- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Inactive card reporting question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Inactive card reporting question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

@dynamicvb wrote:I think I’m just going to pay it off before report date. I had thought of just letting it report to see, but would not be a good test since it would increase the number of revolvers that reported a balance and I know for sure that is a hit.

Are you applying for credit anytime soon? If not, the number of accounts reporting a balance shouldn't matter in practice. Any small score drop can be fixed easily by implementing AZEO and an ultralow utilization in the month before you next apply for credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

@Anonymous wrote:I just got a recent inactivity alert a couple of days ago. Zero score change. My question here is how long does an account have to go to be considered inactive?

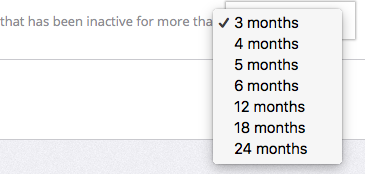

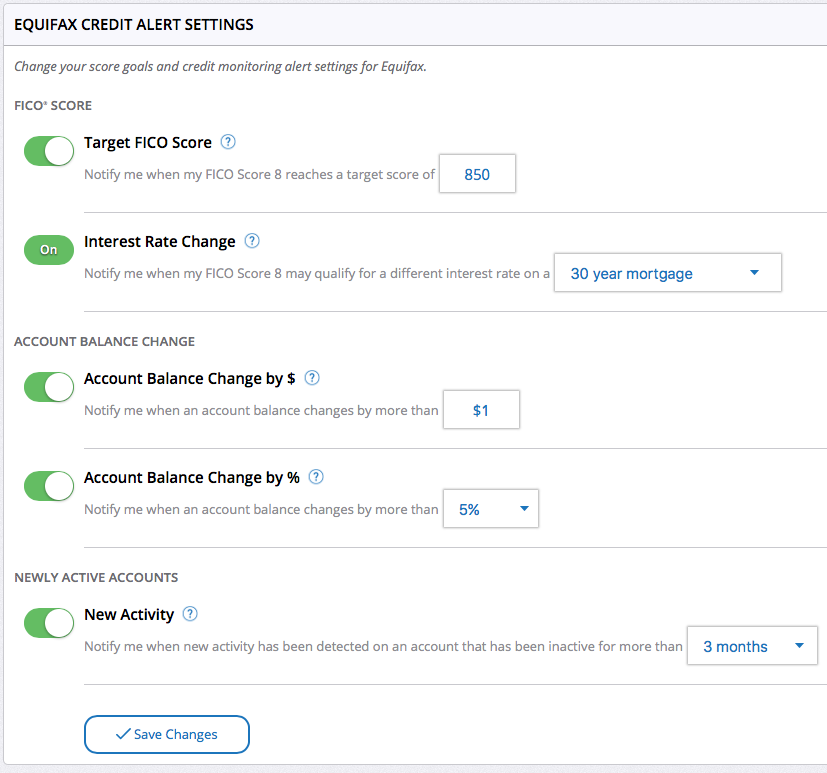

Depends entirely on what you've set the alert to:

This is completely a user-defined alert setting on MyFICO, and only applies to Equifax data.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

@Anonymous wrote:

@dynamicvb wrote:I think I’m just going to pay it off before report date. I had thought of just letting it report to see, but would not be a good test since it would increase the number of revolvers that reported a balance and I know for sure that is a hit.

Are you applying for credit anytime soon? If not, the number of accounts reporting a balance shouldn't matter in practice. Any small score drop can be fixed easily by implementing AZEO and an ultralow utilization in the month before you next apply for credit.

Not planning on any apps at all until my youngest crosses the 1y mark. I’m not really sweating the small point swings from something like it. I am tired of not seeing all three scores over 700, so in that regard I really want those few points on EQ and EX just to see them there. This is just a vanity thing as it’s been a while since I’ve seen that

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

There is this new service to keep your cards active (https://uptopcredit.com). I just put down one of my olds MasterCards after getting approved for that shiny Uber Visa Card this week (recon btw). What do you think of this service?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

@Anonymous wrote:There is this new service to keep your cards active (https://uptopcredit.com). I just put down one of my olds MasterCards after getting approved for that shiny Uber Visa Card this week (recon btw). What do you think of this service?

I think it's pretty ridiculous to sign up for something that's going to hit you for a $1 charge every 3 months to keep a card "alive." One dollar spent to keep a card open is one dollar too many. All one needs to do is take their cards out of their SD every 4-6 months and use them for a few dollars on a purchase that they were going to make anyway. Spending $90 at the grocery store? Bring your 3 SD cards, put $5 on each of the 3 and then use your grocery/normal card for the $75 remaining. Cards go back in the SD and can be forgotten about for 4-6 months. No money spent on anything you wouldn't have spent it on anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

@iv wrote:

@Anonymous wrote:I just got a recent inactivity alert a couple of days ago. Zero score change. My question here is how long does an account have to go to be considered inactive?

Depends entirely on what you've set the alert to:

This is completely a user-defined alert setting on MyFICO, and only applies to Equifax data.

Not to change the subject, but where are you guys seeing all these options for alerts? I've looked in my alert settings and I don't have near this many options for alerts.

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

@Anonymous wrote:

So we still have the open question of whether or not one needs to allow a card to report to the CRA in order to avoid inactive status. I hypothesize that when reporting monthly, the date of last activity is reported anyway and a balance need not be reported to the CRA to establish activity because the algorithm can access the date of the last activity to determine whether or not the card is active/dormant. Comments?

I always thought that inactivity happened when cards stopped reporting to the bureaus because you hadn’t used them for a period of time? Not that you had to let a balance actually report every so many months?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

Either way the context of the discussion was whether FICO penalizes you when you have an inactive account and understanding that, we were then broaching the question of whether inactivity is gaged by a balance being reported every so months to the CRA. My point is that shouldn’t be necessary since there’s a date of last activity. I should be able to pay before the statement closes and still not go inactive

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inactive card reporting question

Eh... my SSFCU card only reports every so many months or months I throw a charge on it, whether it cuts a balance or not, it’s one of my biggest complaints about the card.

If its in the SD for 3 months, it stops being updated the second month and then when I throw a charge I’ll get updated all the months that weren’t reported before when my next statement cuts.