- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Reducing utilization and scoring impact

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Reducing utilization and scoring impact

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

@Stryder wrote:You can get in the 740 to 760 score range with a derog on file but, it is much easier with no derogs on file [Note: generally, a 30 day late delinquency won't prevent proviles from a being a non derog scorecard] was the derog old and Paid? IMO.... my EX is now clean and 739 and with the 7 yr old, $2,400 open derog, its was 679 fico 8 2 days before the jump, as far as I could see...nohing else changed. I think they open derogs are killers...

thats good to know on the 30 day... I guess even if it's a 90 days late it's still not a derog, but just a late? [unfortunately, not so]

As always, thanks TT!

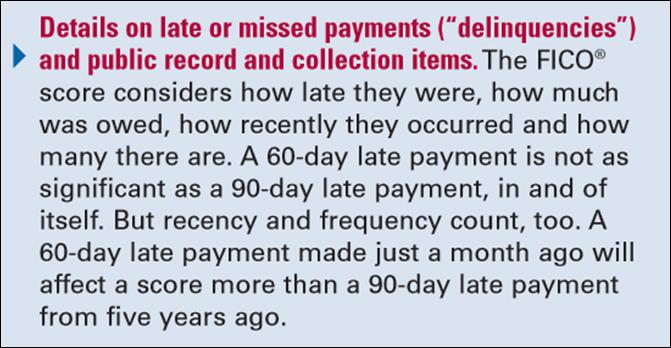

Serious delinquencies (which includes all 90 day lates and most, if not all, 60 day lates) results in a derogatory scorecard assignment.

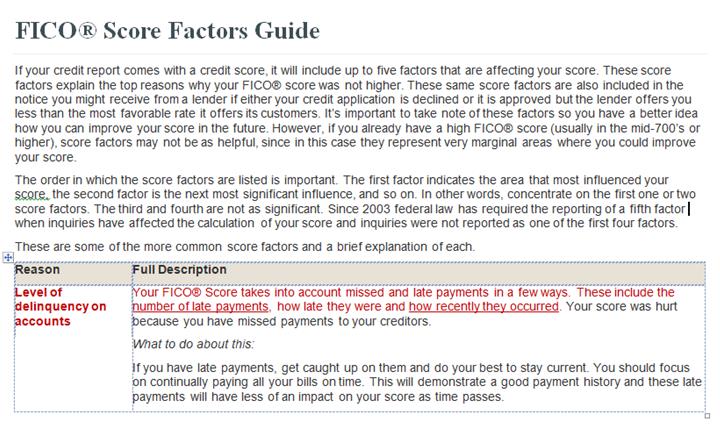

Refer to the below from Fico

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

Hello TT. Do you know what happens with scorecard assignment if a person has many 30-day lates? Suppose we are talking a dozen 30-day lates spread out over four or five different accounts, some in the last 5 months but all in the last two years. And assume that the person has no other derogs.

In other words, is the scorecard assignment rule as simple as "If your only derogs are 30-day lates, then go to clean score card"? Doesn't matter how many or how recent?

Curious as always to hear your thoughts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

