- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score cards

Does anyone have any information on how the score cards work?

from my research I believe there are 8 clean scorecards and 4 dirty scorecards?(it may be the other way around)

but does anyone know the details of each score card? Like what the requirements for each scorecard is? The maximum score for each scorecard? Honestly any information is better than nothing.

I don't know if this information would be considered proprietary or not ? I dont realistically see another credit score company coming out of the woods and stealing this information to try to challenge FICO. Vantage score would be the only threat, but seeing as they have already tried to compete with them and have barely gotten any market share. The only thing keeping them alive is the fact that most people don't know just how useless vantage score is, and it's cheaper for card issuers to supply these scores to their customers so a ton of people get their vantage score every month and don't realize how useless the data is. Anyway this is a long winded way of me saying I think it's safe for FICO to release this information but what do I know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score cards

@SRT4kid93 wrote:Does anyone have any information on how the score cards work?

from my research I believe there are 8 clean scorecards and 4 dirty scorecards?(it may be the other way around)

but does anyone know the details of each score card? Like what the requirements for each scorecard is? The maximum score for each scorecard? Honestly any information is better than nothing.

I don't know if this information would be considered proprietary or not ? I dont realistically see another credit score company coming out of the woods and stealing this information to try to challenge FICO. Vantage score would be the only threat, but seeing as they have already tried to compete with them and have barely gotten any market share. The only thing keeping them alive is the fact that most people don't know just how useless vantage score is, and it's cheaper for card issuers to supply these scores to their customers so a ton of people get their vantage score every month and don't realize how useless the data is. Anyway this is a long winded way of me saying I think it's safe for FICO to release this information but what do I know.

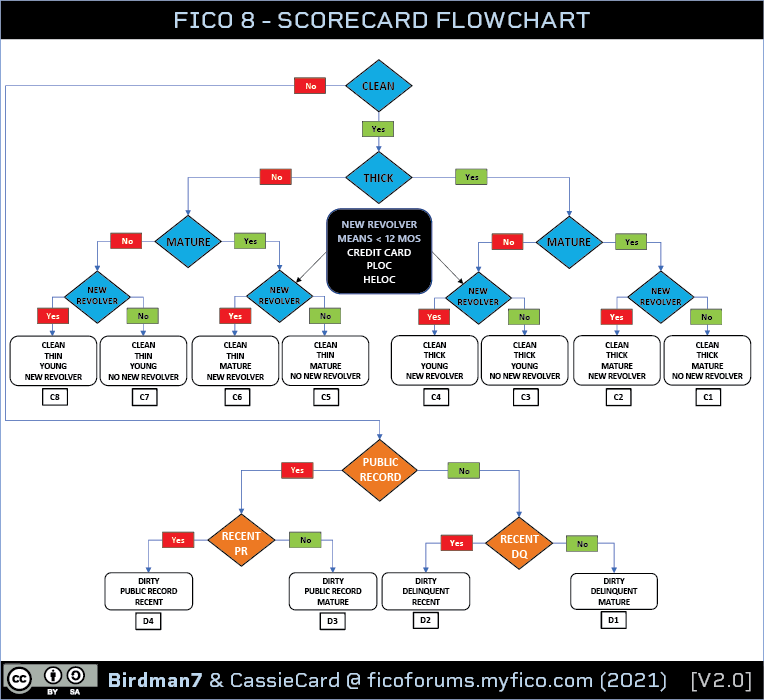

this is the best guess anybody here has, people dispute this as being an unsubstantiated guess, so take that for what it's worth. Much of what I personally believe originates from here, even if the exact details aren't correct.

tldr:

Clean - no 60D late or worse

Dirty - any 60D late or worse

thin - less than 4 tradelines

thick - 4 or more tradelines

young - oldest account less than 3 years

mature - oldest account more 3 years or more

no new revolver- no new revolving accounts in the last 12 months

new revolver - new revolving accounts in the last 12 months

no scorecard, in terms of FICO scoring is 'better' than the other, the 'better' scorecards are the mature, thick, no revolver ones because their scores are more stable and they have more leeway with FICO metrics before things impact their score negatively and by how much things impact their score negatively.

a 780 score from a file with one year of credit history and a $300 credit card and a $1000 secured loan

can never compare to

780 score from a file with 20 years of credit history $200k in revolving limits and a $450,000 mortgage from an underwriting perspective

the scorecards are just FICO's best way to differentiate how file changes impact scores between people at various points in their credit life, it's on the creditor to do the rest.

there's some FICO QA threads sitting around somewhere where FICO people answered questions, they aren't hiding in their black box or anything or censoring anybody's opinion for how FICO scoring works.

Just pay your bills on time and you'll be fine, that's 85% of it.

You don't need a FICO algorithm to tell you that adding more accounts with higher limits and showing responsible usage of those lines will lead to better future underwriting from future creditors, regardless of what any score shows.

Current FICO 8: