- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Paying off cc's works!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paying off cc's works!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

@ronstar7 wrote:

@SouthJamaica wrote:

@ronstar7 wrote:Hi all,

I am so excited!!

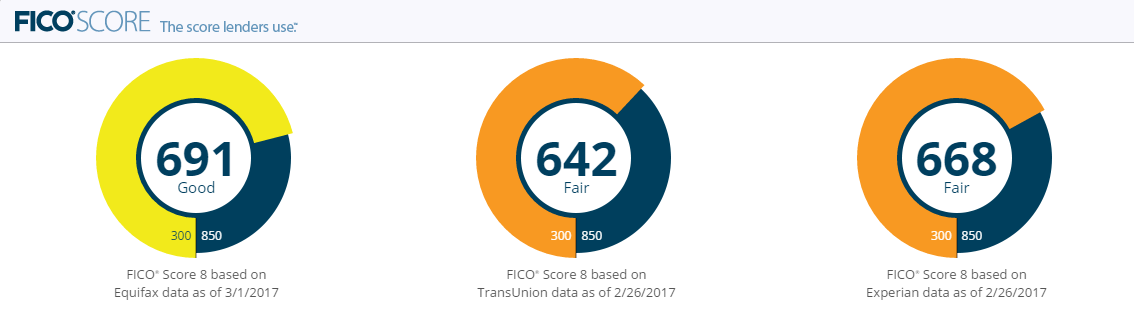

My experian rose 55 points today (My Fico) beause I paid off a $664 balance off on Cap One. I have never been this high. I know others are way higher but I am still thrilled!!! Back in April of last year I paid all cc off and my score only went up a little. But today with one card it goes up by 55. Does that sound right or could it have a combintation that made it rise? Accoring to my fico that was the only reason listed.

Edit: today Equifax follwed with its own 55 point bump!! Im FINALLY in the yellow lol!! now just waiting on transunion

1. Congratulations

2. The contents of the alert and the score change referenced in the alert are not necessarily causally related. Most likely there are other factors which also contributed to the score increase.

Thank you!

Thats what I thought too but it didnt list anything else as the reason unless My Fico just isnt aware yet. It only showed "your balance has changed. Its was at 664 and I paid it off but then cap one tacked on some bs interest that wound up getting reported which left the balance looking as if it were $6 when it should have been 0. Idk I carried a balance on this card for a long time so maybe that had someting to do with. To be honest I dont really care lol Im just happy it went up

That's because the alerts don't provide reasons.

There are certain events, such as a balance change, which trigger MyFICO alerts.

If there happens to be any difference between your present score at that particular bureau, and the previous score reported to you from that bureau, the score change is tacked on to the alert. There is not necessarily any connection at all between the score change and the alert substance.

E.g., I might get an alert that says my balance on a particular account increased by $1100, and my score has increased by 2 points. There was no connection at all between the 2 events. But if I got an alert that says my balance on that account decreased by $1100, and my score has increased by 2 points, I might be seduced into believing -- even after my 2 years of getting used to MyFICO -- that the reason for the score increase was the decrease in the account balance.... which might be the case... and might just as easily not be the case.

We all get confused by this, until we get used to it, and I think MyFICO would do well to take away some of this confusion.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

@SouthJamaica wrote:

@ronstar7 wrote:

@SouthJamaica wrote:

@ronstar7 wrote:Hi all,

I am so excited!!

My experian rose 55 points today (My Fico) beause I paid off a $664 balance off on Cap One. I have never been this high. I know others are way higher but I am still thrilled!!! Back in April of last year I paid all cc off and my score only went up a little. But today with one card it goes up by 55. Does that sound right or could it have a combintation that made it rise? Accoring to my fico that was the only reason listed.

Edit: today Equifax follwed with its own 55 point bump!! Im FINALLY in the yellow lol!! now just waiting on transunion

1. Congratulations

2. The contents of the alert and the score change referenced in the alert are not necessarily causally related. Most likely there are other factors which also contributed to the score increase.

