- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Question for High Achievers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question for High Achievers

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question for High Achievers

Hi All,

I don't want to sound ungrateful but I'm soooo frustrated with FICO. I feel like every single improvement I make is still met with silly negatives.

Is my Home Depot card considered a consumer finance account even though it's a master card? What can I do about this?

Thanks in advance for the helpful insight.

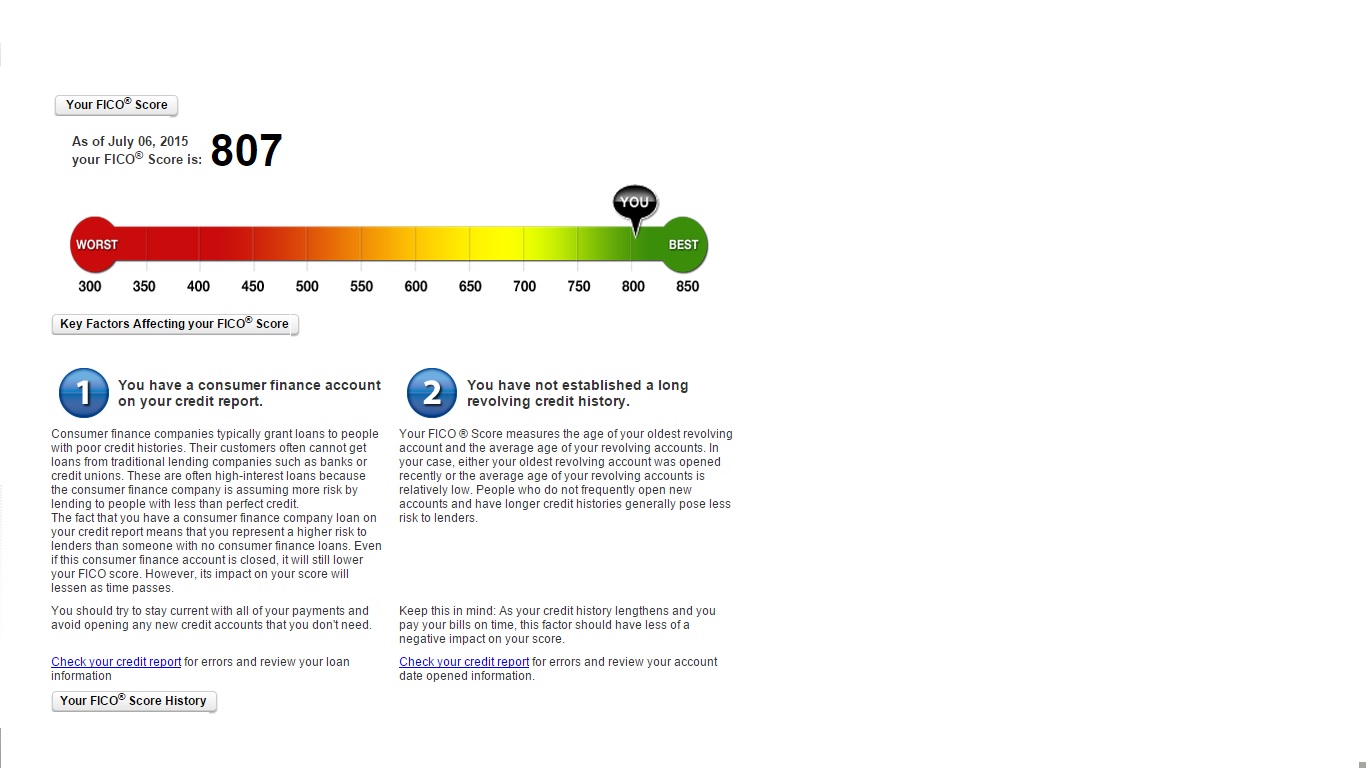

Recent FICO Score:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question for High Achievers

I'm not a high achiever, but I am familiar with HD.

Is sounds like you're talking about the HD Project loan since they give you a card that's a Mastercard for the initial spending part of things. It wouldn't surprise me if that's counted as a Consumer Finance account as it's really a loan with Greensky, not really a Mastercard in the sense of a revolving line of credit, at least that's what mine was. Mine, you had a six month window to spend, and then it's a loan. I think they even sent me a payment book. (Truly, everything they did felt like I was in the 80's which is why I paid it off ASAP despite the decent interest rate.)

