- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Individual card below 29%, Aggregate below 9% - St...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Individual card below 29%, Aggregate below 9% - Still Lost points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Individual card below 29%, Aggregate below 9% - Still Lost points

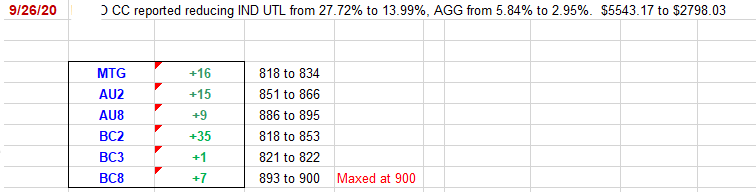

Just want to add additional score movement with 1 card reporting 27.72% and Agg 5.84%. Signed up for Credit.com's Extra Credit and received all scores on 9/1. Keep in mind I'm unable to determine actual point gain/loss due to AoYA reaching 1 year 9/1 (scorecard reassignment) but considering the loss on many...I'm grateful for the 1Y mark ![]() All 8's up likely due to AoYA but not the others. This seems to support my past experience with TU totally freaking out about UTL dollars.

All 8's up likely due to AoYA but not the others. This seems to support my past experience with TU totally freaking out about UTL dollars.

Auto:

9 = EQ 900 to 885, TU 900 to 877, EX 888 to 885

8 = EQ 877 to 882, TU 888 to 896

5 = EQ 834 to 825

4 = TU 870 to 840

Bankcard

9 = EQ 890 to 869, TU 890 to 865

8 = EQ 884 to 887 , TU 891 to 899

5 = EQ 839 to 824

4 = EQ 841 to 809

All other EX scores provided in original and a later post.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Individual card below 29%, Aggregate below 9% - Still Lost points

@Trudy wrote:Just want to add additional score movement with 1 card reporting 27.72% and Agg 5.84%. Signed up for Credit.com's Extra Credit and received all scores on 9/1. Keep in mind I'm unable to determine actual point gain/loss due to AoYA reaching 1 year 9/1 (scorecard reassignment) but considering the loss on many...I'm grateful for the 1Y mark

All 8's up likely due to AoYA but not the others. This seems to support my past experience with TU totally freaking out about UTL dollars.

Auto:

9 = EQ 900 to 885, TU 900 to 877, EX 888 to 885

8 = EQ 877 to 882, TU 888 to 896

5 = EQ 834 to 825

4 = TU 870 to 840

Bankcard

9 = EQ 890 to 869, TU 890 to 865

8 = EQ 884 to 887 , TU 891 to 899

5 = EQ 839 to 824

4 = EQ 841 to 809

All other EX scores provided in original and a later post.

@Trudy so come to find out AoYA appears to be a length of history scoring factor, while AoYRA is the new credit segmentation factor. Kind of like AoORA is a scoring factor while AoOA is the segmentation factor.

Unless a loan, AoYA = AoYRA, just like AoORA = AoOA, unless the profile had an installment loan as the first account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Individual card below 29%, Aggregate below 9% - Still Lost points

@Trudy wrote:Just want to add additional score movement with 1 card reporting 27.72% and Agg 5.84%. Signed up for Credit.com's Extra Credit and received all scores on 9/1. Keep in mind I'm unable to determine actual point gain/loss due to AoYA reaching 1 year 9/1 (scorecard reassignment) but considering the loss on many...I'm grateful for the 1Y mark

All 8's up likely due to AoYA but not the others. This seems to support my past experience with TU totally freaking out about UTL dollars.

I suspect there is much, much more going on behind the scenes with the commonly reference utilization thresholds, and it involves a mix of percentage and balances. A percentage alone can't tell the whole story.

I really don't disagree that much with @SouthJamaica 's viewpoint on this issue. I think a good general util % guideline/chart is still beneficial.

It's data like yours, @Trudy , that will help narrow it down. I can't really add good, clean evidence with testing since everything is already very sensitive on new-to-credit profiles.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Individual card below 29%, Aggregate below 9% - Still Lost points

@Anonymous wrote:

@Trudy wrote:Just want to add additional score movement with 1 card reporting 27.72% and Agg 5.84%. Signed up for Credit.com's Extra Credit and received all scores on 9/1. Keep in mind I'm unable to determine actual point gain/loss due to AoYA reaching 1 year 9/1 (scorecard reassignment) but considering the loss on many...I'm grateful for the 1Y mark

All 8's up likely due to AoYA but not the others. This seems to support my past experience with TU totally freaking out about UTL dollars.

I suspect there is much, much more going on behind the scenes with the commonly reference utilization thresholds, and it involves a mix of percentage and balances. A percentage alone can't tell the whole story.

I really don't disagree that much with @SouthJamaica 's viewpoint on this issue. I think a good general util % guideline/chart is still beneficial.

I agree.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Individual card below 29%, Aggregate below 9% - Still Lost points

@Anonymous wrote:

@Trudy wrote:Just want to add additional score movement with 1 card reporting 27.72% and Agg 5.84%. Signed up for Credit.com's Extra Credit and received all scores on 9/1. Keep in mind I'm unable to determine actual point gain/loss due to AoYA reaching 1 year 9/1 (scorecard reassignment) but considering the loss on many...I'm grateful for the 1Y mark

All 8's up likely due to AoYA but not the others. This seems to support my past experience with TU totally freaking out about UTL dollars.

I suspect there is much, much more going on behind the scenes with the commonly reference utilization thresholds, and it involves a mix of percentage and balances. A percentage alone can't tell the whole story.

I really don't disagree that much with @SouthJamaica 's viewpoint on this issue. I think a good general util % guideline/chart is still beneficial.

It's data like yours, @Trudy , that will help narrow it down. I can't really add good, clean evidence with testing since everything is already very sensitive on new-to-credit profiles.

@Anonymous I don't know Cassie, it being more sensitive makes everything magnified, so it might actually be easier, keeping all other things constant. Look at the data points you've already gathered.

If we can just get you a few more CLIs so you can go higher without breaking 9%, we might be able to find out! 😉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Individual card below 29%, Aggregate below 9% - Still Lost points

Just wanted to add to this....although I crossed whole dollars and %.

I saw the score changes and could not imagine what caused it until I realized the revolver with a balance reported a couple of days early on EX.