- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How does Fico calculate AOYA for multiple new acco...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How does Fico calculate AOYA for multiple new accounts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

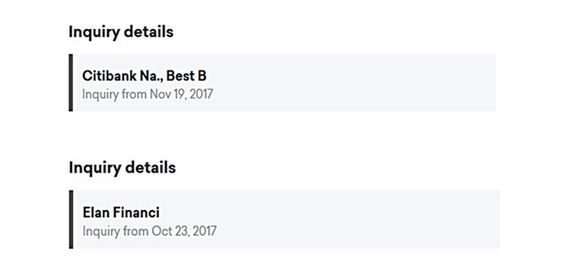

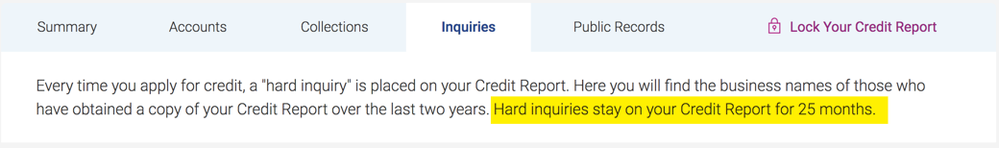

All three CRAs use actual dates for inquiries. However, inquiries are removed from Experian after 25 months; for the other two CRAs its 24 months.

@Thomas_Thumb wrote:Does the same apply to inquiries - meaning some some CRAs go by actual date while others (EX) use 1st of the month?

The two inquiries I have (top one on EQ and bottom one on TU) list actual date per CK. As I recall, a prior inquiry on EQ stopped impacting Fico score based on actual date - not 1st of the month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

Unfortunately I don't know how FICO treats the "Date Opened" information.

@Anonymous wrote:Many thanks. I wonder why EX does that? Perhaps it is an artifact of a long time ago when (I am guessing) EX only collected month and year. And then when they added the day field to their dates they decided to keep it as the 1st for consistency with their previous data.

Otherwise it's strange that they should be deliberately recording false information into their system. (E.g. 12/01 when it was reported to them as 12/03.)

Suppose as per my earlier example, that an account was opened on June 30. Do we have a definite confirmation that FICO treats the Date Opened field as if it were opened on June 1, even when TU and EQ say that it was opened on June 30? For example, if this account was the person's first account ever opened, all three FICO scores will be available on Dec 2 -- not just EX?

I believe this has been confirmed multiple times, but just want to make sure my memory isn't faulty.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

Inquiries are excluded exactly on the day 1 year later.

Virtually everything else ages on month AFAIK, saw that with both my AAOA 1->2 year testing and also with the handling of late aging.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

Going by the 1st of the month is definitely the case for all age of accounts factors.

The most fun IMO is going from 11 months to 12 months of AoYA. Pulling your score on the 1st when you reach 12 months AoYA can often result in a nice score gain of 15-20 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

A screenshot captured from Experian CreditWorks Premium

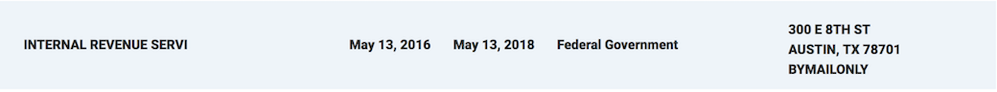

I know this to be true since I've been tracking my credit reports very closely (daily) since last August. Inquiries on Equifax and TransUnion roll off exactly two years after they occurred. With Experian, the same inquiry is not removed until the 1st day of the next month. So for an inquiry slated for removal on June 15, it actually isn't removed from your Experian report until July 1.

My May 16 Experian pull shows an inquiry from the IRS that was due for removal on May 13; it was not removed until June 1.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

I think we have a disconnect here.

I was referring to date(s) for impact of inquiry dropping off Fico scoring, not date an inquiry may be dropped off a report. The Fico impact date is 365 or 366 days from date of inquiry.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

I don't think many people care about when an inquiry actually falls off of their report... 24 months... 25... 23... it doesn't really matter, since for scoring purposes it's irrelevant after 365 days.