- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score impact of total balance in revolving account...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score impact of total balance in revolving accounts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score impact of total balance in revolving accounts

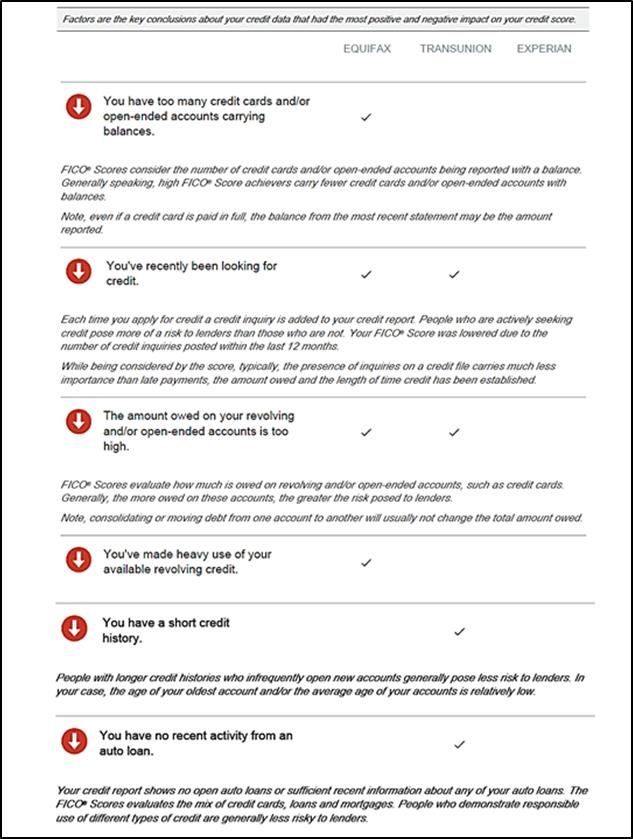

Below are some reason statements from my 4-2018, 3B report. Some "amount owed" statements certainly point to $$$. The "heavy use" statement specifically speaks to a utilization ratio. The "balances on your non mortgage credit accounts is too high" also speaks to a $$$ amount. The reason statements are associated with my Auto & BCE Fico 04, Fico 98 model scores.

In conclusion, reason code wording taken at face value without bias indicates both usage (utilization) and amount owed/balances ($$$) are considered in scoring. Based on my past reports, the amount owed threshold for revolving, open ended accounts is relatively low, not more than $6k. Assuming $6k, someone with a total $150k CL could pass the amount owed threshold mark at 4.0% utilization.

In the above example the profile might think there was a utilization threshold at 4% or 5% - but, this score ding is not based on usage it is based on amount owed. Alternately, someone with a $40k total CL would reach $6k at 15% utilization and mistakenly think there is a UT threshold at 15%. In SJ's case the threshold might appear to be 1.5% aggregate utilization.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score impact of total balance in revolving accounts

@kilroy8 wrote:To be clear this is not a question about utilization percentages. That is well documented and understood.

I am wondering about the score impact of total balances in revolving debt.

Example:

John has $1,000 in total revolving balances and $10,000 in total revolving credit lines. His utilization is 10%.

Mary has $10,000 in total revolving balances and $100,000 in total revolving credit lines. Her utilization is 10%.

Joe has $50,000 in total revolving balances and $500,000 in total revolving credit lines. His utilization is 10%.

We know that income is not a factor in FICO scoring. Because Mary owes 10 times as much as John - does she lose more points? What about Joe? He owes 50 times as much as John ! Assuming they all make the same amount of money (effectively what FICO does), Joe could be in big trouble - so his score should somehow reflect that risk.

From what I've seen, no it doesn't matter.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score impact of total balance in revolving accounts

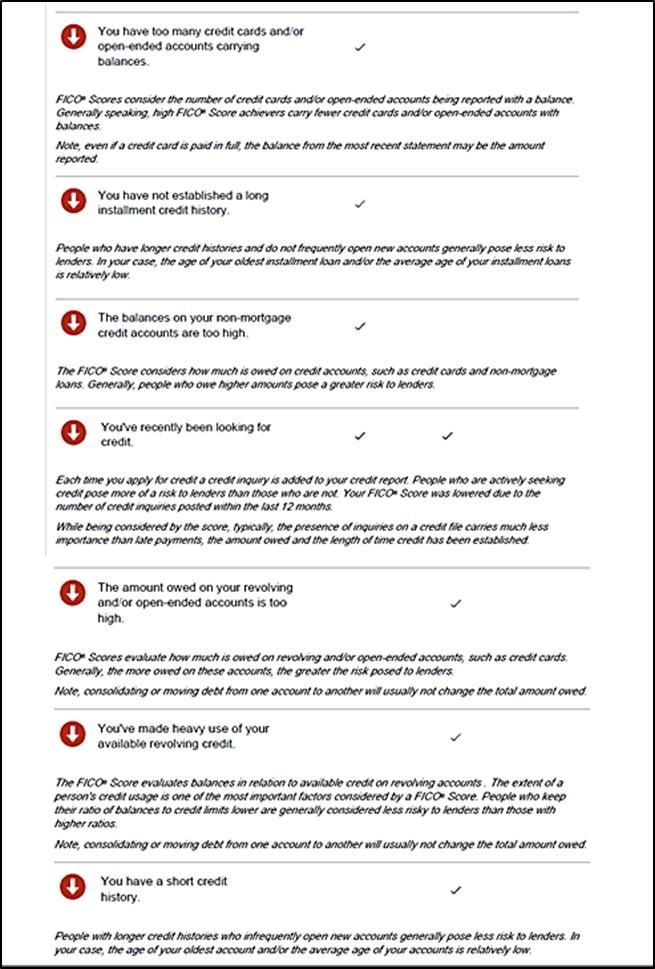

@Revelate wrote:Well jeez, nothing like pulling a 1B Experian report to see that in fact I was mistaken.

EX FICO 2: explicitly a two decade old FICO 98 model still in use for the mortgage trifecta:

- 4. The balances on your non-mortgage credit accounts are too high.

That is from a HELOC. And it's a double-whammy too as get this:

- 1. You've made heavy use of your available revolving credit.

EX FICO 3 that I don't know of a single lender that ever used:

- 2. The amount owed on your revolving and/or open-ended accounts is too high.

For reference the HELOC is sitting at $18,889 / $27,416, high balance according to the credit report of $19,047 and to be fair I'm not 100% certain how HELOC's are scored under FICO 98 I assumed standard revolving with the limit taken into effect, I know they aren't excluded like they are in EQ FICO 5 / TU FICO 4 and all FICO 8/9 models.Interestingly appears I might have gotten a similar +30/40ish points with October similar to EQ FICO 5, wish I'd looked at this a few days ago to see if that happened early as it appeared to on EQ.ETA: the only other revolving balance on there is $1,930/$43,500 which presumably is a non-issue, everything else $0.

FML I feel like an idiot today.

The FICO 3 one could easily be an percentage, and the FICO 2 one maybe though the heavy use one we know to be percentage and that other one is suspect. 20 year old algorithm that we don't know that much on unfortunately when it comes to reason codes.

Sigh, seriously sloppy thinking. Sorry.