- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Mortgage score increase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Mortgage score increase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage score increase

Hello fellow FICO improvement enthusiasts!

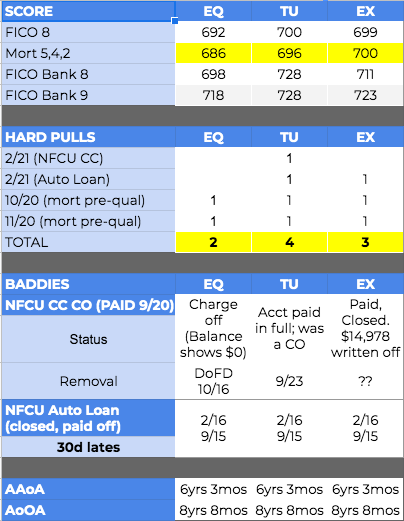

I am trying to figure out if there is anything I can do to improve my mortgage scores.

Current scores and more details in the image below but essentially I can see 3 possible levers to pull outside of just waiting for the baddies to drop off:

- Removing the baddies w/goodwill letters (1 paid/Charged-off CC account & 2 30-day lates on an auto loan which are 5-6 yrs old)

- Seems highly unlikely and maybe not worth the effort of pleading case w/GW letters as my baddies are all with Navy (NFCU) which, as far as I can tell, does not ever remove these for goodwill. (Can't find any indication of success in searching these forums.)

- Maybe though there is a chance as after I paid off my CO with them, I was able to open a new ($8k limit) CC account this Feb and have been heavily utilising and paying it off monthy.

- AZEO

- Currently I have 4 open revolvers reporting, 2 are zero balance (also just opened AMEX Platinum w/no hard pull and not yet reporting)

- Overall CL: $29,500 w/1% utilisation

- Navy Federal More Rewards Amex: $0 balance ($8k CL)

- PayPal Credit: $0 balance ($3k CL)

- American Express Blue Cash Preferred: $98 balance ($2k CL/5% util)

- Chase Sapphire Reserve: $168 balance ($16,500 CL/1% util)

- I plan to pay the Chase down to $0 today since they send an update for $0 balance but not sure if this will get me any boost with such low utilisation anyway.

- Overall CL: $29,500 w/1% utilisation

- Currently I have 4 open revolvers reporting, 2 are zero balance (also just opened AMEX Platinum w/no hard pull and not yet reporting)

- Pay down (or off) my only current auto loan (have no other open loans/mortgages)

- I took out a loan in February w/Subaru (Chase) for a car for my son. I can easily pay this down or off. I only took a loan as they offered me 0% financing so it seemed like a good idea since I had no other open loans and wouldn't cost me any extra money.

- Original balance: $19,938

- Opened: 1/30/21

- Term: 64mos / 0% interest

- Current balance: $18,356

- Current balance: $18,356 (92% of original loan)

- I took out a loan in February w/Subaru (Chase) for a car for my son. I can easily pay this down or off. I only took a loan as they offered me 0% financing so it seemed like a good idea since I had no other open loans and wouldn't cost me any extra money.

Questions:

Option 1 seems unlikely: has anyone been able to GW a Charged-off account or lates from Navy Federal / NFCU?

Option 2: Going to do this regardless as it's easy/no-brainer but I'm not sure if it will help given the low utilisation. Any predictions?

Option 3: Will paying my auto loan off or down to a specific % help my mortage score? I'm hesitant to do this given the 0% interest I'm paying and that it would require selling stocks which are currently doing very well (and likely will continue to do so) so lost opportunity cost so it would help to have any data points as to whether this would move the mortgage scores.

Details:

Thanks for any help!! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score increase

@electra wrote:Hello fellow FICO improvement enthusiasts!

I am trying to figure out if there is anything I can do to improve my mortgage scores.

Current scores and more details in the image below but essentially I can see 3 possible levers to pull outside of just waiting for the baddies to drop off:

- Removing the baddies w/goodwill letters (1 paid/Charged-off CC account & 2 30-day lates on an auto loan which are 5-6 yrs old)

- Seems highly unlikely and maybe not worth the effort of pleading case w/GW letters as my baddies are all with Navy (NFCU) which, as far as I can tell, does not ever remove these for goodwill. (Can't find any indication of success in searching these forums.)

- Maybe though there is a chance as after I paid off my CO with them, I was able to open a new ($8k limit) CC account this Feb and have been heavily utilising and paying it off monthy.

- AZEO

- Currently I have 4 open revolvers reporting, 2 are zero balance (also just opened AMEX Platinum w/no hard pull and not yet reporting)

- Overall CL: $29,500 w/1% utilisation

- Navy Federal More Rewards Amex: $0 balance ($8k CL)

- PayPal Credit: $0 balance ($3k CL)

- American Express Blue Cash Preferred: $98 balance ($2k CL/5% util)

- Chase Sapphire Reserve: $168 balance ($16,500 CL/1% util)

- I plan to pay the Chase down to $0 today since they send an update for $0 balance but not sure if this will get me any boost with such low utilisation anyway.

