- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Over 50% of Cards Reporting A Balance, No Score Ch...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Over 50% of Cards Reporting A Balance, No Score Change

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over 50% of Cards Reporting A Balance, No Score Change

I have 8 open cards, have been carrying a balance on 4 of them for several monthe. Today a fifth card reported a balance, I got the alert from My Fico, but no score change. I was under the impression that if over 50% of you cards reported a balance, it would affect your score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Over 50% of Cards Reporting A Balance, No Score Change

Thanks so much for the info, TC.

The general guess about percentage of cards is generally formulated as there being a scoring shift from < 49% to more than that. You were allready at 50% for the last four months, so that conjecture wouldn't predict a score change for you. (You went from 50% to 62.5%)

Also FICO 8 is known to be weaker with respect to this factor than are previous models, like the mortgage models. With the mortgage models you definitely get some substantial benefit by going from AZEO (all zero except one) to gradually having more and more cards showing positive balances.

Another point is that FICO's lanuage strictly speaking doesn't say "percentage of accounts" but "number of accounts" so it is quite possible that raw number matters a lot too. The conjecture that it is only a percentage has been made, but we can't know that for sure: FICO may care about both percentage and raw number. Also worth noting that FICO's official language refers to number of accounts -- without specifying that they all have to be revolving (maybe FICO considers installment accounts too).

If you can get your credit cards all paid off at some point, it would be interesting for you to try having 1 out of 8 reporting and then take it to 8 out of 8 reporting, and see what that does. I am sure folks here would enjoy hearing what happens.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Over 50% of Cards Reporting A Balance, No Score Change

On my profile, I can go from AZEO to 100% of my cards with balances reported and I see no score drop at all under FICO 08. I have never once looked at my mortage scores, but from what I understand they likely drop significantly with all cards reporting balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Over 50% of Cards Reporting A Balance, No Score Change

It is my understanding that mortgage scores drop quite a bit depending on number of credit cards that report a balance and not as a percentage of cards. Equifax is supposedly the worst with scores really dropping fast if more than 3 cards report a balance.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Over 50% of Cards Reporting A Balance, No Score Change

@jamie123 wrote:It is my understanding that mortgage scores drop quite a bit depending on number of credit cards that report a balance and not as a percentage of cards. Equifax is supposedly the worst with scores really dropping fast if more than 3 cards report a balance.

It still strikes me as peculiar that FICO's language never refers specifically to revolving accounts here, but rathen just to plain old accounts. I'd love to see a case study where we have two people, one with one open loan, and the other with six or more open loans, but both with five credit cards each, try to duplicate the experment (going from 1 cards to 2 to 3, to 4 etc. showing a balance). If revolvers are the only thing that matter, we should see a very similar or perhaps identical effect. If installment accounts count too, then the guy with all the loans would see very little difference whereas the guy with 0/1 loans would see a striking difference.

And of course it might be only fully visible when testing the mortgage scores.

I have myself some weak evidence along this line. I received a reason statement on my mortgage scores that stated that I had "too many" accounts showing a balance. I saw this reason across multiple CRAs. At the time I had twelve open cards with exactly two showing a balance. I also had two open loans, however.. Total number of accounts shwing a balance was four, though for revolvers it was only two out of twelve. My mortgage scores were higher than average but still a good ways from perfect (770s) and therefore the reason codes might be expected to be accurately describing real reasons I was being penalized.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Over 50% of Cards Reporting A Balance, No Score Change

@Anonymous wrote:On my profile, I can go from AZEO to 100% of my cards with balances reported and I see no score drop at all under FICO 08. I have never once looked at my mortage scores, but from what I understand they likely drop significantly with all cards reporting balances.

Hi BBS! I know you tested something like this (for FICO 8) at least a year ago, when you had fewer cards. Remind us how many cards you have now? And have you tried rigorously testing this in the last few months?

Also curious (see my post to Jamie above) how many open loans you had at the time of your original test and also now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Over 50% of Cards Reporting A Balance, No Score Change

@Anonymous wrote:I have 8 open cards, have been carrying a balance on 4 of them for several monthe. Today a fifth card reported a balance, I got the alert from My Fico, but no score change. I was under the impression that if over 50% of you cards reported a balance, it would affect your score?

