- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Hey guys.. noob here with questions

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Hey guys.. noob here with questions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey guys.. noob here with questions

My Equifax score is currently at 593. My Fico is at 639. I have zero late payments, zero collections (had 2 medical bills that never came to me reversed within the last few weeks) I have zero negative currently and I havent for at least 7 years (thats what shows on the reports) My credit utilization is high (90%) since I lost my job in 2014 and had to live off of credit (i know thats terrible but my kids needed to eat) for 6 months. Now that I'm working again, I've found it really difficult to pay down the debt I've accumulated during those 6 months... but my point is that, since I have never paid anything late... Why is my score so low? I find it hard to believe that if I were to magically pay down my debt, my score would jump to an 800... Is there anyone to contact within the credit bureaus that could explain my specific situation? Zero lates, good DTI... I'm just confused. Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hey guys.. noob here with questions

DTI doesn't affect Fico. Utilization does. If you're ever 90%, FICO considers you maxed out which on some reports has the same effect as a recent late payment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hey guys.. noob here with questions

The high utilization is definitely holding your score down. It may not be the only factor, though. When you got your FICO score, did it provide you a section showing the things helping and hurting your score? The reasons listed will lead you to understand what's holding you back.

People can try to answer your questions with a little more info.

Do you have any installment loans?

How many credit cards? (Balance/Credit Limit)

How old are your accounts?

Do you have any store cards?

How many Inquiries in the last two years?

There are a lot of factors that go into your score. Your payment history may be excellent, but other factors are dragging your score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hey guys.. noob here with questions

@Anonymous wrote:My Equifax score is currently at 593. My Fico is at 639. I have zero late payments, zero collections (had 2 medical bills that never came to me reversed within the last few weeks) I have zero negative currently and I havent for at least 7 years (thats what shows on the reports) My credit utilization is high (90%) since I lost my job in 2014 and had to live off of credit (i know thats terrible but my kids needed to eat) for 6 months. Now that I'm working again, I've found it really difficult to pay down the debt I've accumulated during those 6 months... but my point is that, since I have never paid anything late... Why is my score so low? I find it hard to believe that if I were to magically pay down my debt, my score would jump to an 800... Is there anyone to contact within the credit bureaus that could explain my specific situation? Zero lates, good DTI... I'm just confused. Thanks in advance!

Glad to hear that your situation has improved. And welcome to the forum, you've come to the right place to understand your scores and what they mean.

FICO scoring is meant as an imprecise but useful gauge of how risky it would be to lend someone additional money. It doesn't have access to your income information -- only what's on your credit report. Being almost maxed out on cards is definitely a red flag for FICO -- both because it suggests that you have recently been using credit for living expenses, and because it means that you won't have much wiggle room if you're pitched a curveball. FICO has no way of knowing that things have recently been getting better in your overall financial picture. 639 is not a terrible score to start at -- and if you had a history of missed payments it would be significantly lower.

Once you are able to start paying down your cards, you should see immediate improvement as your credit report eventually shows these balances going down. There are experts on this forum who can give you facts and educated guesses about the precise amounts and order where you will see improvement, but as a general matter by reducing overall utilization you will see huge score improvements. The optimal utilization to aim for (eventually) is where all cards but one are at zero percent, and one is showing a small balance.

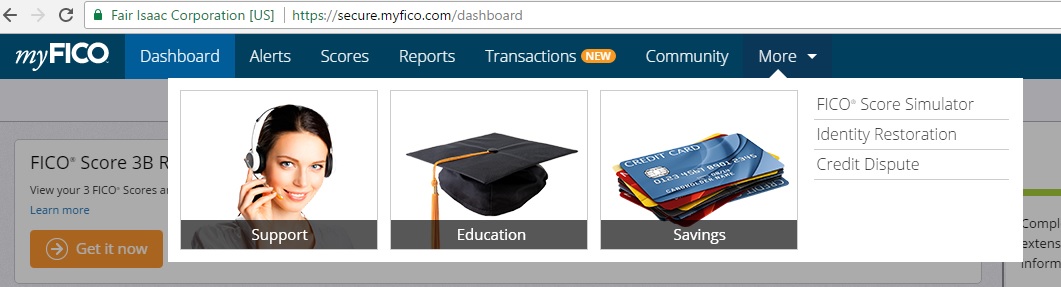

If you are currently subscribed to a myFICO product, there is a simulator tool that you can use to get a rough idea of what the possible score improvement are at this time and over the next 24 months. It is only a rough simulation, and you can get much more precise advice from some of the experts on this forum, so take it with a grain of salt. However, the nice thing about it is that it will base its estimates off of your exact credit profile.

