- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How can the same event cause your score to go up A...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How can the same event cause your score to go up AND down?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can the same event cause your score to go up AND down?

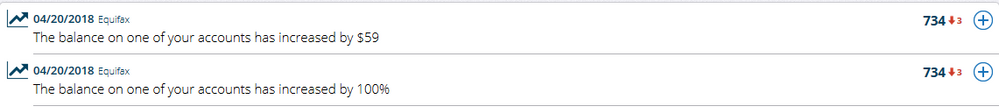

I used one of my credit cards yesterday and charged $54 on it. The CL is $3500 and the $54 is the total balance. It was charged yesterday so it cannot be a delinquency. I have no other credit card debt and total lines of $15K so this charge is minimal in my Utilization. My only other debt is a mortgage which is always paid on time.

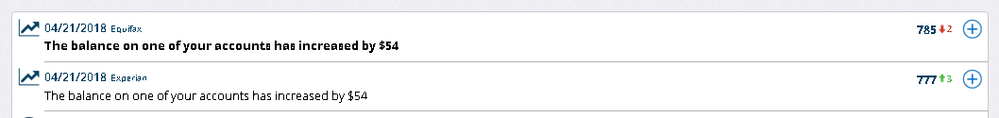

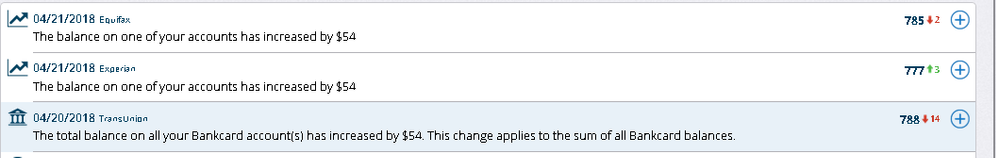

Today I get two notifications from MyFICO - that the $54 INCREASED my score at Experian by 3 points and in the same day the same $54 LOWERED my score on Equifax by 2 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How can the same event cause your score to go up AND down?

@Anonymous wrote:I used one of my credit cards yesterday and charged $54 on it. The CL is $3500 and the $54 is the total balance. It was charged yesterday so it cannot be a delinquency. I have no other credit card debt and total lines of $15K so this charge is minimal in my Utilization. My only other debt is a mortgage which is always paid on time.

Today I get two notifications from MyFICO - that the $54 INCREASED my score at Experian by 3 points and in the same day the same $54 LOWERED my score on Equifax by 2 points.

A $54 charge sends your score UP and Down at the same time.OK, how can a minimal use of a credit card (1.5% Util) both INCREASE and DECREASE one's score at the same time?

You err when you assume that the notification is indicating that the reported event caused the change of score. It should be thought of as an "and" statement. It lets you know of a triggering change in your report and also lets you know your score which might have changed for an unrelated non-triggering event that also was in your report. This admittedly causes mass confusion for many who wrongly think the reported credit score change is because of the reported alert which rarely is the case.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How can the same event cause your score to go up AND down?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How can the same event cause your score to go up AND down?

and on the third CB, Transunion, I lost 14 points. All for the same $54. I am temptred to sock drawer all cards. Use them, your score goes down. Pay them, your score goes down. Don't use them and your score goes up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How can the same event cause your score to go up AND down?

@sarge12 wrote:

@Anonymous wrote:I used one of my credit cards yesterday and charged $54 on it. The CL is $3500 and the $54 is the total balance. It was charged yesterday so it cannot be a delinquency. I have no other credit card debt and total lines of $15K so this charge is minimal in my Utilization. My only other debt is a mortgage which is always paid on time.

Today I get two notifications from MyFICO - that the $54 INCREASED my score at Experian by 3 points and in the same day the same $54 LOWERED my score on Equifax by 2 points.

A $54 charge sends your score UP and Down at the same time.OK, how can a minimal use of a credit card (1.5% Util) both INCREASE and DECREASE one's score at the same time?

You err when you assume that the notification is indicating that the reported event caused the change of score. It should be thought of as an "and" statement. It lets you know of a triggering change in your report and also lets you know your score which might have changed for an unrelated non-triggering event that also was in your report. This admittedly causes mass confusion for many who wrongly think the reported credit score change is because of the reported alert which rarely is the case.