Thank you!

Thats what I thought too but it didnt list anything else as the reason unless My Fico just isnt aware yet. It only showed "your balance has changed. Its was at 664 and I paid it off but then cap one tacked on some bs interest that wound up getting reported which left the balance looking as if it were $6 when it should have been 0. Idk I carried a balance on this card for a long time so maybe that had someting to do with. To be honest I dont really care lol Im just happy it went up

That's because the alerts don't provide reasons.

There are certain events, such as a balance change, which trigger MyFICO alerts.

If there happens to be any difference between your present score at that particular bureau, and the previous score reported to you from that bureau, the score change is tacked on to the alert. There is not necessarily any connection at all between the score change and the alert substance.

E.g., I might get an alert that says my balance on a particular account increased by $1100, and my score has increased by 2 points. There was no connection at all between the 2 events. But if I got an alert that says my balance on that account decreased by $1100, and my score has increased by 2 points, I might be seduced into believing -- even after my 2 years of getting used to MyFICO -- that the reason for the score increase was the decrease in the account balance.... which might be the case... and might just as easily not be the case.

We all get confused by this, until we get used to it, and I think MyFICO would do well to take away some of this confusion.

Absolutely lol. well now I am really am anxious to know what caused it!

Starting scores after BK (Filed 4/18/24) EQ 571 , TU , EX

Starting scores after BK (Filed 4/18/24) EQ 571 , TU , EXCurrent Scores EQ 582 TU 597 EX 601 Goal 700+ across

UTL

Last Inq: 8/3/2024

Starting Score: 582

Starting Score: 582Current Score: 582

Goal Score: 700

Take the myFICO Fitness Challenge

Chapter 7 BK filed 4/18/24 Discharged 7/22/24

Ally Financial CC 11/24 Credit limit $1,000 preapproval mailer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

Just now I got a MyFICO alert that my total bankcard balances had increased by $10, and my TU FICO 8 score had increased by 5 points ![]() I seriously doubt there was a connection

I seriously doubt there was a connection

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

Some really helpful comments by BBS and SouthJ.

BTW, I will throw out one strategy that can work really nicely for a person who:

(a) Is certain that he wants to use the $30/mo myFICO Ultimate credit monitoring product

(b) Already has a bunch of credit cards

(c) Is willing to use at least 4-5 of them each month with balances reporting to the bureaus.

Suppose for (c) you have 5 different cards that you know you'll use each month. (More is even better.) Contact each issuer and ask them to change the date that the statement reports. Then stagger the statement dates so that you have a different card reporting to the bureaus (with a new balance) every 5-7 days.

This way you'll be guaranteed to get almost constant alerts of score changes, which in turn reduces (but does not eliminate) the chance that the score change has nothing to do with the alert message. That chance is highest when several weeks have gone by without an alert from that CRA. It is lowest when you get an alert yesterday.

All that said, the whole "alert" based system that myFICO products give is not for everyone. Some people (and I am one of them) are just to darn stingy to pay $300 a year for it. Instead we opt for free or ultra low cost methods of monitoring our scores and reports, of which there are many.

But.... if someone is willing to pay for it, and if they have a bunch of credit cards already, to me it makes sense to spread out their reporting dates evenly so that you are really getting the most bang for your buck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

I would say you were correct, SJ, in that there is no connection there ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

@ronstar7 wrote:I get what ur saying, for now thats all I know as the reason and Im happy with that. And yes Im at 53,650 with 3% utl. I ahve been playing the "credit game" for a min now so maybe its fianlly paying off.

I would be happy too with a 55 point gain... but I would also want to know exactly where it came from. But that's just me. It's completely fine to go with the "don't ask, don't tell" point of view.

CGID, that's a good idea strategy-wise with respect to the myFICO alert system for those that use it consistently.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

@Anonymous wrote:

@ronstar7 wrote:I get what ur saying, for now thats all I know as the reason and Im happy with that. And yes Im at 53,650 with 3% utl. I ahve been playing the "credit game" for a min now so maybe its fianlly paying off.

