- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Need help optimizing credit scores for mortgage

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need help optimizing credit scores for mortgage

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

Glad that is one less thing to have to deal with at the present. I agree with Heaven's reply in paying creditors. In my journey, yes utilization plays a factor, but mortgage scores do react to too many accounts reporting a balance.

When you add your spouse as an authorized user, as told that one of your oldest cards, but make it a bank card and not a retail store card. She will generate a FICO score at the card's next reporting, and not have to wait another 3 mos on the loan.

Best of luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

@jg1983 wrote:

These balances are a close approximation.

DCU: $1000/$1000 pay off

Navy Federal: $1500/$1600 pay off

Chase: $500/$500 pay off

Mattress Firm: $300/$2500

Amazon Store card: $800/$800 pay off

Capital One: $400/$500 pay $100 a month

CO platinum: $0/$300

Walmart: $0/$300

Based on this and your minimal savings for the trip, I would suggest putting off a Mortgage for a while longer. You really are close to being maxed out, and being that close for too long is likely to make the Banks skittish. I would recommend paying off all above except Mattress Firm and Cap one. Then start saving everything and anything you can for a Down payment. All while paying Cap One mroe than the minimums.

But still, that isn't going to help much with DTI. CC payments are rather small compared to Car payments, Loan payments and back Taxes etc. That's where you're really taking the hit.

Navy $125 pay off

NF CLOC $100 pay off

CU #3 $180

Taxes $150

Car $???

Total $330 + Car $?? + Mattress $50

^ This will create a lower DTI. So you've got a busy year to bring all this down. And depending on what you pay for rent, any disposable income should go towards this goal. Once that happens it will be easier to save more Money for a House without paying all that interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

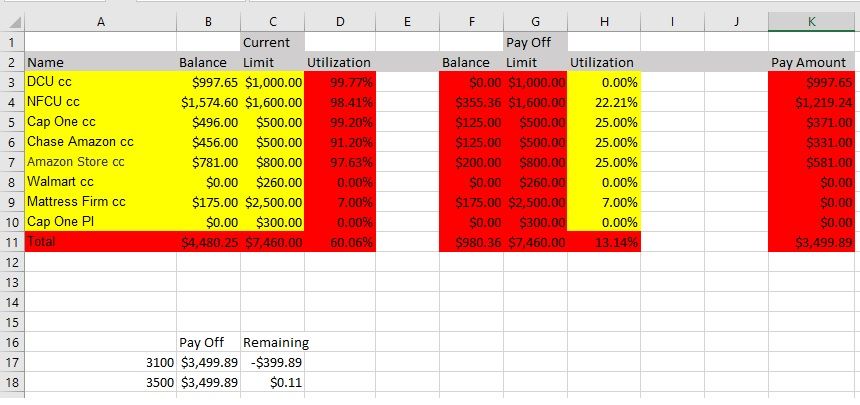

Here is a screenshot of a spreadsheet I put together to calculate utilization and the amount to pay for each card. Before I had estimates of what I thought were my balances. In the spreadsheet I used the exact numbers. Do you guys think I am on the right track here or would you adjust some things? I chose to pay the DCU card to zero because it is my oldest card and I can add my wife to it. Looks like I will be a little over 13% over all utilization. Below 10% is the target correct? If that is the case I may be able to squeeze a little more money out of my budget to hit 10%. Regardless going from 60% to 13% should give my scores a decent boost correct? It is encouraging to know I will be less than $1000 from paying off all my credit cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

We are three years into our FHA loan through homebridge financial. No its not the best loan, but it got us into our home here is South Florida and we love it.

Keep at it bud. It will be worth it in the end.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help optimizing credit scores for mortgage

Good work, @jg1983. ![]() Those new numbers will give your report a much prettier look.

Those new numbers will give your report a much prettier look.

Note that "below 10%" actually means 8.9% or below. That's because all fractions round up. 9.000000001% rounds up to 10% and is no longer "below 10%."

Now that all cards are below 28.9%, you should start bringing cards to zero, starting with the smallest balance first. If you can reach the ideal, exactly one card would be reporting a non-zero balance.