- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Minor data point on CC utilization

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Minor data point on CC utilization

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minor data point on CC utilization

When 1 card went from 31% utilization to zero, & overall CC utilization went from 3% to 1%, TU & EX added 2 points in FICO8.

# of cards went from 4/19 to 3/19.

My sense is that it was the 1 card at 31% that was the difference.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor data point on CC utilization

Interesting observation. You are very likely right. High utilization on one card usually affects my score even with overall utilization <1%.

In my currrent bucket, going from 3 to 4 cards, out of 28, reporting a balance caused a 2 point drop in TU 08, even with per card utilization <1% and overall utilization <1%.

Going from 1 to 2 cards caused a 2 point drop in TU 04.

In my current buckets, Experian and Equifax FICOs are unbelievably stable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor data point on CC utilization

@SouthJamaica wrote:When 1 card went from 31% utilization to zero, & overall CC utilization went from 3% to 1%, TU & EX added 2 points in FICO8.

# of cards went from 4/19 to 3/19.

My sense is that it was the 1 card at 31% that was the difference.

Hrm, not sure I buy that on EX: I don't drop points for much higher utilizations than that as a fellow dirty file... I can't test your TU finding personally.

I'm planning to do a detailed analysis soon with my brand spanking new $200 Discover Secured from whatever the minimum is ($2 presumably) all the way up to 100% and everywhere in between and try to nail down this stupid individual tradeline utilization which has been out in the wind for way too long without concrete data.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor data point on CC utilization

@Revelate wrote:

@SouthJamaica wrote:When 1 card went from 31% utilization to zero, & overall CC utilization went from 3% to 1%, TU & EX added 2 points in FICO8.

# of cards went from 4/19 to 3/19.

My sense is that it was the 1 card at 31% that was the difference.

Hrm, not sure I buy that on EX: I don't drop points for much higher utilizations than that as a fellow dirty file... I can't test your TU finding personally.

I'm planning to do a detailed analysis soon with my brand spanking new $200 Discover Secured from whatever the minimum is ($2 presumably) all the way up to 100% and everywhere in between and try to nail down this stupid individual tradeline utilization which has been out in the wind for way too long without concrete data.

If you let $2 report, Discover will eat the $2 and report $0.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor data point on CC utilization

@SouthJamaica wrote:When 1 card went from 31% utilization to zero, & overall CC utilization went from 3% to 1%, TU & EX added 2 points in FICO8.

# of cards went from 4/19 to 3/19.

My sense is that it was the 1 card at 31% that was the difference.

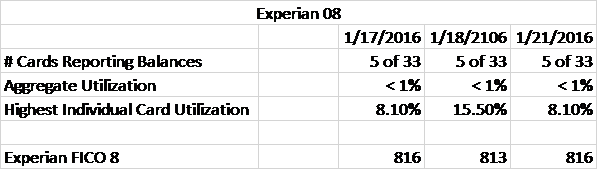

I had a similar result on EX 08:

| Experian 08 | ||||

| 1/17/2016 | 1/18/2106 | 1/21/2016 | ||

| # Cards Reporting Balances | 5 of 33 | 5 of 33 | 5 of 33 | |

| Aggregate Utilization | < 1% | < 1% | < 1% | |

| Highest Individual Card Utilization | 8.10% | 15.50% | 8.10% | |

| Experian FICO 8 | 816 | 813 | 816 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor data point on CC utilization

@oilcan12 wrote:

@Revelate wrote:

@SouthJamaica wrote:When 1 card went from 31% utilization to zero, & overall CC utilization went from 3% to 1%, TU & EX added 2 points in FICO8.

# of cards went from 4/19 to 3/19.

My sense is that it was the 1 card at 31% that was the difference.

Hrm, not sure I buy that on EX: I don't drop points for much higher utilizations than that as a fellow dirty file... I can't test your TU finding personally.

I'm planning to do a detailed analysis soon with my brand spanking new $200 Discover Secured from whatever the minimum is ($2 presumably) all the way up to 100% and everywhere in between and try to nail down this stupid individual tradeline utilization which has been out in the wind for way too long without concrete data.