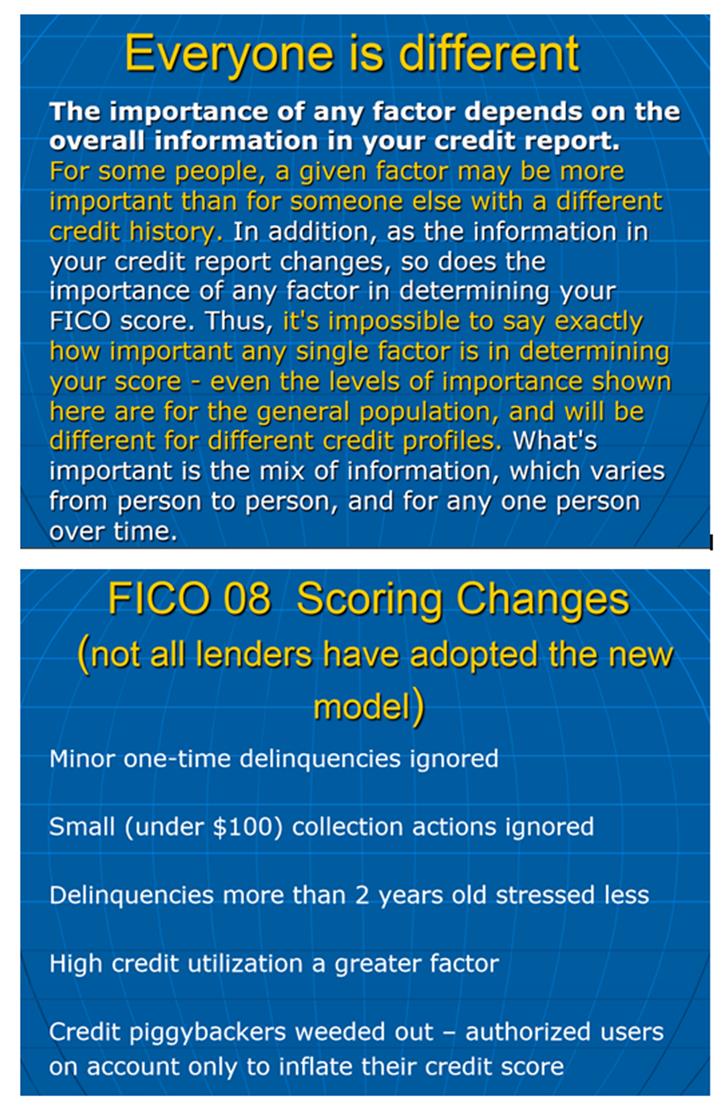

Someone on a non derog scorecard who becomes a 30 day late habitual offender is likely to get kicked to the curb and re-assigned a derogatory scorecard - IMO. Frequent, recent, delinquencies would be considered serious

I'll check my files and paste some Fico statements alluding to this issue as I find them.

Below is a link to a Fico presentation from John Meeks for reference and a paste of a couple slides.

http://www.wvasf.org/presentation_pdfs/John_Meeks_-_WV_Asset_Building_Charleston_102811.pdf

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

Thats an interesting link TT

Thanks for posting it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

@Thomas_Thumb wrote:

@sjt wrote:Thanks all for your responses. They are very insightful.

A little background on my friend's credit profile:

- AAOA is 13 years.

- Several charge-offs from 2011-12, all but two are paid.

- Last charge-offs paid were in full to the original creditor in 2015, but those accounts were charged off in 2011-12.

- Two unpaid charge-offs are still owned by the original creditor and reports monthly to all three CRA.

- Current Experian Score is 606.

- Utilization is around 70-75%

- Three open credit cards. one was opened in 2008, the other two in 2015.

- Action Plan:

- Pay off the three credit cards.

- Pay off the charge off in full. Will then show a zero balance, bring accounts to current, and stop monthly reporting. I think the monthly reporting of a charge off balance is suppressing his score.

When we went through the FICO simulator it showed a score bump to 621, a 15 point increase. I though the bump would be higher, considering he is paying off a couple of charge-offs that continue to report monthly.

Note: The plan to pay off all cards and avoid ongoing interest penalties is the right strategy. However, once they are all paid off your friend should allow a small balance to report on one card every month. After balance reports on statement then pay statement balance in full before the due date. This will avoid any ongoing interest penalties. If a zero balance reports on all credit cards that hurts credit score - typically a 10 to 25 point score drop compared to one cards reporting a "small" balance.

I would anticipate a bit higher score potential if the above is done with one card reporting a small balance. Perhaps a Fico 08 score in the 640 to 650 range. Either way, the plan makes sense. We would be interested in feedback on results.

Note 1: The charge offs will continue to impact Fico 08 score negatively even when they are paid off. Try to negotiate removal of the charge offs (with the original creditor) as part of the plan in paying them off. Although leverage is minimal with the paid charge offs, writing a good will letter to the creditor(s) requesting the charge offs be removed can't hurt.

Note 2: My understanding is charge offs that show a zero balance are ignored as a negative in Fico 09 - but not any of the earlier Fico scoring models.

Hi All,

Sorry for the delay in getting you these updates:

My friend paid off the outstanding balances on his credit cards, but left a small balance on one of them. He also paid in full the charge offs that are still owned by the orginal creditor. None of them would do a PDF. Their leverage is that they own the debt and report monthly. One of them updated first and we saw a little bump, but when the second one reported he got a big bump on FICO 08:

FICO 08

Experian from 606 to 638

Equifax from 624 to 659

Trans Union from 631 to 650

CURRENT FICO 08 Bankcard

Experian: 661

Equifax: 670

Trans Union: 671

When reviewing all the other FICO scoring versions, those scores are much higher then his FICO 08 scores. They are in the 690-700 range and in the FICO 09, they are all above 700.

We are trying to figure out why Experian is so low and why there is a large variance between the FICO 08 and FICO 08 Bankcard.

He also has an open collection from 2012 for a large amount. We are trying negociate a PFD because if we pay it it will update and possibly lower the score. Im also thinking that the collection is little impact on the score. Can anyone confirm this.

Another thing, he applied and was approved for a Venture Card ($20K limit), Arrival+ ($7K limit), and a Amex Platinum Charge (NPSL). The Arrival + was the last card he applied for but its already showing up on his reports. No scoring impact. Also got a $1K increase on his C1 QS WMC ($10K limit.) The other two have not reported yet.

Bank of America: Alaska Air Atmos Summit Visa Infinite

Barclays: Arrival Premier WEMC (Closed)

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 816 / EQ: 825 / TU: 818