- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Lower UTIL for a boost. Need Advice

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Lower UTIL for a boost. Need Advice

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

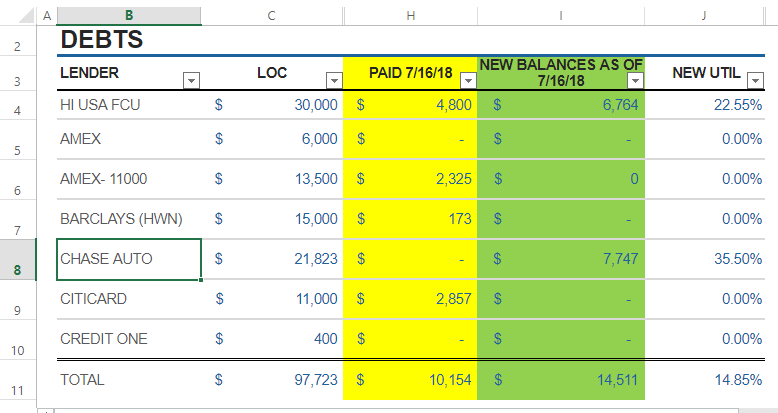

Thank you both for your suggestions! HI USA is a LOC.

Today I paid off all credit cards. I also paid $4700 to HIUSA LOC, leaving a balance of $6764 (util 22.5%)

I left the car loan as is and didn't pay anything towards it. I hope I did this right!

We will do a rapid rescore soon.

Bonus news: M&T bank (short sale in fall 2011) responded to my goodwill letter and may be removing the TL soon! This could put us in a much better position than before!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

Thank you! I didn't see your post until after I made my payments, but I think I did what you suggested except I didn't leave a balance on the cc. If my calculations are correct, I should now be at 8.9%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

I didn't leave a balance on the AMEX. I hope that'll be okay. This should bring my revolving accounts down to 8.9%. I beleive the LOC is counted as a revolving account. Again, thank you for your advice!

Updated...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

@Anonymous, revolving utilization is optimized when one account reports a small balance and the rest report zero. It's always recommended that the account with the positive balance be a major card (not a store card, not an AU, and not a LOC) because it's tough to tell how one's profile will react when the balance is on something other than a major card.

You might be fine and not be dinged. Or maybe there's a small ding. The worst case scenario is that you receive the "all cards at zero" ding, which can be pretty substantial (15–20 points on FICO8, not sure about mortgage scores). With one card and the LOC reporting positive balances, a ding would have been small, or it might not have occurred at all. Using that tack would have been less of a gamble as the scoring result would have been more predictable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

@Anonymous wrote:I didn't leave a balance on the AMEX. I hope that'll be okay. This should bring my revolving accounts down to 8.9%. I beleive the LOC is counted as a revolving account. Again, thank you for your advice!

Updated...

The above paydown is not ideal. You may be leaving quite a few points on the table:

1) All CCs reporting a zero balance may cost you 15 to 20 points vs reporting a balance on one card. I'd recommend charging something on a CC card and letting the balance report on a statement. You can then pay the statement balance in full to avoid interest charges. No need to ever carry a balance month to month; just allow one to report and then PIF by due date.

2) I do think not taking the Auto loan to below 29% might be costing 5 to 10 potential points.

The fix for #1 above is quite easy. A small charge on any card (say $5 or more) - ideally one with a higher limit (say any card but Credit One) will do.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

Some have reported little to no score gains from lowering installment loan utilization across the believed revolving utilization thresholds. I know some people like SJ didn't see much of a score gain until installment loan utilization was paid down across the 8.9% mark into "ideal" territory.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

@Anonymous wrote:Some have reported little to no score gains from lowering installment loan utilization across the believed revolving utilization thresholds. I know some people like SJ didn't see much of a score gain until installment loan utilization was paid down across the 8.9% mark into "ideal" territory.

Your memory is great, but we were talking about FICO 8 scores. Yes when I first took out the Alliant SSL I was looking for a point gain, but didn't find it until I'd paid the loan down to 9%, at which point my FICO 8 and 9 scores benefited handsomely, as did some of the other scores.

But the OP is concerned specifically with mortgage scores. And my experience in the mortgage score realm has been:

EX FICO 2 doesn't care at all about my overall installment loan utilization

EQ FICO 5 doesn't care at all about my overall installment loan utilization

TU FICO 4 does react similarly to FICO 8, but with only about 25% of the signal strength -- i.e., if dropping to 8.9% got me 32 points in TU FICO 8, it would probably pick up around 8 points in TU FICO 4

Needless to say, this is just my experience with my profile, and as we know, each profile reacts differently to the same stimuli.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

@Anonymous wrote:Some have reported little to no score gains from lowering installment loan utilization across the believed revolving utilization thresholds. I know some people like SJ didn't see much of a score gain until installment loan utilization was paid down across the 8.9% mark into "ideal" territory.

