- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Known Thresholds for Number of Accounts?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Known Thresholds for Number of Accounts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Known Thresholds for Number of Accounts?

Good morning,

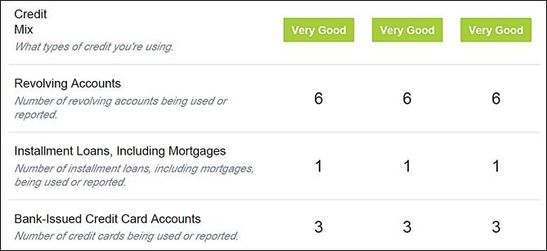

I was just hoping someone could tell me what the known thresholds are for number of accounts that might positively effect fico scores. Also, my current understanding is that the number of accounts applies to all accounts (loans and revolving), but I've read conflicting info on whether there are additional thresholds for number of cc's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Known Thresholds for Number of Accounts?

I think it would matter which scorecard you're on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Known Thresholds for Number of Accounts?

Three revolving accounts and one installment account are sufficient to give you maximum FICO scoring. Additional accounts only really help in keeping utilization low. Of course, there are other factors that go into scoring, but OP only asked about the number of accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Known Thresholds for Number of Accounts?

Thanks! I know that 3 cards plus a loan is enough technically to reach perfect scores, but I've also read of additional thresholds where points can be picked up or that effect scoring. I'd be curious of the impact difference on clean/dirty and thin/think scorecards but am more interested in just knowing what thresholds have been established, if any.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Known Thresholds for Number of Accounts?

@Revelate might be able to shed some light on your question, and quite possibly debunk the "you have to have X amount of this and that" as I believe there are those who reached a "perfect" score with a single card.

Perhaps having various types of accounts simply makes it happen sooner than with only one type of account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Known Thresholds for Number of Accounts?

Basically you can get to 850 (eventually) with a thin file, question is how much faster can you get there with a thicker file.

We still are trying to nail down some idiosyncrasies on the mortgage scores and it's dependent on scorecard (new accounts) and maybe even by inquiries too though we only have one data point on that to my knowledge.

I think a good rule of thumb is to have 5 open revolvers, that is optimal at 1/5 on every FICO 8 scorecard that I'm aware of and 2/5 on two out of the three bureaus (and it is a really minor ding on EQ in some scorecards, like 3 points or whatever).

There is some data that suggests 7 might be better on the older algorithms but it's just not necessary as you can get well above 760 which is gold plated from a mortgage perspective without that.

End of the day have a number you feel comfortable with. True need I could get by with 5 pretty easily, I mostly only use 2 and some I am keeping open just for future FICO purposes even when rationally I know my scores are good enough today for anything I need and my average age is not even close to 10 years (how long closed tradelines stay on your report). The extra tradelines don't really do me much benefit other than my own idiosyncrasies when it comes to credit... namely, it's pretty, you no take candle!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Known Thresholds for Number of Accounts?

@Revelate wrote:Basically you can get to 850 (eventually) with a thin file, question is how much faster can you get there with a thicker file.

We still are trying to nail down some idiosyncrasies on the mortgage scores and it's dependent on scorecard (new accounts) and maybe even by inquiries too though we only have one data point on that to my knowledge.

I think a good rule of thumb is to have 5 open revolvers, that is optimal at 1/5 on every FICO 8 scorecard that I'm aware of and 2/5 on two out of the three bureaus (and it is a really minor ding on EQ in some scorecards, like 3 points or whatever).

There is some data that suggests 7 might be better on the older algorithms but it's just not necessary as you can get well above 760 which is gold plated from a mortgage perspective without that.

End of the day have a number you feel comfortable with. True need I could get by with 5 pretty easily, I mostly only use 2 and some I am keeping open just for future FICO purposes even when rationally I know my scores are good enough today for anything I need and my average age is not even close to 10 years (how long closed tradelines stay on your report). The extra tradelines don't really do me much benefit other than my own idiosyncrasies when it comes to credit... namely, it's pretty, you no take candle!

Thank you! This is helpful and also super interesting!

I know I already have a good number and mix (5 installments, 10 open cards, several closed), but I was really just curious. I watched a YouTube video yesterday about credit cards that said that there are thresholds at 12 and 21 accounts for Fico. I wasn't sure where he got that info and figured I'd get more reliable/tested info here. It's amazing how much misinformation there is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Known Thresholds for Number of Accounts?

