- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How many points could you get when paying off cred...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UTI)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UTI)

Hello all!

I was thinking of something and trying to rap my head around a good number. Currently my 1 of 2 cc's are sitting at 90% UTI as I use it heavily. I have a payment set up for $1350.00 to go towards the card as the limit is 1500.00 today. Im know this will have my UTI go down big time but was trying to think of #(%) that I would be sitting at and how many points i will gain in the process, with this payment now processing. My statement will cut in 3 days after this as I will not touch this card and let my new limit go threw and afterwards I will start using it at the begining of the cycle.

Do we have any really smart people out here (lol) who would have any idea what my UTI percentage(%) and points I can (will) be sitting at when my Credit Report updates? Currently I have FICO'S OF TU 667 EQ 641 AND EXP 654. I was doing a lot traveling these past 2 weeks so needed to gain some points on my cash rewards card. Thanks everyone and hope to get some good conversation going on this, Im super excited to see what I will be at soon and figured i culd ask all of you before it happens??! Will be appyling for 3 new cards next week after this payment, statement and credit updates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UT

Thanks for responding. My UTI on my 1st card is 20% but I'm going to pay that down on the 28th to where it will report 5% and the one im talking about now on this forum is 90% which I paid today and it will report around 15%. Total this month (total UTI is 72 %). And idea what you think my UTI and how many points I might get?

Thanks!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UT

You have mentioned what your individual utilizations were on two of your cards and what the u% will be after paydown. You also mention what your total util was. You do not, however, mention what the total util will be after paydown. That's important to know.

Personally I have a bit of a different take on your question. My thinking is that you should just pay off all your CC debt because its the right thing to do. It will save you a lot of money, so just do it. Then you'll know what the scoring benefit is later after you have done it.

Pay all CC debt off and then allow one card to report a small balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UT

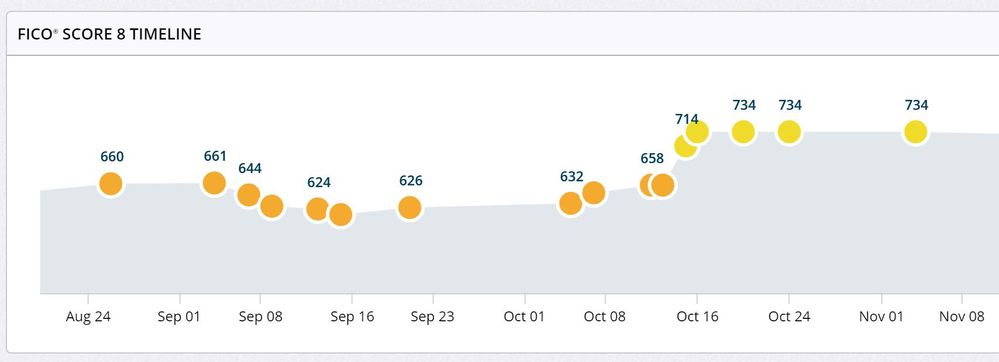

For me I had a massive data point from September because of Irma causing me to not have an internet signal the 4 days when I usually PIF my cards before statement cut. So instead of PIF, 3 of my 6 cards reported over 90% instead of $0.

As you can see, my AZEO FICO on August 26 was 660. Then I went out to sea on a sailing expedition that should have lasted 5-6 days but ended up around 10-11 days so I missed ALL of my statement cuts while at sea. So I went from AZEO ($50 balance on one card) to 3 cards maxed out (93-95%) and one card with a balance over 9%. I had 6 cards total, 4 reported balances. My score dropped from 660 on 8/26 down to 616 on 9/15 when my last balance updated. 44 point slaughter. The thing is, my report also had an unpaid collection reporting from January of this year, so if you have a clean profile, it's feasible your maxed cards may hurt you even more.

On 9/21, one of my maxed out cards re-reported to $0 because it's a Chase card so they updated midcycle. My score went up 10 points to 626 so of the 44 point drop, I reclaimed 10. On 10/5 my score went up another 6 points to 632 because my card reporting more than 9% was PIFd. On 10/7 another maxed out card showed PIF so score went up 15 points to 647. Then on 10/12 another PIF card was reported so I went up 11 points to 658 -- which is about where I started.

On 10/15, my unpaid collection dropped off for no reason, so my score shot up another 56 points from that, so ignore everything yellow as it doesn't fit the data points for the prior month.

Basically, here are the data points:

- AZEO = 660

- One card out of 6 maxed out plus one small balance = 17 point drop total

- Two cards out of 6 maxed out plus one small balance = 33 point drop total

- Three cards out of 6 maxed out plus one small balance = 44 point drop total

I bet if I had a totally clean profile, the point drops would be FAR worse but that's just conjecture as I won't test it out again and now I will PIF all my cards BEFORE going sailing again, lolol

I also have this belief that the NUMBER of credit cards maxed out based on your TOTAL number of credit cards probably has some effect on how many points are lost. Meaning if you maxed out 1 card and had 19 other cards at $0, it might probably affect your scores less than you have you have 1 maxed out card and 2 others at $0. I have no idea, not enough people share these data points for me to calculate it unfortunately. But if I have 6 cards and the "total maxed out penalty" is 100 points, then 16 points per card is probably likely. So 6 cards x 16 points = 96 possible points, seems probably correct. It's actually 16.666 for 6 cards, so 1 card = 17, 2 cards = 33, 3 cards = 50...Pretty darned close.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UT

...and then you get things like what happened to me today, reporting on my myFICO. Experian knocked me down 27pts for DECREASING my C1V1 balance by $700 and going from 49 to 14% util. Good thing those bastards don't know it's actually paid off and sitting at $3 instead of $299. They'd probably take another 20pts. Rediculous.

