- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Maxed one card - Utilization memory

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Maxed one card - Utilization memory

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maxed one card - Utilization memory

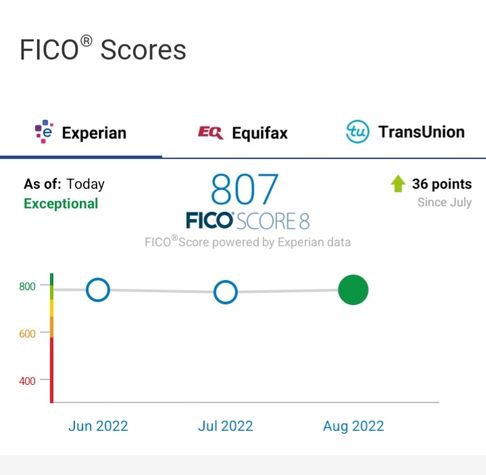

As an experiment for myself I let one card report as maxed. Technically it reported at 94%. My EX 8 score dropped 32 points. One month later, I paid off the card in full. I gained 36 points back showing that there is no utilization memory.

For reference I have a thick/mature/clean file. Attached pics for reference.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed one card - Utilization memory

Thanks for sharing these data points ! How much did the maxed card impact your overall revolving utilization? Also how many cards with balances were reporting ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed one card - Utilization memory

Wow. Maxed out does do some damage as we know. Thanks brother for sharing.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed one card - Utilization memory

I've gotten declined for credit line increases for lack of utilization. Does maxing out that one line and paying it in full make that line ripe for an increase?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed one card - Utilization memory

@pizzadude wrote:Thanks for sharing these data points ! How much did the maxed card impact your overall revolving utilization? Also how many cards with balances were reporting ?

@pizzadude My overall utilization was 14% with the card. I had 7 cards reporting a balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed one card - Utilization memory

Can confirm. I recently let one card go from 3% to >50% (overall went from 1% to 9%), and lost 16 points (EX8). And then I gained 15 points, when I paid it off to 2% (<1% overall). Young/thin/clean file.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed one card - Utilization memory

@GatorGuy Yep, the utilization makes a difference as I discovered that several years back . . . thanks for posting!!!

Current FICO 8 Score in 06/2021: EQ-796, TU-806, EX-812

Goal FICO 8 Score in 06/2022: EQ-825, TU-850, EX-850

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed one card - Utilization memory

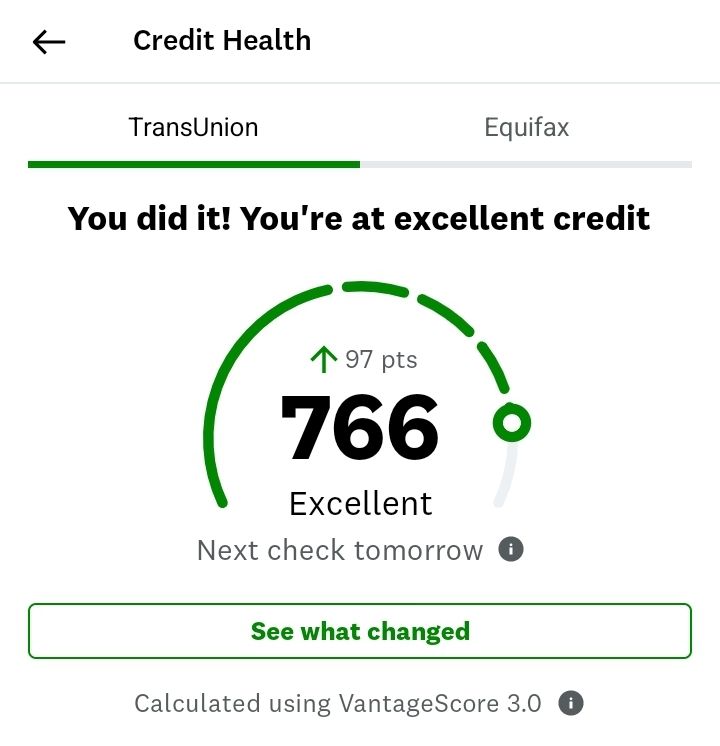

As a comparison here is my TU VS3 score that just reported. I lost 88 points when the card first reported. Now gained 96 points back. Also shows how much more sensitive VS is to utilization than Fico8s.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed one card - Utilization memory

@D10001 wrote:I've gotten declined for credit line increases for lack of utilization. Does maxing out that one line and paying it in full make that line ripe for an increase?

@D10001 This card was a Chase card which I have gotten auto CLIs with them in the past for high utilization, although not this high. Usually they want to see atleast 2 to 3 months of heavy utilization. Personally I would not max out a credit card to try and get a CLI since many lenders can be very sensitive to it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed one card - Utilization memory

@GatorGuy wrote:As a comparison here is my TU VS3 score that just reported. I lost 88 points when the card first reported. Now gained 96 points back. Also shows how much more sensitive VS is to utilization than Fico8s.

Can confirm as well. The effect on my jump to >50% utilization on a single card (9% overall) and back was TU VS3 -39/+40, EQ VS3 -37/+33. So more than double the -16/+15 of EX FICO 8.

It's harder to assess FICO 9s, because the ones I have access to only update 1/month and don't come with a credit report (i.e. they weren't generated at the precise time utilization was updated, and I can't double check the utilization they used to generate the score), but they seem to be comparable to FICO 8: EQ FICO 9 was -2/+14, while EX FICO 9 Bankcard was -17/+15. Can't explain the -2.