If I remember the Credit Karma guidelines correctly, the 12 and 21 sound like it could be for them and VS3?

I remember about 1.5 years ago starting my rebuild journey thinking Credit Karma was the KING (didn't find this wonderful place until about a year ago). To my horror, CK recommended some crazy number of accounts required for high scores and with me only having 2 cards to my name. Its like CK gets money by recommending as many cards as possible to us! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Known Thresholds for Number of Accounts?

VantageScore 3.0 does indeed like to see more accounts on file. I think 11 accounts may be a thing for VS3.

I have been dropping accounts off my file in recent years and I did note a reduction in VS3 score ceiling. All accounts that dropped off were closed. I started at 12 accounts (7 open + 5 closed). Now I am down to 8 (7 open + 1 closed). My ceiling VS3 score has dropped a total of 7 points during the ensuing 5 years - even though AAoA, AoYA and AoOA have increased.

Fico is not as sensitive to # accounts. However, I have seen an effect on EQ and TU "mortgages score" since dropping to 8 accounts total (5 open cards, 1 open AU card, 1 open mortgage and 1 closed card). My ceiling on EQ has dropped from 809 to 804. In contrast, my EX mortgage score has risen (ceiling was 839 - now 842). The increased EX ceiling is likely due to reduced mortgage B/L.

As we know, the CRAs have tweaked the Fico 04 and Fico 98 algorithms. Based on reviewing my data over time, it appears EQ and TU use # accounts as a scoring attribute more strongly than does EX - or EX uses a lower # of accounts threshold.

Fico did publish the following reason codes for Classic Fico "mortgage" scores:

1) R5 - Too few bank/national revolving accounts

2) R3 - Too few active accounts

3) R2 - Too few accounts with recent payment information

Achieving Fico 8 and Fico 9 scores of 850 is a lot easier than achieving top mortgage scores (EQ = 818, TU = 839 , EX = 844). Fico 8 scores of 850 have been reported om MyFico by a profile with 4 total accounts. I have not seen an 850 reported with a 2 account profile - likely not possible IMO. Regardless, as Revelate said, having more than the TBD minimum accounts helps boost score without having all scoring attributes "optimized".

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Known Thresholds for Number of Accounts?

Thanks for that info and perspective! Generally, my mortgage scores are what matter most to me. It almost feels like I'm in a continual state of refinancing, so those are the scores I need to watch. It seems interesting that those mortgage score models would weight number of accounts more heavily.

@Thomas_Thumb wrote:VantageScore 3.0 does indeed like to see more accounts on file. I think 11 accounts may be a thing for VS3.

I have been dropping accounts off my file in recent years and I did note a reduction in VS3 score ceiling. All accounts that dropped off were closed. I started at 12 accounts (7 open + 5 closed). Now I am down to 8 (7 open + 1 closed). My ceiling VS3 score has dropped a total of 7 points during the ensuing 5 years - even though AAoA, AoYA and AoOA have increased.

Fico is not as sensitive to # accounts. However, I have seen an effect on EQ and TU "mortgages score" since dropping to 8 accounts total (5 open cards, 1 open AU card, 1 open mortgage and 1 closed card). My ceiling on EQ has dropped from 809 to 804. In contrast, my EX mortgage score has risen (ceiling was 839 - now 842). The increased EX ceiling is likely due to reduced mortgage B/L.

As we know, the CRAs have tweaked the Fico 04 and Fico 98 algorithms. Based on reviewing my data over time, it appears EQ and TU use # accounts as a scoring attribute more strongly than does EX - or EX uses a lower # of accounts threshold.

Fico did publish the following reason codes for Classic Fico "mortgage" scores:

1) R5 - Too few bank/national revolving accounts

2) R3 - Too few active accounts

3) R2 - Too few accounts with recent payment information

Achieving Fico 8 and Fico 9 scores of 850 is a lot easier than achieving top mortgage scores (EQ = 818, TU = 839 , EX = 844). Fico 8 scores of 850 have been reported om MyFico by a profile with 4 total accounts. I have not seen an 850 reported with a 2 account profile - likely not possible IMO. Regardless, as Revelate said, having more than the TBD minimum accounts helps boost score without having all scoring attributes "optimized".