- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Positive and negative factors affecting scores are...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Positive and negative factors affecting scores are often contradictory

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Positive and negative factors affecting scores are often contradictory

This is the kind of stuff that drives me bonkers.

Negative factors:

Few accounts paid on time

You have an insufficient number of accounts that are currently paid as agreed.

Number of your accounts currently being paid as agreed

6 accounts

The FICO® Score considers the number of accounts showing on time payments. Generally, the higher the number reported the lower the risk. Compared to other people with a similar age of credit history, the number of accounts you have that are currently paid as agreed is low.

FICO High Achievers have an average of 6 accounts currently being paid as agreed.

WTH?

In the past I've also seen "short credit history" under Negative Factors and "long credit history" under Positive Factors, at the same time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Positive and negative factors affecting scores are often contradictory

@NYC_Fella wrote:This is the kind of stuff that drives me bonkers.

Negative factors:

Few accounts paid on time

You have an insufficient number of accounts that are currently paid as agreed.

Number of your accounts currently being paid as agreed

6 accounts

The FICO® Score considers the number of accounts showing on time payments. Generally, the higher the number reported the lower the risk. Compared to other people with a similar age of credit history, the number of accounts you have that are currently paid as agreed is low.

FICO High Achievers have an average of 6 accounts currently being paid as agreed.

WTH?

In the past I've also seen "short credit history" under Negative Factors and "long credit history" under Positive Factors, at the same time.

I've found it's best for your own sanity not to put too much stock in the different reason codes. They differ between the 3 CRAs, and sometimes, when you're doing everything right credit wise, it seems that the algo just has to 'find' something to report on the negative factors. However, if you're like me and it'll still drive you insane, it seems 7 accounts is the magic number to get rid of the 'few accounts paid as agreed' code. From the primer:

"G. Number of Accounts Paid as Agreed

The category needs a certain amount of current payment history to score most accurately. A variety of at least 7 positive accounts, actively reporting paid as agreed, seems sufficient. Since the algorithm is considering length and depth of payment history, the code is more likely for a young/thin file or one lacking Mix diversity."

Team Garden Club as of Oct 2021

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Positive and negative factors affecting scores are often contradictory

@SoonerSoldier33 wrote:

@NYC_Fella wrote:This is the kind of stuff that drives me bonkers.

Negative factors:

Few accounts paid on time

You have an insufficient number of accounts that are currently paid as agreed.

Number of your accounts currently being paid as agreed

6 accounts

The FICO® Score considers the number of accounts showing on time payments. Generally, the higher the number reported the lower the risk. Compared to other people with a similar age of credit history, the number of accounts you have that are currently paid as agreed is low.

FICO High Achievers have an average of 6 accounts currently being paid as agreed.

WTH?

In the past I've also seen "short credit history" under Negative Factors and "long credit history" under Positive Factors, at the same time.

I've found it's best for your own sanity not to put too much stock in the different reason codes. They differ between the 3 CRAs, and sometimes, when you're doing everything right credit wise, it seems that the algo just has to 'find' something to report on the negative factors. However, if you're like me and it'll still drive you insane, it seems 7 accounts is the magic number to get rid of the 'few accounts paid as agreed' code. From the primer:

"G. Number of Accounts Paid as Agreed

The category needs a certain amount of current payment history to score most accurately. A variety of at least 7 positive accounts, actively reporting paid as agreed, seems sufficient. Since the algorithm is considering length and depth of payment history, the code is more likely for a young/thin file or one lacking Mix diversity."

Thank you. That is extremely helpful. Can you point me to the source? I'd like to read the rest of it!

Also, do sock-drawered cards count as being paid as agreed?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Positive and negative factors affecting scores are often contradictory

@NYC_Fella wrote:

@SoonerSoldier33 wrote:

@NYC_Fella wrote:This is the kind of stuff that drives me bonkers.

Negative factors:

Few accounts paid on time

You have an insufficient number of accounts that are currently paid as agreed.

Number of your accounts currently being paid as agreed

6 accounts

The FICO® Score considers the number of accounts showing on time payments. Generally, the higher the number reported the lower the risk. Compared to other people with a similar age of credit history, the number of accounts you have that are currently paid as agreed is low.

FICO High Achievers have an average of 6 accounts currently being paid as agreed.

WTH?

In the past I've also seen "short credit history" under Negative Factors and "long credit history" under Positive Factors, at the same time.

I've found it's best for your own sanity not to put too much stock in the different reason codes. They differ between the 3 CRAs, and sometimes, when you're doing everything right credit wise, it seems that the algo just has to 'find' something to report on the negative factors. However, if you're like me and it'll still drive you insane, it seems 7 accounts is the magic number to get rid of the 'few accounts paid as agreed' code. From the primer:

"G. Number of Accounts Paid as Agreed

The category needs a certain amount of current payment history to score most accurately. A variety of at least 7 positive accounts, actively reporting paid as agreed, seems sufficient. Since the algorithm is considering length and depth of payment history, the code is more likely for a young/thin file or one lacking Mix diversity."

Thank you. That is extremely helpful. Can you point me to the source? I'd like to read the rest of it!