Really only goes to show that much of the scoring system is seemingly completely random, arbitrary and composed in good part, of equine by-product

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UT

There's no way you were dings 27 points for reducing your credit balance. Something else happened on your profile but I honestly would need a fine toothed comb and both reports to tell you what it was.

I've been working on a FICO simulator calculator now for 6 months and have put in almost 40 people's credit reports and FICO8s and the calculator is coming together very well for me (in fact, it even estimated what my scores would jump if my collection disappeared and it was within 5 points of correct).

In the 6 months I've been working on this thing, I have never once seen a FICO score change that is random. Not at all. And I've looked at 40 different profiles from 40 people, who run the gamut of "this person deserves a 400 FICO score" to the unicorn "Why are you only at 837 and not 850?" profiles. All of their FICO changes make sense to me and after explaining it to them, they understand better.

Go over your 1B report and compare every line and see. A 27 point drop could be anything: a new account showing up, an incorrectly reported balance or limit are common reasons for a drop of that magnitude. 27 points out of 550 = 5% drop in points, so it's something serious enough. If an account went inactive due to no usage, it's also feasible you dropped below the 5+ credit card number that FICO wants to see for maximum boost (that's assuming you only have 5 cards or so). Also, if you paid off your only installment loan recently, that could slay your scores 27 points, too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UT

WOW ABCD2199 ![]()

That was pretty freak AWESOME what you just told me and thanks so much for the insight! Last month, as I only have 2 cc's but did max out as well as I said before, I travel a lot, and do it for work and pleasure. So my point dropped a ugly 32 point for 1 CARD! ![]()

![]()

Then the other card I have, i ran that up to useage of 75%. So all together, my point went dow a good 56 point al together. From what you told me and from what I gathered i would guess somewhere around 50 to 60 some point as I have gotten back 33 already as my statement and score updated. Now to wait at the end of this month to see what happen when this last card I have will be PIF.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UT

That was pretty freak AWESOME what you just told me and thanks so much for the insight! Last month, as I only have 2 cc's but did max out as well as I said before, I travel a lot, and do it for work and pleasure. So my point dropped a ugly 32 point for 1 CARD! ![]()

![]()

Then the other card I have, i ran that up to useage of 75%. So all together, my point went dow a good 56 point al together. From what you told me and from what I gathered i would guess somewhere around 50 to 60 some point as I have gotten back 33 already as my statement and score updated. Now to wait at the end of this month to see what happen when this last card I have will be PIF.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many points could you get when paying off credit card (UTI @ 90%. Will pay it down to 15% UT

@Anonymous wrote:WOW ABCD2199

That was pretty freak AWESOME what you just told me and thanks so much for the insight! Last month, as I only have 2 cc's but did max out as well as I said before, I travel a lot, and do it for work and pleasure. So my point dropped a ugly 32 point for 1 CARD!

Then the other card I have, i ran that up to useage of 75%. So all together, my point went dow a good 56 point al together. From what you told me and from what I gathered i would guess somewhere around 50 to 60 some point as I have gotten back 33 already as my statement and score updated. Now to wait at the end of this month to see what happen when this last card I have will be PIF.

I wish I knew you in person so we could sit down and put that data in! I'm just throwing darts right now but your data helps.

Let's assume that you have a total of 100 points possible. If one card is maxed out (over 89% usage) that's 50 points gone. If the other card is between 69% and 89%, maybe that's 80% loss (40 points). But you say you feel you lost 60 points, so my math estimate is obviously incorrect, lol. Still, it's obvious that both your credit cards reporting balances is hurting you MASSIVELY.

Please do note that FICO "allows" you to get 3 credit cards without the "new account" penalty hitting very hard. So once you get one card to $0 and the other card reporting between $5 and 8% utilization, your scores should be high enough for you to get a third card and you'll get some magical FICO points for going from 2 to 3 cards. Post here for card ideas before applying of course but I bet your scores will look gorgeous in 6-7 months if you have 3 cards reporting.

FICO actually prefers seeing 5 cards total (or more) but cards #4 and #5 will penalize you with the "new account penalty" for 6 months of aging. So get to 3 cards first, and after they age a bit, get cards 4 and 5 and 6 months later, you'll really have a nice FICO score -- if you manage your utilization well. During a rebuild, you really shouldn't carry a balance because that means you're building debt, not building great credit. Never build debt. Better to go without TV and Netflix than carry a balance during a rebuild!