- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score Drop after applying for Delta Credit Communi...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score Drop after applying for Delta Credit Community Visa Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score Drop after applying for Delta Credit Community Visa Card

I'm only 19 and I'm searching for a good card with a low interest rate. I already have a Discover card ($1700| $0 balance), Capitol One ($4000 | $800, balance), and American Express ($1000 | $30 balance.) I used to have an Atlanta Postal Credit Union Visa card, but it was closed by the credit grantor unexpectedly (2 weeks after I paid my balance in full. Good Riddance!) My Postal Credit Union card was the only one I had with a low interest rate at 12%.

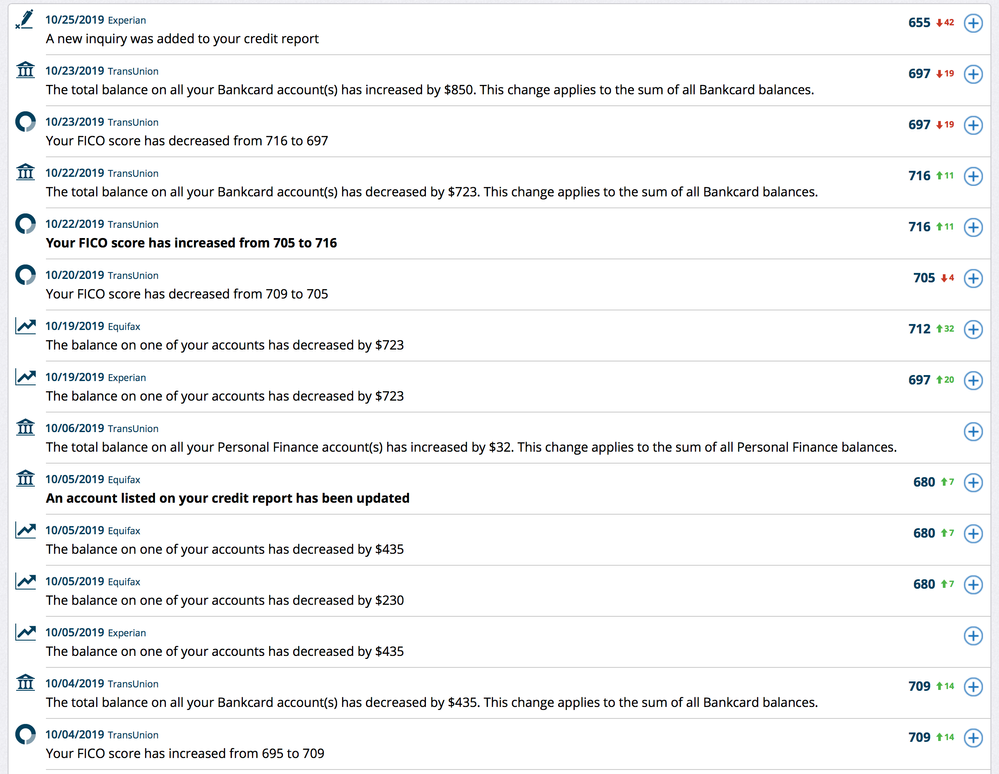

I decided to apply for the DCCU Visa Platinum card after looking through my emails and saw that I had a pre-qual offer that expired next week. So, I decided to go for it. I got the message that it's under review and a anlayst will contact me soon, which is fine.. It pulled Experian which is fine again...but it dropped my score down 42 points!!!! I hope this card was worth it ![]()

Anybody knows why DCCU drops the score by so many points? Has this happened to you before?

My FICO 8 scores before applying

Transunion - 716

Equifax - 712

Experian - 697 (after DCCU inquiry 655)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delta Credit Community Visa Card

42 points is extremely steep for just an inquiry. Get the Experian app and check your report to see what else happened. These alerts when things change are often not what actually dropped your score. There are other activities that don't generate an alert but drop your score. It's extremely confusing. I can guarantee you though, a single inquiry didn't drop your score 42 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delta Credit Community Visa Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delta Credit Community Visa Card

@Anonymous wrote:

I already have the app. After Delta did the inquiry, I instantly got an alert from experian about the inquiry, score drop and rating decreased alert. I haven’t had any activity since my score went up on the 19th for paying my discover card off in full.

Go look at the report. An inquiry can not drop your score 42 points. It's literally not possible. Something else changed and the inquiry prompted an update.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delta Credit Community Visa Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delta Credit Community Visa Card

How close together were all those CC apps? If they all happened close enough, and then were all reported together. It would cause a significant score drop. Also, why did they Close your card? There could be a reason noted in your CR that's negatively affecting your score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Drop after applying for Delta Credit Community Visa Card

As this thread is more about the reason(s) for the score drop, I've moved it to Understanding FICO Scoring and updated the thread title.

I agree that it's certainly more than just a single inquiry required to drop a score by that much. There must be a significant change of other factors on your Experian credit report between the previous score and the current one. Whether that is the introduction of any new negative information, the disappearance of closed accounts, the appearance of new accounts, etc. you will only know by comparing every part of the two reports. Are the balances you listed the current ones listed on your credit report, or just the current balances? All 3 of those lenders will only report your most recent statement balance. If those accounts were all just added, your average age of accounts would have taken a nosedive as well as being dinged for new accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delta Credit Community Visa Card

My Discover card was opened on 11/18, Capitol One 4/19, American Express 7/19. I just paid of Discover this month and it's reported already. I also have an Apple Card which was opened in September, but it's only reporting on Transunion. As for the Postal CU, I have no clue as to why the closed my account. It was a Joint account I shared with my dad, and all it says in the notes is "Closed by Credit Grantor".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Drop after applying for Delta Credit Community Visa Card

All of the balances are current expected my American Express, it's still listed as me owing $723, but I got that down to $30 last month, but that hasn't really affected me this month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delta Credit Community Visa Card

I've checked everything on my Experian credit report and there's nothing on there negative. I've paid off the balances on some of my cards listed on there.