- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Least/Most Stubborn CRA?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Least/Most Stubborn CRA?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Least/Most Stubborn CRA?

In reading these boards religiously, it regularly occurs to me to post the following: Which of the [Big 3] Credit Reporting Agencies seems most/least generous when providing your scores? Has it always been the way for you (between the 3?) What, do you think, attributes to the way you are scored by each?

I expect the replies to this thread to be a decent mix of fact, speculation and YMMV.

I'll start things off - in my 20+ years of being credit worthy, my credit file has been through several iterations (up & down.) With each fluctuation in scores, I have always noticed that TU has been the highest scoring. And, to that point, regardless of how much effort I put into improving the other two, my scores for both EQ and EX seem to lag 25-30 points behind TU. I think, in some respects this may be attributed to geography (I have lived in the Midwest 12 of the last 20 years, with equal portions of the other 8 years split between Las Vegas and NYC.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least/Most Stubborn CRA?

Amex Cash Magnet: 24.4k

Fidelity Visa: 21.5k

Apple Card: 13k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least/Most Stubborn CRA?

Lived in AR for 3 years, 4 months in MO and more than 3 years in CA.

More pulls EX in AR. More pulls in TU in CA.

I agree, EX score is always lower ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least/Most Stubborn CRA?

It's all a wash for me. Of my three FICO 8s and three mortgage scores, the lowest is my Experian FICO 8 (804), and the highest is my Experian mortgage score (820).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least/Most Stubborn CRA?

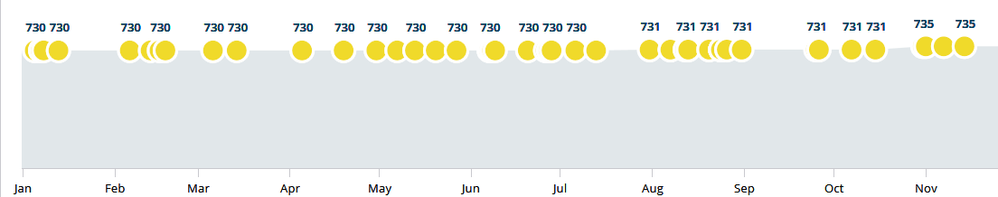

TU. Jan 2018 to Jan 2019. Got 2 cards. Two inqs fall off. Now 0 scorable inq's. Always 1% reporting aggregate. Evreything got a year older. As they say a picture speaks a 1000 words. 5 points gained. ![]() EX/EQ up 15-20.

EX/EQ up 15-20.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least/Most Stubborn CRA?

EX for me,too. They dont like my new accounts or inquires

Sadly, where I live, you cannot get a glass of water without someone tugging on EX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least/Most Stubborn CRA?

@pinkandgrey wrote:

Me no likey EX lol. It always seems lower. Probably due to the fact that EVERYONE pulls EX here in Colorado..... lol

Really? Only BBVA and Amex have pulled Experian for me in CO, EQ and TU got hammered...

TU was my worst til I got my EE, now EX is my worst.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least/Most Stubborn CRA?

I think there's a fundamental point that needs to be made up front and that's that it's not (usually) the CRA's providing you with scores, as they don't "score" you. They provide the data that goes through a scoring algorithm that then generates a score. The basic takeaway here should be that you can't be unhappy (or happy) with the CRA since they don't give you the score.

That aside, by definition when these threads come about your going to see overall that the split when the dust settles is going to be by definition around 1/3 for each of the Big 3... whether it's 1/3 saying X is the "best" CRA or 1/3 saying that Y is the "worst" CRA, etc. all based on personal experience.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Least/Most Stubborn CRA?

For me, EQ is the "worst" - they're stubborn with disputes, they seem to take the longest to update payments/status, and everyone pulls them for me (it's either EQ or EQ/EX double hit).

EX is the best for me, they update with reporting information super fast and they're easy with my disputes and other information.

TU just sits there - no one ever pulls (the only inquiry I have is from a Cap1 triple pull) it, and it usually sits in the middle of the other two scores. My only issue is that their website always stalls out on me, so if I need anything I have to call or send a letter.