The card in your signature, on the other hand, is a revolving line of credit with Citi, but it's not a Mastercard. So I'm thinking you're not asking about that one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question for High Achievers

A few things occur to me. The first is three cheers for you! You have an 807. That's great. It means that you have really accomplished a lot by steadily making your way up this high. You have some breathing space -- as opposed to some other folks where their score might be costing them a lot in future mortgage costs or whatever.

The second is that it sounds like you have an account on your report that you may have been accidentally misled about when you opened it. You were truly under the impression that it was a major credit card and you are discovering now that FICO is describing it (in that error message) as a big black eye that they will not remove for ten years -- even if you pay it off and close it tomorrow.

There is something terribly ironic about the fact that you could refuse to pay a huge CC bill -- and FICO will let that fall off in 7 years. But this account (on which you are being a good scout) you could close and they will not remove for TEN years, an account they are treating in practice as something negative.

I wonder whether anyone on the forum knows whether you might be able to get one or more of the CRAs, with the cooperation of the creditor, to remove it completely from your report. The first step of course is to review every account on all three reports and make sure you know for 100% sure which is the one that is being flagged as a consumer finance account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question for High Achievers

My Report says the same thing with a

Capital one Quicksilver 6000

US AIR MasterCard 10,000

JC Penny Card 2750

Credit One 1400

PayPal smart connect 6000

Never thought it maybe is one of my credit cards I thought it was a finance company I had for for rebuild years ago for 35 months and paid perfect. Not late one day any month. I just assumed it was that being looked at. I wonder which one of my cards the algorithm is looking at as Finance company Grade.

This is the point I was trying to make the other day when I had a post on premiums cards but everyone totally misunderstood my post. It was about this very subject of some of these cards are not Premium and since I have looked at updated FICO and reports of 775, 773 and 755 and one report says plainly no enough premium credit cards held by you.

That reminds me I need to use all 5 cards tomorrow. I forgot JC penny when out of town today. I use all 5 each month pay them off shy 1 card to get the best bumps.

Another observation I have made.

You can have a 800 + Credit score and unless your income is there you can and will be turned down by some of the best cards out there like Blue AMEX or Chase Freedom or Citibank and Discover for sure. I have read this online. Credit score alone is not enough. You income means the world. Infact it seems you can get a card faster with a medial credit or Fico of say 680-750 with a high income than a low income or lower and a 800 FICO. That seems unfair but that is the mortgage meltdown collateral damage we are all dealing with.

excuse any misspells, typed this right before bedtime.

Starting FICO Score 2007: >> >> 533 -- God those were some Dark Days !!

Starting FICO Score 2007: >> >> 533 -- God those were some Dark Days !! Current >>>> 9-29-15 - (Experian 800 FICO-8 - (Equifax 798) - ( Transunion 808 )FICO Goals: 820-830 For all 3 or above

Ultimate Fico 850 x 3 Even if for a week Just to say I crawled out of the sewer and trust me it was the pits. I could not borrow a cent

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question for High Achievers

@paramed3 wrote:My Report says the same thing with a

Capital one Quicksilver 6000

US AIR MasterCard 10,000

JC Penny Card 2750

Credit One 1400

PayPal smart connect 6000

Never thought it maybe is one of my credit cards I thought it was a finance company I had for for rebuild years ago for 35 months and paid perfect. Not late one day any month. I just assumed it was that being looked at. I wonder which one of my cards the algorithm is looking at as Finance company Grade.

This is the point I was trying to make the other day when I had a post on premiums cards but everyone totally misunderstood my post. It was about this very subject of some of these cards are not Premium and since I have looked at updated FICO and reports of 775, 773 and 755 and one report says plainly no enough premium credit cards held by you.

That reminds me I need to use all 5 cards tomorrow. I forgot JC penny when out of town today. I use all 5 each month pay them off shy 1 card to get the best bumps.

Another observation I have made.

You can have a 800 + Credit score and unless your income is there you can and will be turned down by some of the best cards out there like Blue AMEX or Chase Freedom or Citibank and Discover for sure. I have read this online. Credit score alone is not enough. You income means the world. Infact it seems you can get a card faster with a medial credit or Fico of say 680-750 with a high income than a low income or lower and a 800 FICO. That seems unfair but that is the mortgage meltdown collateral damage we are all dealing with.

excuse any misspells, typed this right before bedtime.

It's the Credit One card.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20