- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Multiple lates vs. worse lates

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Multiple lates vs. worse lates

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple lates vs. worse lates

Is there any information out there about how exactly multiple lates of one severity "count as a pattern" or are "equivalent to the next severity"? Is it actually the case that a certain number of 30s are literally counted as a 60? If so, is it cumulative? For instance if hypothetically speaking 3x 30s counted as a single 60 and someone had 9x 30s would that count as 3x 60s? Does this combining happen across all TLs or only each one individually? How does time factor into it (for instance, a 30 across 5 TLs in the same month says something different than 5x 30s in a row across the same TL)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiple lates vs. worse lates

Delinquencies that are 30 or 60-late are considered minor derogs, and those that become 90+ are major for scoring purposes.

The primary importance is that minor derogs generally lose most of their scoring impact within 1-2 years, and also do not result in the scorecard being categorized as "dirty" for purposes of bucketing your scoring.

The question of whether multiple minor derogs are scored by FICO at a higher penalty, or whether multiple minors also result in the scorecard being considered as "dirty" for bucketing purposes, has not been publicly addressed by Fair Isaac, and is subject to interpretation/speculation.

Fair Isaac does not publicly release that level of detail, as their scoring algorithms require continued trade secret protection to prevent reingineering based on public record information. I am not aware of any objective statements by Fair Isaac that disclose the degree to which the reporting of multiple minor derogs may result in scorecards being considered as dirty for scoring purposes.

I am also have not seen any thorough documentation by way of collection of anecdotal experiences provided by others that would substantiate how the algorithms handle multiple minor derogs in some enhanced fashion.

I would hypothesize that FICO likely has some provision for treating multiple, repeated 30 or 60-late reportings in a negative manner, but that is only speculation on my part.

Perhaps someone has access to comprehensive anecdotal experiences posted by others that would shed some factual light on the issue.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiple lates vs. worse lates

As for pattern vs worse, we honestly don’t know: FICO 8 instituted patterns in their algorithm but it isn’t clear what precisely they are scoring on; that said, a worse late absolutely costs more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiple lates vs. worse lates

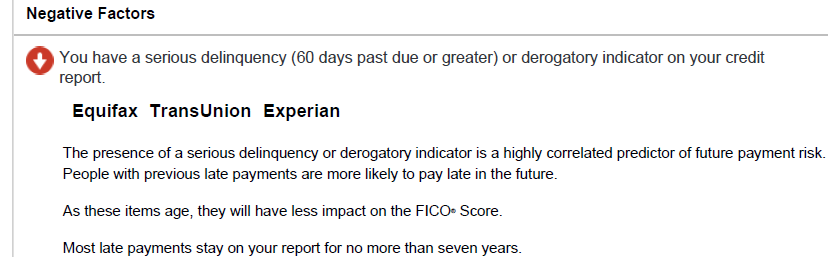

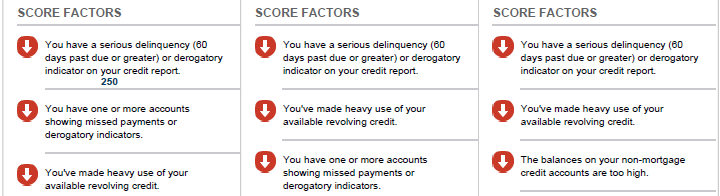

I'm not familiar with the exact wording of the negative reason codes associated with lates, but I know for a major one of the common ones is something to the tune of "serious delinquency present." I guess my question would be if someone has multiple minors, like say 3-4 30's, do they get a reason statement in line with the one I quoted above, or would it just land as something more like "too few accounts paid as agreed?"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiple lates vs. worse lates

A 30D late segments, as does a 60D or higher too: my guess is you get sorted into scorecard and then the pattern might penalize you more heavily than someone who just has one.

The reason code likely wouldn’t change in that case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiple lates vs. worse lates

Well I pulled up an old report when I had 2-3 30d's, 1 60d and 1 90d.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiple lates vs. worse lates

It seams to me that you do not understand what a 60D and worse are compared to a 30D. If you have a 60D it does not stand alone but is a 60D and a 30D on your account at the same time. It also says that you allowed the account to become a problem by ignoring it. Lates work by falling into three categories: existing, lates per account, and number of lates.

In your hypothetical situation one 60D will be worse than three 30D assuming it is on a single account. This is because of the earlier mentioned stacking of a 60D+30D. In the case where you have multiple 30D's across multiple accounts in a month that will also hurt more than a single account being 30D late for five months consecutively. This is because you will have multiple accounts in the Fico formula reporting negative information and as a result something happened in the real world to make you drop the ball on payments. Maybe you lost your job? On the other hand one account continuously 30D late also will show that something is wrong but that the reason is something else since you are now intentionally choosing to not pay this account. Also in such a case the first late would have aged resulting in not as much damage compared to the earlier ones being perfectly fresh.

Regardless I recommend paying on time. This is because just getting any negative info added to your report is a great way to boat anchor it in the middle of the mariana's trench.

Active:

Bank of America (Customized Cash Rewards VSC, Unlimited Cash Rewards WMC{PT}), Capital One (Discover It DC, Savor WEMC), Chase (Amazon Prime VSC, Freedom Flex WEMC [x2]), Citi (Custom Cash WEMC, Dividend MC), Citizens GreenSense WMC, Curve WEMC{S}, FNBO Ducks Unlimited VSC, GBank VSC, Imprint Rakuten AC, PenFed Pathfinder Rewards VSC, Santander Ultimate Cash Back WMC, Synchrony (OnePay Walmart CashRewards MC, PayPal Cashback WMC), UMB Simply Rewards VSC[Milford Federal], US Bank (Cash+ VSC [x2], Kroger Rewards WEMC, Pick n Save/Metro Market Rewards WEMC, Shield VC)

Wishlist: AAA Daily Advantage, AOD Signature, Aven, Bellco Colorado Rewards, Nusenda Platinum Cash Rewards, PCMCU Platinum Rewards, Redstone FCU Signature

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiple lates vs. worse lates

@zerofire wrote:It seams to me that you do not understand what a 60D and worse are compared to a 30D. If you have a 60D it does not stand alone but is a 60D and a 30D on your account at the same time.

A string of lates together (30 one month, 60 the next, 90 the next) is viewed/scored by the severity of the late payment at the end of the string. So, if someone is 30 days late in March and then 60 days late in April, that account is viewed/scored as having a 60 day late... the 30 day and 60 day from 2 different months aren't counted as different lates. They are the same late, it just doubled in time/severity.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiple lates vs. worse lates

“Sure, what do you want, two $9’s or three $6’s ?”

If we are talking about lates which accumulate in the dozens, it seems to me the cardholder may want to not worry about score just yet, and get a better budget in place.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Multiple lates vs. worse lates

@NRB525 wrote:

If we are talking about lates which accumulate in the dozens, it seems to me the cardholder may want to not worry about score just yet, and get a better budget in place.

Let's not forget that budget is only one reason why someone may be late. Ignorance is right up there with budget; many times it has nothing to do with money and individuals just don't care to pay things on time. Look at filthy rich millionaires with 500-600 FICO scores, for example, that may know that paying late isn't good for their credit health, but they don't care. Others don't know that paying late impacts their credit health (they think worst case is they get a late fee, say), so even though they have the money to pay things on time they don't. I just use the broad term ignorance here... not saying people are "stupid" simply that they don't know/understand the consequences related to their actions sometimes.