This is an absolute gold mine for understanding FICO metrics. Grab a cup of coffee and a comfortable chair, and dig in. While they have found additions to what's mentioned in the Primer, I don't believe anything in there has been found to be incorrect.

Also, do sock-drawered cards count as being paid as agreed?

Yes. A card that is not used with a $0 balance should still be reported monthly as 'paid as agreed'. Make sure to use them every so often (at least every 6 months is recommended) to keep them from being closed for inactivity if you want to keep them open. If there's no AF, it's free credit building to keep them open in the sock drawer.

Team Garden Club as of Oct 2021

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Positive and negative factors affecting scores are often contradictory

@SoonerSoldier33 wrote:

This is an absolute gold mine for understanding FICO metrics. Grab a cup of coffee and a comfortable chair, and dig in. The original author is working on version 2.0 now. While they have found additions to what's mentioned in the Primer, I don't believe anything in there has been found to be incorrect.

Also, do sock-drawered cards count as being paid as agreed?

Yes. A card that is not used with a $0 balance should still be reported monthly as 'paid as agreed'. Make sure to use them every so often (at least every 6 months is recommended) to keep them from being closed for inactivity if you want to keep them open. If there's no AF, it's free credit building to keep them open in the sock drawer.

Once again, many thanks for your responses. This board is an amazing resource!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Positive and negative factors affecting scores are often contradictory

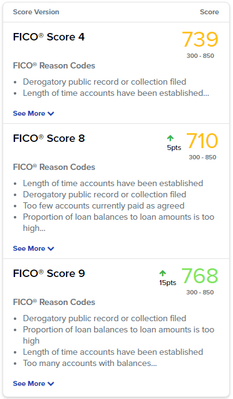

LOL, yeah, the whole "Reason Code" thing could really drive someone to drink if they really paid too much attention to them. The following is a snapshot of my August 2021 TU scores and the reason codes:

The specifics are:

- Chapter 13 bankruptcy, set to fall off in Jan-2022

- 4 Credit Card accounts opened since April 2020, one closed a few weeks later (paid in full)

- Total Credit Card Limit: $14,000

- Total Utilization: < 1%

- Cards showing a balance: 1

- Total Card debt: $90

- Late payments: 0

- 1 SSL

- Initial balance: $3,000

- Current balance: $1,004

I guess it's a good thing I pretty much ignore stuff like the above. ![]()

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Positive and negative factors affecting scores are often contradictory

@Horseshoez wrote:The specifics are:

- Chapter 13 bankruptcy, set to fall off in Jan-2022

- 4 Credit Card accounts opened since April 2020, one closed a few weeks later (paid in full)

- Total Credit Card Limit: $14,000

- Total Utilization: < 1%

- Cards showing a balance: 1

- Total Card debt: $90

- Late payments: 0

- 1 SSL

- Initial balance: $3,000

- Current balance: $1,004

I guess it's a good thing I pretty much ignore stuff like the above.

Very interesting. My pattern is similar to yours, although the numbers and the activity levels are greater. Just for kicks:

- Chapter 7 bankruptcy, set to fall off in December 2026

- 19 credit card accounts opened since January 2017, 14 closed recently (all paid in full); plus 5 AU accounts

- Total credit card limits: $46K, plus $60K on AU accounts

- Total utilization: 4% (6% including AU)

- Cards showing a balance: 1 (3 including AU)

- Total card debt: $2K ($6K including AU)

- Late payments: 3 (all pre-BK and IIB)

- 2 auto loans, 1 paid in full (refinanced)

- Initial balance: $17K

- Current balance: $12K

Lots of similarities, huh? Except for the AU wrinkle. Current non-AU cards are WF $22K, Apple $4K, Barclays AAviator Red $7.5K, Discover $7.5K, and Bob's Furniture (WF) $5K. EX score has been stuck at 702 for 3-4 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Positive and negative factors affecting scores are often contradictory

@NYC_Fella, what's interesting is over the last five months, I've had 2 months where 1 card showed a small balance, 2 months where 2 cards showed a small balance, and 1 month where all of my cards reported zero. For the four months where I was showing small balances, my FICO scores were rock solid, I mean literally nothing more than an 1 point gain or loss in any category; however, for the month where I was showing no balances at all, most of my FICO scores tanked by an average of about 19 points. I say "most of my FICO scores" because through it all, my 5/4/2 mortgage scores stayed static, even when I had no balances.

While my mortgage scores are cruising along at 720/739/729, I am hopeful once my Chapter 13 falls off my reports in less than 4 months, they'll take a nice jump up.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Positive and negative factors affecting scores are often contradictory

@Horseshoez wrote:@NYC_Fella, what's interesting is over the last five months, I've had 2 months where 1 card showed a small balance, 2 months where 2 cards showed a small balance, and 1 month where all of my cards reported zero. For the four months where I was showing small balances, my FICO scores were rock solid, I mean literally nothing more than an 1 point gain or loss in any category; however, for the month where I was showing no balances at all, most of my FICO scores tanked by an average of about 19 points.

My experience has been almost identical; in fact, I alluded to that in the other thread on AZEO and small balances:

https://ficoforums.myfico.com/t5/General-Credit-Topics/AZEO-vs-Small-balance-question/td-p/6410385