I would be happy too with a 55 point gain... but I would also want to know exactly where it came from. But that's just me. It's completely fine to go with the "don't ask, don't tell" point of view.

CGID, that's a good idea strategy-wise with respect to the myFICO alert system for those that use it consistently.

I would like to know where it came from as well but since I cant seem to figure it out I am not going to stress it. Thats more along the lines of what I meant to say. But now I do agree that other things going on aided in that increase.I just dont know why trans hasnt moved... oh well I'll be happy with what I have lol

Starting scores after BK (Filed 4/18/24) EQ 571 , TU , EX

Starting scores after BK (Filed 4/18/24) EQ 571 , TU , EXCurrent Scores EQ 582 TU 597 EX 601 Goal 700+ across

UTL

Last Inq: 8/3/2024

Starting Score: 582

Starting Score: 582Current Score: 582

Goal Score: 700

Take the myFICO Fitness Challenge

Chapter 7 BK filed 4/18/24 Discharged 7/22/24

Ally Financial CC 11/24 Credit limit $1,000 preapproval mailer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

Have you compared all of your reports in detail? There aren't too many things that could cause a gain that significant from what I know. The one near-maxed out CL being paid off but dropping aggregate utilization from 3% to 2% IMO would yield about 10 points. Others can chime in on that estimate. If that's a good guess, it means 45 points came from something else. If I had to guess I'd say it was something like a negative item falling off or a single negative item crossing an aging threshold. It would take quite a few combinations of other factors to yield an increase that big... such as an AAoA threshold crossed, AoYA/AoOA crossing thresholds, inquiries coming off, a substantial change in installment loan utilization (which could only be up to 30 points), etc. It would seem unlikely that that stars aligned just right such that a bunch of these things happened at the same time, but you never know which is why I'm just throwing it out there, food for thought style.

Do you have negative items on your reports and if so what is there severity and age(s)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

@Anonymous wrote:Have you compared all of your reports in detail? There aren't too many things that could cause a gain that significant from what I know. The one near-maxed out CL being paid off but dropping aggregate utilization from 3% to 2% IMO would yield about 10 points. Others can chime in on that estimate. If that's a good guess, it means 45 points came from something else. If I had to guess I'd say it was something like a negative item falling off or a single negative item crossing an aging threshold. It would take quite a few combinations of other factors to yield an increase that big... such as an AAoA threshold crossed, AoYA/AoOA crossing thresholds, inquiries coming off, a substantial change in installment loan utilization (which could only be up to 30 points), etc. It would seem unlikely that that stars aligned just right such that a bunch of these things happened at the same time, but you never know which is why I'm just throwing it out there, food for thought style.

Do you have negative items on your reports and if so what is there severity and age(s)?

Well right now my utl is 1%. Cap one wasnt maxed bal was 664 on a limit of 4650 the amex never ever report s a balance so I know thats not it. I have 2 baddies and according to my update from credit karma today it fell off since my last update last week. Old cc charge off so thats probably it. I guess trans just hasnt seen it yet. The other baddie is set to drop off in 2018 I believe.

Thanks for the great advice ![]()

Starting scores after BK (Filed 4/18/24) EQ 571 , TU , EX

Starting scores after BK (Filed 4/18/24) EQ 571 , TU , EXCurrent Scores EQ 582 TU 597 EX 601 Goal 700+ across

UTL

Last Inq: 8/3/2024

Starting Score: 582

Starting Score: 582Current Score: 582

Goal Score: 700

Take the myFICO Fitness Challenge

Chapter 7 BK filed 4/18/24 Discharged 7/22/24

Ally Financial CC 11/24 Credit limit $1,000 preapproval mailer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off cc's works!

Any time, glad you figured this out. That baddie being removed IMO made up almost all of the 55 points you gained.

Since the CO account wasn't maxed, it probably only yielded you a couple of points by making that payment.

In 2018 when that other baddie comes off you should be golden score wise!