The score change that may or may not happen due to a change in # of cards reporting is dependent on the scorecard your profile is assigned and on the profile itself. Furthermore, different Fico scoring models (and the CRA tweaks to the Fico model) evaluate the # accounts reporting a balance differently. Thus, there is no set "rule". That being said, there are some general threshold guidelines that appear common among many posters.

As with BBS, I can report balances on 100% of my open accounts without experiencing a Classic Fico 8 score drop (4 revolving CCs, 1 charge card, 1 AU CC and 1 installment loan).However, I have observed that my Bankcard EQ Fico 8 is mildly influenced by # cards reporting balances - perhaps 10 points total, at most.

Time and time again I see that Fico mortgage scores do react more strongly to # (or %) of cards reporting that their Fico 8 counterparts. The score sensitivity and thresholds are CRA dependent. What I observe is as follows (AU included in count because older Fico models always consider AU accounts:

1) EQ Fico score 5 (Fico 04 model): 2 of 6 => 3 of 6 no score change; 3 of 6 to 4 of 6 => minor, 5 point score drop; 4 of 6 to 5 of 6 => another, significant, score drop (about 15 points more); 5 of 6 to 6 of 6 => additional major score drop (a bit over 20 points)

2) TU Fico score 4 (Fico 04 model): 2 of 6 => 3 of 6 => 4 of 6 no score change. 4 of 6 => 5 of 6 minor score drop, 5 of 6 => 6 of 6, another minor score drop

3) EX Fico score 3 and EX Fico score 2 (Fico 04 and Fico 98 models): 2 of 6 => 3 of 6 => 4 of 6 => 5 of 6, no score drop. 5 of 6 => 6 of 6, score drop.

In summary for % cards reporting balances, I see the following for Fico mortgage scores

* % cards reporting rounded up to the next whole number

| CRA | 34% to 50% | 50% to 67% | 67% to 84% | 84% to 100% |

| Equifax | no change | 1st score drop | 2nd score drop | 3rd score drop |

| TransUnion | no change | no change | 1st score drop | 2nd score drop |

| Experian | no change | no change | no change | 1st score drop |

Note: There are indications that Fico looks at total open accounts with balances not just card accounts.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Over 50% of Cards Reporting A Balance, No Score Change

@Anonymous wrote:Hi BBS! I know you tested something like this (for FICO 8) at least a year ago, when you had fewer cards. Remind us how many cards you have now? And have you tried rigorously testing this in the last few months?

Also curious (see my post to Jamie above) how many open loans you had at the time of your original test and also now.

When I tested this it was back when I had 5 cards, one of which was Blispay which only reports to EX so on EX I was at 5 of 5 with balances reported and on TU and EQ I was at 4 of 4 with balances reported. Since that time I scooped up 3 more cards, so I sit at 8 total. EX sees all 8 of course, where EQ sees 7 (no Blispay) and TU sees 6 (no Blispay or Citi). No clue why my near 5 month old Citi account has yet to report to TU. The Citi EO has been "looking into this" for about 3 weeks now for me. I have not tried testing this again since getting my 3 new cards earlier this year, but it's something I have no problem doing again soon.

I'm just about done with a minimum balance reported by creditors test for which I'll start a thread in the relative near future. What I've been doing is allowing a $1.00 balance to remain on my CCs. If the creditor reports $0, I raise the balance to $2.00 the following month and continue the process until I find the point where they report the balance. While this information isn't all too meaningful, it's simply something I wanted to know and was just fun to test. I've got all but 2 finite values at this point, one of which I'll get on or about the 25th of this month and the final one will be on or about the 4th of next month.

At that point I'll allow all of my cards to possess small balances at the same time again and rock a $1 CCT trial once they have all reported.