I see a SSL as being treated differently than Auto loans or Mortgages. Payment history/age of open loan really does not come into play with token SSLs. Those that get a SSL for score boosting typically pay down balance immediately to get B/L under 9%. This shortcuts potential points that could have been awarded from a lengthly open installment loan payment history.

Not sure how old the OPs Auto loan is. If it is over 2 years, he may not see a significant score shift dropping below a 9% B/L. It would be nice to get some data points on longer term loans (over 24 months payment history) being paid down from above 20% to under 9%. I'd be surprised if point gain exceeds 10 point. Unfortunately, it looks like the OP won't have the opportunity to test this due to a potential mortgage.

End of the day, having the short sale fall off will be the biggest score booster - even if lates are still on file. On derog scorecards utilization has a muted signal strength. However, having zero cards reporting a balance may not be muted. Also, in general, # and/or % of cards is given more weight on Mortgage Ficos than with Fico 8.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

TT, above you sort of lump auto loans and mortgages together when discussing the topic of whether it's substantially paid down. My understanding has always been that mortgages are viewed differently than any other installment loan type, which of course includes auto loans. I can definitely understand a 30 year mortgage that's 10 years paid down to be considered a "substantial" paydown even if utilization wise it's still at 75% or so. You spoke of 2 years [as a supposed threshold?] and an auto loan in the same sentence. Do you believe or have you seen data to show that an auto loan that crosses the 2 year mark in age counts for something with respect to scoring, outside of a utilization percentage of course? I've always thought that getting below 8.9% on a non-mortgage loan is what mattered most, whether it's an auto loan, SSL, etc. Perhaps my understanding on that is flawed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lower UTIL for a boost. Need Advice

I mentioned Auto and Mortgage specifically but do lump them together from a payment history perspective. What is common between Mortgages and most Auto loans are payments extending out over many years.

Open loan payment history is mentioned in a reason statement as a scoring consideration. Two years is not mentioned anywhere by Fico - that's a hypothesis on my part. I have seen data points that support the aging theory. Unfortunately, the data is not rigorous. For example, a poster reports Fico 8 scores dropping 30 points after paying off a car loan with over 2 years payment history. The loan had over 30% B/L prior to paydown and was the only open loan on file. The result indicates points had already been realized, IMO, without having to drop below the 9% SSL benchmark.

For mortgages fairly high B/L ratios do not appear to harm score. There are various data points out there with slightly different results. Conservatively I'd say dropping below 69% B/L is all that's needed for favorable treatment by Fico - assuming at least a couple years of payment history. Is two years an important threshold for mortgage payment history? Not sure. Is five years important, again not sure?

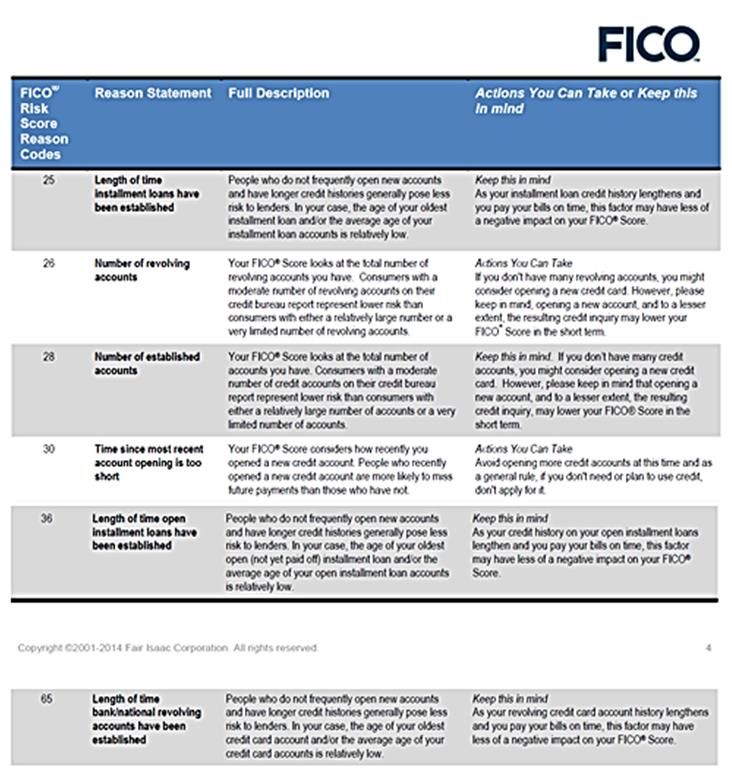

The below speaks to length of time for installment loans and length of time for open installment loans. These particular attributes only refer to installment loans in general - other Fico reason statements speak to Auto and "non mortgage".

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950