If you let $2 report, Discover will eat the $2 and report $0.

Ah thanks for the heads up; I had heard Discover did something akin to that but didn't know where their line was... worst case $5 will be fine for this purpose I suspect.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor data point on CC utilization

@Revelate wrote:

@oilcan12 wrote:

@Revelate wrote:

@SouthJamaica wrote:When 1 card went from 31% utilization to zero, & overall CC utilization went from 3% to 1%, TU & EX added 2 points in FICO8.

# of cards went from 4/19 to 3/19.

My sense is that it was the 1 card at 31% that was the difference.

Hrm, not sure I buy that on EX: I don't drop points for much higher utilizations than that as a fellow dirty file... I can't test your TU finding personally.

I'm planning to do a detailed analysis soon with my brand spanking new $200 Discover Secured from whatever the minimum is ($2 presumably) all the way up to 100% and everywhere in between and try to nail down this stupid individual tradeline utilization which has been out in the wind for way too long without concrete data.

If you let $2 report, Discover will eat the $2 and report $0.

Ah thanks for the heads up; I had heard Discover did something akin to that but didn't know where their line was... worst case $5 will be fine for this purpose I suspect.

$3 works fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor data point on CC utilization

@Revelate wrote:

@SouthJamaica wrote:When 1 card went from 31% utilization to zero, & overall CC utilization went from 3% to 1%, TU & EX added 2 points in FICO8.

# of cards went from 4/19 to 3/19.

My sense is that it was the 1 card at 31% that was the difference.

Hrm, not sure I buy that on EX: I don't drop points for much higher utilizations than that as a fellow dirty file... I can't test your TU finding personally.

I'm planning to do a detailed analysis soon with my brand spanking new $200 Discover Secured from whatever the minimum is ($2 presumably) all the way up to 100% and everywhere in between and try to nail down this stupid individual tradeline utilization which has been out in the wind for way too long without concrete data.

So you don't think 80%, 50% 30%, and 10% are pretty solid?

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor data point on CC utilization

@oilcan12 wrote:

@SouthJamaica wrote:When 1 card went from 31% utilization to zero, & overall CC utilization went from 3% to 1%, TU & EX added 2 points in FICO8.

# of cards went from 4/19 to 3/19.

My sense is that it was the 1 card at 31% that was the difference.

I had a similar result on EX 08:

It does look that way

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor data point on CC utilization

@SouthJamaica wrote:

@Revelate wrote:

@SouthJamaica wrote:When 1 card went from 31% utilization to zero, & overall CC utilization went from 3% to 1%, TU & EX added 2 points in FICO8.

# of cards went from 4/19 to 3/19.

My sense is that it was the 1 card at 31% that was the difference.

Hrm, not sure I buy that on EX: I don't drop points for much higher utilizations than that as a fellow dirty file... I can't test your TU finding personally.

I'm planning to do a detailed analysis soon with my brand spanking new $200 Discover Secured from whatever the minimum is ($2 presumably) all the way up to 100% and everywhere in between and try to nail down this stupid individual tradeline utilization which has been out in the wind for way too long without concrete data.

So you don't think 80%, 50% 30%, and 10% are pretty solid?

Certainly not on all scorecards and or on all bureaus. Individual tradelines I've gone up to ~72% without penalty, but I've also been at 93% and did see a drop there; unfortunately my one test at 88% got lost as a result of Chase's mid-cycle reporting which I was unaware of at the time, oopsie. We still have folks suggesting 90% is maxxed out, and others suggesting 80%, which effectively shows we haven't come to a good conclusion on that. Really the way people push their limits here makes it unfeasible for most people to test it unless you're in my situation where credit is kinda irrelevant at this point in time... and a throwaway tradeline makes absolutely no difference: I can't really test it on my other lowest tradeline ($2500) without carrying balances, but I will be spending $200 during a month still repeatedly.

I think 10% and 30% are aggregate boundaries but aggregate and individual are scored differently and there's nothing to suggest they're the same in the implementation either.