The only other event that happened within the same month was I made another payment my mortgage, bringing the balance down another $800 or so, but that hsn't been reported yet. I have three open accounts - Chase (which is this transaction) with a $3500 CL, Amex (no blance, no activity) with a $12,000 CL and my mortgage (original balance $100,000 opened in August 2017, current balance $94,000 and always current). There simply is nothing else there that is open.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How can the same event cause your score to go up AND down?

OP...there are many changes that you might not be aware of...your AAoA and AoOA increased. Past derogs have become older also. Obviously not the exact same data is in both CRA files or the scores would be the same. You are not talking about huge differences here. Nobody here can say with certainty what caused a 3 point increase on their score or a 2 point decrease. Perhaps the one that increased reflects that one crossed some threshold on AAoA, derog dropping off or whatever, while the other has not. Perhaps at some time something minor was only reported to one CRA. If you pull a full report from both CRA's and examine the full reports you might discover what might explain this, but I doubt it. It might also be a mistake on the data entered at one of the CRA's...they do happen. Point is, the alerts are totally seperate from the score reported and should never be considered the cause of the reported score change. It could be, but just as well might not be related to the score change at all.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How can the same event cause your score to go up AND down?

@sarge12 wrote:OP...there are many changes that you might not be aware of...your AAoA and AoOA increased. Past derogs have become older also. Obviously not the exact same data is in both CRA files or the scores would be the same. You are not talking about huge differences here. Nobody here can say with certainty what caused a 3 point increase on their score or a 2 point decrease. Perhaps the one that increased reflects that one crossed some threshold on AAoA, derog dropping off or whatever, while the other has not. Perhaps at some time something minor was only reported to one CRA. If you pull a full report from both CRA's and examine the full reports you might discover what might explain this, but I doubt it. It might also be a mistake on the data entered at one of the CRA's...they do happen. Point is, the alerts are totally seperate from the score reported and should never be considered the cause of the reported score change. It could be, but just as well might not be related to the score change at all.

That is the point I think you are missing - my credit file has no derogs - they all aged off a year ago. My AAoA increased by exactly one month, as all three open accounts have been opened within the past 6 months. I realize that the excuses given as "reasons" for the change are all bullcrap (I refuse to digbnify them by calling them "reasons" and in my hiostory some ghave actually been contradictory - like too little credit being used and too much credit being used at the same time, or impossible conditions, like credit card balances too high when all cards were reporting a Zero balance).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How can the same event cause your score to go up AND down?

@Anonymous wrote:and on the third CB, Transunion, I lost 14 points. All for the same $54. I am temptred to sock drawer all cards. Use them, your score goes down. Pay them, your score goes down. Don't use them and your score goes up.

$54 charge causes loss of points on 2 out of 3 CRA's

The balance change is only a trigger to pull data and then have score re-calculated. It is highly unlikely that trivial balance change itself is the influencing factor here. Interestingly, your TU data was pulled a day earlier than EQ and EX. It's hard to offer up a root cause as it would involve too much speculation given the available information.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How can the same event cause your score to go up AND down?

OP it happens. Just yesterday my anuual fee for the Venture posted. (Forgot to call) I have always been AZEO. Venture has always reported 0. I use 1 card for the 1-3% reporting. 2 and 1/2 yrs of that one card going up and down within 5-10 bucks doesnt change my scores. Now that 2 of 5 cards will have a balance reported. I got the same 3 point deduction. It will go back up once the Venture reports 0 next month. YMMV.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How can the same event cause your score to go up AND down?

@Anonymous wrote:and on the third CB, Transunion, I lost 14 points. All for the same $54. I am temptred to sock drawer all cards. Use them, your score goes down. Pay them, your score goes down. Don't use them and your score goes up.

$54 charge causes loss of points on 2 out of 3 CRA's

I would strongly advise against changing credit behavior based on an alert that triggers a new pull and assuming that the alert is what caused the change. My scores have varied between 790-831 since probably 2010. Just practice what is time tested...AZEO(although utilization is only point in time affect), perfect payment history, no derogs, good credit mix...etc. A person could go insane micro-managing credit and adjusting behaviors on the small drops and rises of their score. You should monitor it for huge drops...if it drops 50 points then yes, you should look for the reason. Any score over 760 is really just for bragging rights anyway and life is too short to sweat the insignificant tiny swings of credit scores IMHO. I have one card that is used only by my sister that is at about 50% utilization, but she pays that, and it is low interest. All my other cards get any balances paid weekly, and I have over 15 of them, so I do not even worry about statement cut dates and such, and if more than the 1 reports, that is fine.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20