You can access it under the "More" menu in the myFICO dashboard.

Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hey guys.. noob here with questions

@Anonymous wrote:My Equifax score is currently at 593. My Fico is at 639. I have zero late payments, zero collections (had 2 medical bills that never came to me reversed within the last few weeks) I have zero negative currently and I havent for at least 7 years (thats what shows on the reports) My credit utilization is high (90%) since I lost my job in 2014 and had to live off of credit (i know thats terrible but my kids needed to eat) for 6 months. Now that I'm working again, I've found it really difficult to pay down the debt I've accumulated during those 6 months... but my point is that, since I have never paid anything late... Why is my score so low? I find it hard to believe that if I were to magically pay down my debt, my score would jump to an 800... Is there anyone to contact within the credit bureaus that could explain my specific situation? Zero lates, good DTI... I'm just confused. Thanks in advance!

Believe it, maybe 800, maybe not quite 800, but a lot!

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hey guys.. noob here with questions

@Anonymous wrote:My Equifax score is currently at 593. My Fico is at 639. I have zero late payments, zero collections (had 2 medical bills that never came to me reversed within the last few weeks) I have zero negative currently and I havent for at least 7 years (thats what shows on the reports) My credit utilization is high (90%) since I lost my job in 2014 and had to live off of credit (i know thats terrible but my kids needed to eat) for 6 months. Now that I'm working again, I've found it really difficult to pay down the debt I've accumulated during those 6 months... but my point is that, since I have never paid anything late... Why is my score so low? I find it hard to believe that if I were to magically pay down my debt, my score would jump to an 800... Is there anyone to contact within the credit bureaus that could explain my specific situation? Zero lates, good DTI... I'm just confused. Thanks in advance!

Your high utilization is costing you 100 points. Get that down below 9% aggregate with only a couple accounts reporting "small" balances and your score could be in the 720 to 760 range - if your profile is truely clean.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hey guys.. noob here with questions

I appreciate all the responses... So i'm working on getting the debt down now. I'm shooting for 2 years to eliminate the current debt. It'll be aggressive... but I dont like having it. Prior to my unfortunate circumstances... I had almost zero debt. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hey guys.. noob here with questions

@Anonymous wrote:I appreciate all the responses... So i'm working on getting the debt down now. I'm shooting for 2 years to eliminate the current debt. It'll be aggressive... but I dont like having it. Prior to my unfortunate circumstances... I had almost zero debt.

The fact that you went through what you described without missing a single payment is ... extraordinary.

And that will be reflected in your scores even before your debt is eliminated, just once it's down to levels considered more manageable.

I don't know the exact breakpoints but my recollection is that your FICO will pick up once utilization is below 80%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hey guys.. noob here with questions

OP, I'm glad to hear that things are getting better for you. I agree with some of the others that your utilization is likely holding your scores down by about 100 points. If you don't mind sharing, how many cards do you currently have and what is the balance/limit on each of them? Do you have a plan in place as to which you're trying to pay off first? Do you have any 0% options or have you considered scooping up a BT type card that may save you some money on interest since you said it's likely going to take you some 2 years to pay it off? A little more info from you could allow us to offer up some more advice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hey guys.. noob here with questions

Op;

I'm amazed and impressed being able to not miss a payment at all.... as most have already said, its the UTIL thats hurting you now...

Youll see some come back roughly when all cards are paid to below 80% but a lot more when they are near the ideal numbers...

That said..

Tell us a bit about what you got , your APRs your limits and how much is on them...

Its possible you might be able to get or work toward getting a BT credit card.. Or some form of consolidation loan or such to take some of the sting out of the APRs....

And also give some hints on plans of attack with how much and what order to pay them off.... presume your already paying more than minimum on these cards....

but you may want to give priority for the amounts over the minimum to different cards... to save you some money AND get out of debt...

If your reports are as clean as you say they are.. which no lates or COs is clean.. just bringing down that util will reward you pretty quickly...

-J