- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Removing Late Payments

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Removing Late Payments

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Removing Late Payments

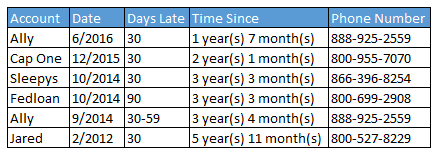

So I have not always been the most responsible when it comes to my credit. Apparently my OCD started about two years ago. It makes me sick to admit that I have 6 missed payments showing on my report. I have also learned my lesson about helping out family, since two of these missed payments were due to me handing my car over to my parents in a time of need (their time of need, not mine). They took over payments and were late twice. I couldn't get the payments transfered to them since they wouldn't have qualified. These are the two Ally financial missed payments listed in the table below. My question is, what is the best way to mail in a letter that can increase my chances of getting the late payments removed and have any of you had any luck getting them removed by the financial institutes listed in my table? Also, what hurts a score more, most recent missed payment or largest time period a payment was missed? I am going to do everything I can to remove as many of these as possible, but I have always been curious about that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing Late Payments

I suggest reading the first post of the thread linked below. If you follow that technique you'll give yourself a very good shot at getting late payments removed. I had 4 dirty accounts (90-120 day lates on several) and was able to clean all 4 of them up using this technique:

The account that you were 90 days late on is going to be the constraint to your scores dramatically improving. That single late payment will adversely impact your scores in a major way for a full 7 years until it falls off. The 30 day lates are much less impactful and most feel they lose the majority of their sting within 2 years. They are still visible for the full 7 years though, so upon a manual review anyone looking at your report will be able to see them and ask questions. 30 day lates, especially if they are isolated (your only late with that lender) are the easiest to remove as they are of the lowest severity. If they only happened once and you have a strong payment history both before and after, most lenders are willing to forgive the minor hiccup. Cleaning up the 30's is always a good way to start, as it gives you a sense of accomplishment and gives other lenders less dirty accounts to look at when you're asking THEM for GW adjustments. If you have any specific questions you can PM me or post them in the thread linked above as I check that often. Good luck!