But I paid the $467 today also so $0 balance of $500

Amex $0 of $1700

Capital one $0 of $300

NFCU $1049 of $3000

HFCU $1449 OF $2200

CAPITAL ONE (AU)$667 OF $3800

HFCU LOAN $909 OF $1000

NFCU (SSL) LOAN $244 OF $3150

Those are my totals.

3 cards with balance ( some count the AU...SOME don't) I don't think fico does.

3 without balance.

Guess I will just have to wait and see..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico confusion

Might be 5 of your cards are reporting a balance and the new card is what happened. Get below 50% of total cards reporting that will help. But it appears the new card is what happened.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico confusion

The new card was a replacement card but for some reason they reported the new balance when they sent it out ..it wasn't due until Sept 7th payment date.

(But I Pif before due date and before I even got the replacement card) that should be reporting $0 balance soon.

So 3 at $0 balance

3 with a balance counting my AU CARD.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico confusion

My new scores as of today.