At the time of the original test I had 3 open loans; 1 mortgage, 2 auto. I still have the same 3 open loans today.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Over 50% of Cards Reporting A Balance, No Score Change

Interesting. So if we take FICO's own language at face value -- that it is accounts with a positive balance that matters (not revolvers alone) then you went from 4 accounts (out of 7) reporting a balance to 7. This may be why you didn't see a score shift,

I have been trying to find a couple people with many open installment accounts to run this test and compare that with a couple people who zero or one open loans.

http://ficoforums.myfico.com/t5/Student-Loans/Do-you-have-several-student-loans/m-p/5050141

In a perfect world I'll find somebody with five loans and five revolvers. Then compare that with somebody who has one loan and five revolvers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Over 50% of Cards Reporting A Balance, No Score Change

@Anonymous wrote:Interesting. So if we take FICO's own language at face value -- that it is accounts with a positive balance that matters (not revolvers alone) then you went from 4 accounts (out of 7) reporting a balance to 7. This may be why you didn't see a score shift,

I have been trying to find a couple people with many open installment accounts to run this test and compare that with a couple people who zero or one open loans.

http://ficoforums.myfico.com/t5/Student-Loans/Do-you-have-several-student-loans/m-p/5050141

In a perfect world I'll find somebody with five loans and five revolvers. Then compare that with somebody who has one loan and five revolvers.

The accounts reporting balances certainly is tweaked by each CRA at least up until Fico 9. In my summary above total accounts with balances including mortgage would be:

A) 3 of 7 => 4 of 7 => 5 of 7 => 6 of 7 => 7 of 7 (Fico 04 and Fico 98 models)

b) 2 of 6 => 3 of 6 => 4 of 6 => 5 of 6 => 6 of 6 (Fico 8 and Fico 9, AU card not counted)

Note: The only two accounts that report a balance each and every month are the mortgage and the AU card - actually there was one month in the last 5 years that the AU card did not show a balance (10/2016).

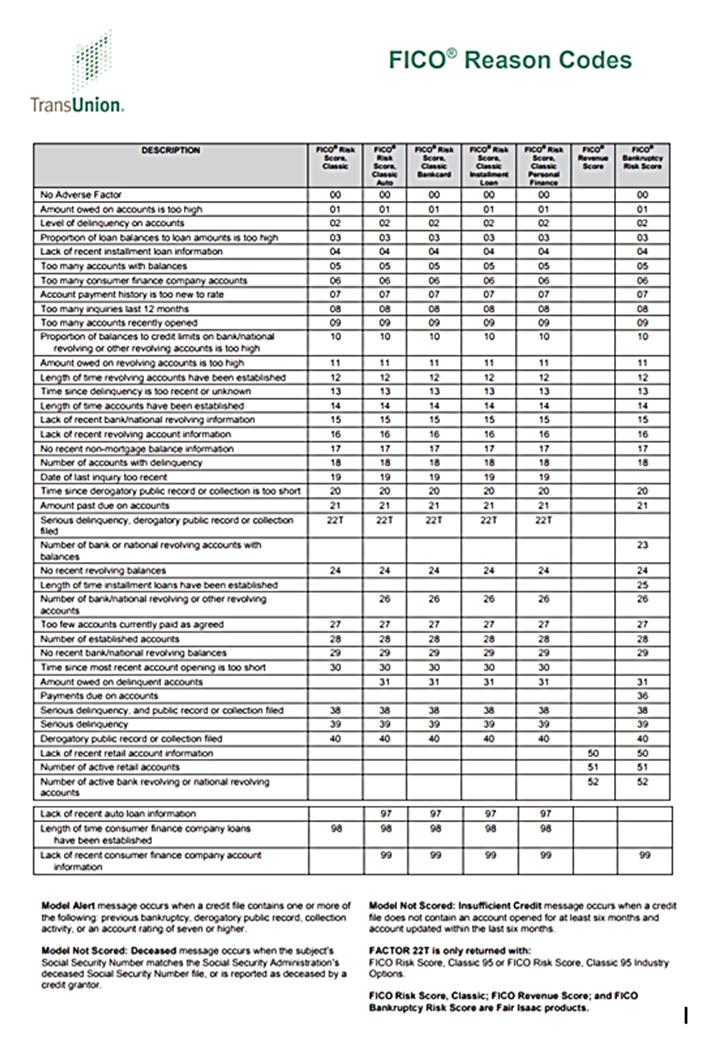

FYI - pasted below are TU reason codes publish date listed is 2009

What I find quite interesting is that the Classic Fico Enhanced Fico models (such as Auto and Bankcard) evaluate # of bank/national accounts or other revolving accounts. The other interesting factor on the Classic Fico enhanced versions only is "lack of recent Auto loan information".

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950