- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How low will my scores go?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How low will my scores go?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Checked my account status on Credit Karma. My high balance card shows being paid off on TransUnion but the balance still shows on Equifax. Typically my VS3 scores are the same on all three CRAs if open accounts are showing the same payment status.

The reduction in aggregate utilization (12% to 4%) was worth 11 points on VS3. Looking at EQ the increase in aggregate utilization (11% to 12%) cost 2 points.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Hey TT, off topic but can you remind me how to get to my CBIS on CK? It's been a few years and I don't recall how to navigate to them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

TransUnion CBIS are no longer available thru Credit Karma. Perhaps they stopped that practice when Intuit purchased CK. Another source for those scores was direct from TransUnion. A few years back I gained access to the CBIS scores as part of a paid TU credit monitoring subscription which I canceled shortly thereafter.

Unfortunately, LexisNexis CBIS are no longer accessable either. That practice was discontinued by LN in 2018.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Gotcha, that would explain my inability to find them on CK. Too bad, I enjoyed checking up on those periodically.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:

@Anonymous wrote:

@Thomas_Thumb wrote:

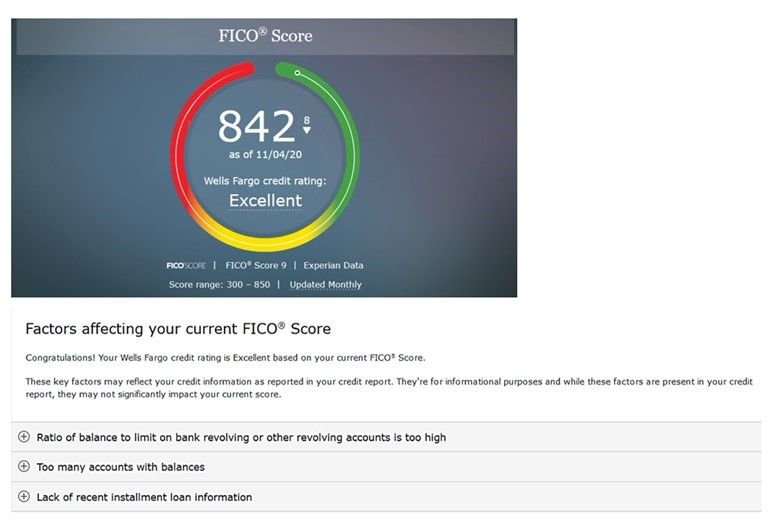

All as expected. My mortgage was still reporting as open. However, I had no other installment loans.

The "lack of recent installment loan information" is present because this particular metric excludes mortgages..

So is that metric costing you points? I mean, the presence of a negative reason code means it's adversely impacting score... is that a Fico 9 thing? To me that suggests credit mix isn't being satisfied... does that mean you have no other non-mortgage installment loans (closed included) on your CR?

@Anonymous My credit mix has always been Very Good, never Excellent/Exceptional. According to Fico representatives, the front end software accuractly reflects the Fico scoring algorithm's assessment of various profile metrics. Certainly my profile is not optimized with respect to credit mix and it is leaving some points on the table for that metric. The situation is not specific to Fico 9.

As you know, mix is a minor contributor to score. I never had an issue holding 850 on Fico 8 or Fico 9 with a VG mix. My recent point drops (Fico 8 and Fico 9) are undoubetedly due to a rise in revolving utilization above a critical threshold.

