- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Paying off all but 3k of debt dropped my TU mortga...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

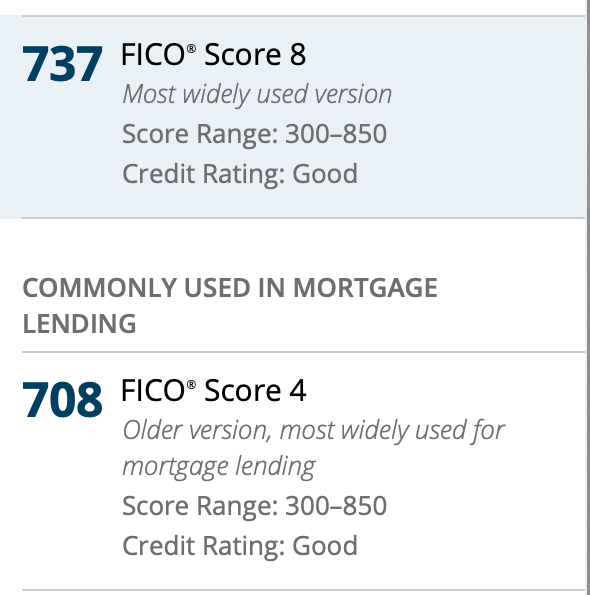

Paying off all but 3k of debt dropped my TU mortgage score from 708 to 664 - why?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

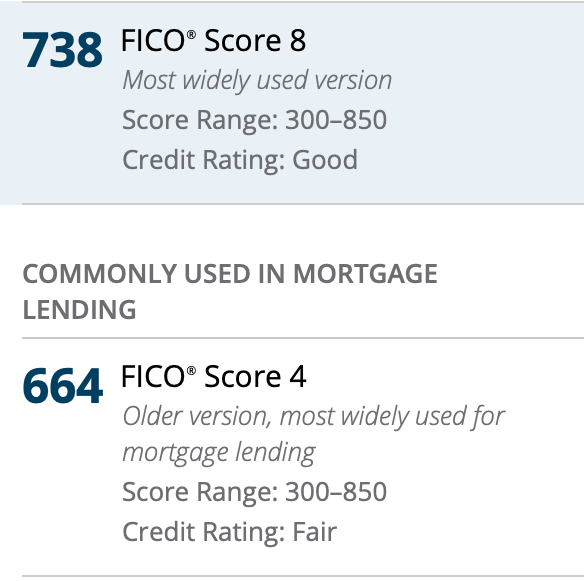

Paying off all but 3k of debt dropped my TU mortgage score from 708 to 664 - why?

I paid $20k in debt and my FICO 8 went up ranging from 25-45 points. I did a screenshot of my mortgage numbers before all was reported and FICO 4 took a nosedive after paying the debt. The mortgage we just paid off hasn't been reported yet. Nothing else happened. So, why am I being penalized for paying debt?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off all but 3k of debt dropped my TU mortgage score from 708 to 664 - why?

Did you pay down or pay off?

If you paid down debt (but not off) I don't see how that could possibly lower your scores. If your score dropped, it's due to a different factor IMO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off all but 3k of debt dropped my TU mortgage score from 708 to 664 - why?

I paid down, leaving 3k on 2 cards. I paid out 20k. That's how I feel too, but there was absolutely nothing else. I have 2 installment loans that I paid at the same time, but they aren't showing yet, so they can't factor in, right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off all but 3k of debt dropped my TU mortgage score from 708 to 664 - why?

What are the score factor codes ? They wiil be in order of impact and upto four of them. If you have them for either one or both of the TUC4 FICO scores it would help.

Discover 09/90 19,000, JCPenney 10/2008 4,700 US Bank Cash 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 15,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 Banking: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican CU

Pelican State CU Redstone FCU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off all but 3k of debt dropped my TU mortgage score from 708 to 664 - why?

@Anonymous wrote:I paid down, leaving 3k on 2 cards. I paid out 20k. That's how I feel too, but there was absolutely nothing else. I have 2 installment loans that I paid at the same time, but they aren't showing yet, so they can't factor in, right?

Right, only the data on your report is considered when your score is generated.

If you paid down $20k in debt but left $3k on 2 cards there is no way that you would have seen a score drop (from that). If your score dropped it was due to a different reason. If you are 100% sure that there is nothing else that changed on your report then I would chalk it up to an algorithm glitch or something, because paying down $20k in debt isn't going to drop your F4 some 40+ points.

I agree with the other reply that taking a look at your negative reason statements before and after would be beneficial in your investigation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off all but 3k of debt dropped my TU mortgage score from 708 to 664 - why?

Also yes I believe that a account can be reported and affect score before the data is dropped into the interface where you can see it, occasionally. I don’t believe this is widespread, but I’ve experienced this on occasion. there’s also a link in the Primer regarding it, post 7.

For example, US Bank reported my balance on the 30th, but it didn’t appear on EX till the fourth. Does that mean the CRA didn’t get it until the fourth? No, they had it since 30th, but the interstitial time (the time between when the CRA receives it and when its inserted into their live dataset) varies.

Typically it is inserted in the primary and secondary datasets pretty close together, I believe, but as I said, I have experienced times when it was obviously counting the report, but the data was not accessible to me from the interface until the following day.

And as mentioned EX has had some scoring irregularities lately.

Maybe we can figure out which one it is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off all but 3k of debt dropped my TU mortgage score from 708 to 664 - why?

I guess I had to do a new report to see it. They are now 708/715/765, so it's correct now. Thanks all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off all but 3k of debt dropped my TU mortgage score from 708 to 664 - why?

@Anonymous wrote:I guess I had to do a new report to see it. They are now 708/715/765, so it's correct now. Thanks all.

Mystery solved ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691