- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score dropped 11 points TU

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score dropped 11 points TU

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

@Anonymous wrote:

@Anonymous wrote:

It didn’t tell me anything specific on what changed. I got a notification saying my score changed... No reason was given.I know nothing about MF other than what I've read on here having never used the product personally. From my understanding however, alerts are provided due to credit report changes. I have not heard of alerts for a score change. Many times a score change will go hand in hand with a credit report change, which is why many people wrongly assume they must always be related.

Some that has used the MF service, please correct me if I'm wrong. Can you in fact receive an alert of a "score change" or are all alerts for credit report changes (that simply come with a fresh score at the time)?

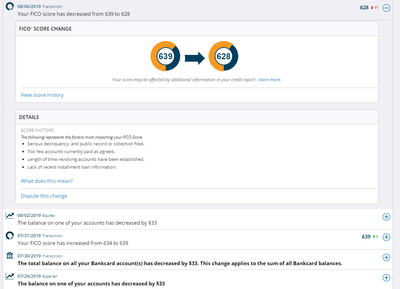

With FICO Premier (monthly 3B) I get score change alerts like this: (The alert says 5/31, but I always get them the next afternoon around 1:30 PM EDT.)

Trudy posted an image of what it looks like before you click the '+' to see more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

When I clicked on the "+" this is what I got:

1. I do have a discharged chapter 13 bankruptcy in my file, when it was discharged last month I received a score increase of 6 points so I doubt me being discharged would cause a drop of 11 points 1 month later.

2. I have and have had 100% payment history now and even before I filed ch13 in 2016. And nothing on my credit report shows being late on any payments.

3. AAoA I can understand because mine is at about 3.5 years, BUT I dont see how that would cause an 11 point drop seeing as how my credit file has aged another month.

4. Lack of recent installment loan would definitely keep my scores from rising, but I dont see how it would cause me to receive an 11 point drop seeing as how I havent had an installment loan in 3 years.

This is frustrating because I have been working hard to rebuild my credit the right way and I am even one week from closing on my first home, and after I close I will be adding a car loan to take care of the installment loan for my credit file. And an 11 point decrease on my already subpar scores I feel will make things that much harder. Especially when I havent really been given a legitimate reason.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

@Anonymous wrote:

This is frustrating because I have been working hard to rebuild my credit the right way and I am even one week from closing on my first home, and after I close I will be adding a car loan to take care of the installment loan for my credit file.

An inquiry during a mortgage application would do it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

Perhaps an old account fell off your CR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

one inquiry from July 8th would knock me 11 points even though I was already hit for 3 points a couple days after it happened?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

@Anonymous wrote:Perhaps an old account fell off your CR.

possibly. I wish it would tell me that instead of just saying my score dropped 11 points

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

@Anonymous wrote:one inquiry from July 8th would knock me 11 points even though I was already hit for 3 points a couple days after it happened?

Oh you already took the hit, ok. Unless someone involved with the mortgage process checked your credit again for some unknown reason.

I guess check all your aging metrics (oldest, average, youngest) from July compared to today.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

@Anonymous wrote:

@Anonymous wrote:one inquiry from July 8th would knock me 11 points even though I was already hit for 3 points a couple days after it happened?

Oh you already took the hit, ok. Unless someone involved with the mortgage process checked your credit again for some unknown reason.

I guess check all your aging metrics (oldest, average, youngest) from July compared to today.

I haven't received any notifications about another hard inquiry and its still sitting at 5, which is what it was at after I applied for a mortgage. So no changes there that I can see. As far as my aging metrics, everything is the same. Just really confused right now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

@Anonymous wrote:I haven't received any notifications about another hard inquiry and its still sitting at 5, which is what it was at after I applied for a mortgage. So no changes there that I can see. As far as my aging metrics, everything is the same. Just really confused right now.

How long is it until you can get another report from your myFICO subscription? The report won't update with the alerts - you have to wait until another one is available.

I know there can be another inquiry prior to closing, but I can't see how that would be 11 points, even if it did happen.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score dropped 11 points TU

@Anonymous wrote:

2. I have and have had 100% payment history now and even before I filed ch13 in 2016. And nothing on my credit report shows being late on any payments.

If this is true you need to identify the accounts and dispute. I have a 30 day from 12/2012 that still generates a score factor in the top 4.

Do you have a previous score change where we can compare the score factors and sequence to this one? Not always but sometimes you can see a change in the top 4 or resequencing of the top 4 which can sometimes help you narrow down the issue.