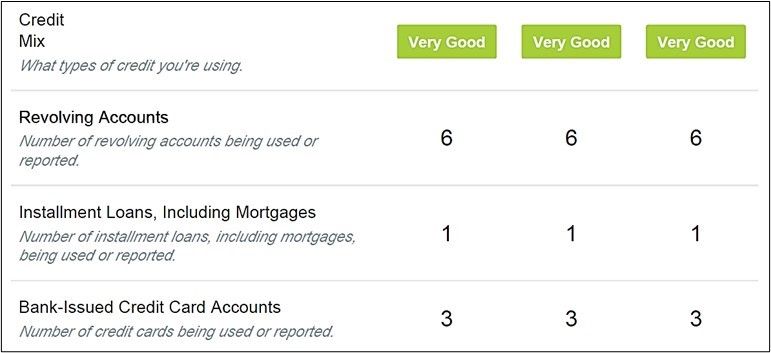

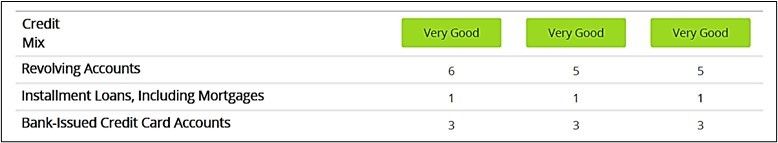

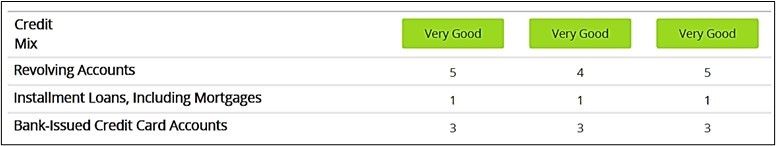

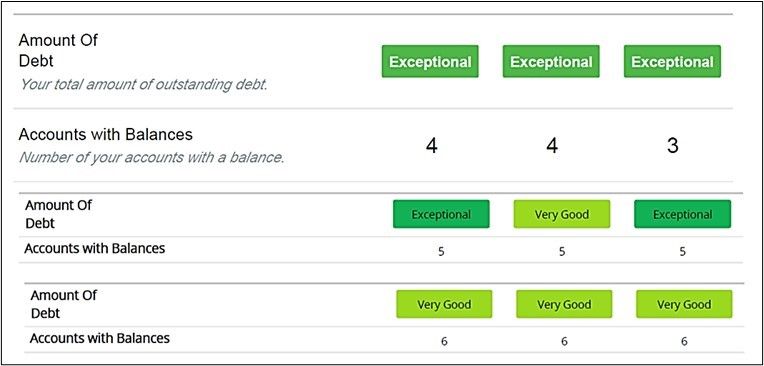

My open card accounts (1 charge card, 4 credit cards and 1 AU credit card) have remained constant since 2014. No changes in any CLs since 2017. All accounts are listed in each report and all are being used. However, the # of revolving accounts LISTED ON THE 3B SUMMARY has dropped from (EQ=6, TU=6, EX=6 in 4/2018) to (EQ=6, TU=5, EX=5 in 4/2020) to (EQ=5, TU=4, EX=5 in 10/2020). See below pastes (top to bottom 4/2018, 4/2020, 10/2020):

For reference, # of accounts with balances (4/2018, 4/2020, 10/2020 top to bottom):

Why the drop in # of Revolving Accounts as shown in the summary? All accounts being reported and are in active use. Furthermore, the # of accounts showing balances has increased.

I suspect the front end software was updated this year to no longer include the AU card in the count total for any of the CRAs. In addition, I suspect the charge card (which is an open account with 1 month terms as opposed to a revolving account) is now not included in the TU count. Alternatively, my AMEX charge card is not included on any CRA with the AU card being excluded from count on TU only.

I would appreciate input from others that get 3B reports on whether or not their AMEX charge card and/or AU credit cards are included in the "Revolving Accounts" number and/or "Accounts With Balance" number.

@Thomas_Thumb my authorized user PLCC account, which is discounted on version 8, is counted in the total number of revolving accounts in MF, as are closed revolvers.

Even though EX & TU have the same accounts, TU shows one less bankcard, maybe Carecredit is counted as a bankcard at EX. Not counted as bankcard at EQ either apparently as it shows 3 less bankcards and it has an old JCP plus my 2 PLCCs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:

@Anonymous wrote:

@Thomas_Thumb wrote:Anyone have an Exceptional rating with under 10 accounts? If so, please list them and open/closed status for reference.

Not sure how many types of accounts Fico recognizes. Below are some categories that come to mind

1) Mortgage loans

2) Auto loans

3) Student loans & Share Secure loans (SSL)

4) Charge cards (open accounts with 1 month terms)

5) Credit cards (revolving accounts)

6) HELOC and PLOC

It is unclear to me where home equity loans (HEL) would fall.

HELOC is a type of Revolving Account, according to the myFICO Credit Education section (scroll to 'Types of Credit Accounts'):

Yes, I understand that a HELOC and PLOC are classified as revolving - at least up to a certain $$ threshold.

@Thomas_Thumb Do HELOCs/PLOCs change at a threshold?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

I paid off the Fidelity card with a large balance and then stopped using it for a month. It since reported a small statement balance. Another card not currently in use reported a zero statement balance. Five cards had reported small balances on today's pull. No cards were over 10% and aggregate was down to 2% (from 13%). See pastes below.

EX Fico 8 thru Discover scorecard is reporting at 848 - 1/16/2021 pull. (TU Fico 8 thru my Discover card account still shows December pull). EX Fico 9 thru Wells Fargo updated 1/2/2021 and now is at 849. Fico 8 and Fico 9 scores of 850 score are undoubtedly achievable without an open loan. However, optimizing other factors such as aggregate and individual card revolving utilization becomes critical. Keeping # cards reporting balances low is important but, AZEO is still not critical. For my "no open loan" profile, I suspect 850 is possible with 3 or less cards reporting "small" balances

Prior to the October 2020 loan payoff I could maintain 850 with 6 of 6 cards reporting balances and even with an individual card reporting 71% utilization ($3200/$4500) as long as aggregate utilization was under 9%. Loan reported closed to CRAs in November.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Here is some comparison data from CK on VantageScore 3.0 relating to score improvements due to decreased utilization. Note the intermediate data points for TransUnion which suggests TU is being updated more often than EQ. For today's update both TU and EQ list 5 of 6 cards reporting balances as pasted below. Overall utilization is 2% with AMEX charge card not counting toward revolving utilization.

1/16/2021 Update

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Anonymous wrote:

@Thomas_Thumb wrote:HELOC is a type of Revolving Account, according to the myFICO Credit Education section (scroll to 'Types of Credit Accounts'):

Yes, I understand that a HELOC and PLOC are classified as revolving - at least up to a certain $$ threshold.

@Thomas_Thumb Do HELOCs/PLOCs change at a threshold?

@Anonymous Revelate and other old timers have stated that on the older Fico versions PLOCs and HELOCs above some $ threshold were no longer factored into revolving utilization. Some threshold amounts were mentioned but, I don't recall a specific value ever being validated. Best I can say is it was somewhere less than $50k but above $20k.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content