- Pay down (or off) my only current auto loan (have no other open loans/mortgages)

- I took out a loan in February w/Subaru (Chase) for a car for my son. I can easily pay this down or off. I only took a loan as they offered me 0% financing so it seemed like a good idea since I had no other open loans and wouldn't cost me any extra money.

- Original balance: $19,938

- Opened: 1/30/21

- Term: 64mos / 0% interest

- Current balance: $18,356

- Current balance: $18,356 (92% of original loan)

Questions:

Option 1 seems unlikely: has anyone been able to GW a Charged-off account or lates from Navy Federal / NFCU?

Option 2: Going to do this regardless as it's easy/no-brainer but I'm not sure if it will help given the low utilisation. Any predictions?

Option 3: Will paying my auto loan off or down to a specific % help my mortage score? I'm hesitant to do this given the 0% interest I'm paying and that it would require selling stocks which are currently doing very well (and likely will continue to do so) so lost opportunity cost so it would help to have any data points as to whether this would move the mortgage scores.

Details:

Thanks for any help!!

1. You can also send "verification" letters to the credit bureaus. Sometimes the lender doesn't bother responding, in which case the items get removed.

2. You're pretty much optimized on revolving utilization. You might pick up a couple of points by letting just one of the non-Chase cards report a small balance.

3. The mortgage scores don't react much, if at all, to installment utilization, but if you were to pay it off they would probably react favorably to having one less account with a balance.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score increase

Thanks @SouthJamaica !

I paid the Chase account to zero, guess we'll see in a day or two if that helps although I think I'll have to pull another report to get updated mortgage scores, right?

Question: what is a verification letter? Is that different from just filing a dispute? Any examples/threads you could point me at?

For the auto loan, I don't really want to pay it off because then I won't have any current loans and I think that will ding me on my other scores. I only need 4 points on TU to hit 700 which would give me a middle mortgage score of 700 which I think is the next bracket for lower interest so even if I'd only get a few points it might be worth it to pay it down. Is there a % balance that might win me a few points?

Thanks so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score increase

@electra wrote:Thanks @SouthJamaica !

I paid the Chase account to zero, guess we'll see in a day or two if that helps although I think I'll have to pull another report to get updated mortgage scores, right?

Question: what is a verification letter? Is that different from just filing a dispute? Any examples/threads you could point me at?

For the auto loan, I don't really want to pay it off because then I won't have any current loans and I think that will ding me on my other scores. I only need 4 points on TU to hit 700 which would give me a middle mortgage score of 700 which I think is the next bracket for lower interest so even if I'd only get a few points it might be worth it to pay it down. Is there a % balance that might win me a few points?

Thanks so much for your help!

I agree, leave the auto loan open as you will probably lose a few points for not having an active installment loan if you paid it off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score increase

@electra wrote:

Question: what is a verification letter? Is that different from just filing a dispute? Any examples/threads you could point me at?

The TL,DR is that you dispute the item on your credit report. The CRA comes back and tells you that the information on the credit report is accurate.

You have the right to send a verification demand letter (sent CMRR, as the date they receive the letter is relevant) requesting they explain the method they used to verify the accuracy of the information.

The gamble is that the creditor can't prove within the necessary timeframe that the debt is valid. If they can't or don't then the CRA risks being sued if they don't remove the item. The flip side is if that if the creditor does prove the debt is valid then the item just became even more difficult to get removed from your report.

If you search using your favorite search engine you can find examples and sample letters to help explain the process. I would discourage posting links because links to some of those sites are not permitted here either in the forum itself or via PM.

FICO 8 (EX) 838 (TU) 846 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score increase

@electra wrote:Thanks @SouthJamaica !

I paid the Chase account to zero, guess we'll see in a day or two if that helps although I think I'll have to pull another report to get updated mortgage scores, right?

Question: what is a verification letter? Is that different from just filing a dispute? Any examples/threads you could point me at?

For the auto loan, I don't really want to pay it off because then I won't have any current loans and I think that will ding me on my other scores. I only need 4 points on TU to hit 700 which would give me a middle mortgage score of 700 which I think is the next bracket for lower interest so even if I'd only get a few points it might be worth it to pay it down. Is there a % balance that might win me a few points?

Thanks so much for your help!

1. Yes the only way I know to get your 3 mortgage scores is the expensive way... through MyFICO.

2. A verification letter is a letter to the credit bureau requesting that they verify a particular item.

3. Yeah, pay the car loan down to 9% of the original loan amount. That's a magic number for aggregate installment loan utilization percentage. It usually gets people a big bonus in FICO 8's and 9's. As to the mortgage scores, sometimes it produces nothing, but it sometimes can get you a few points. Revelate reported receiving a small boost in his EX FICO 2. I received a small boost in my TU FICO 4.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage score increase

Thanks @SouthJamaica @coldfusion @pizzadude

I paid the Chase down to zero and it's updated on their site as zero but haven't yet gotten an alert from myFICO for the balance change. I'm going to wait for that and until the month rolls over and then pull a new report and decide whether to pay the loan down to 9% and in the meantime I'll try the verification technique for the CO.