- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Scores changing for reasons that don't generate al...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Scores changing for reasons that don't generate alerts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scores changing for reasons that don't generate alerts

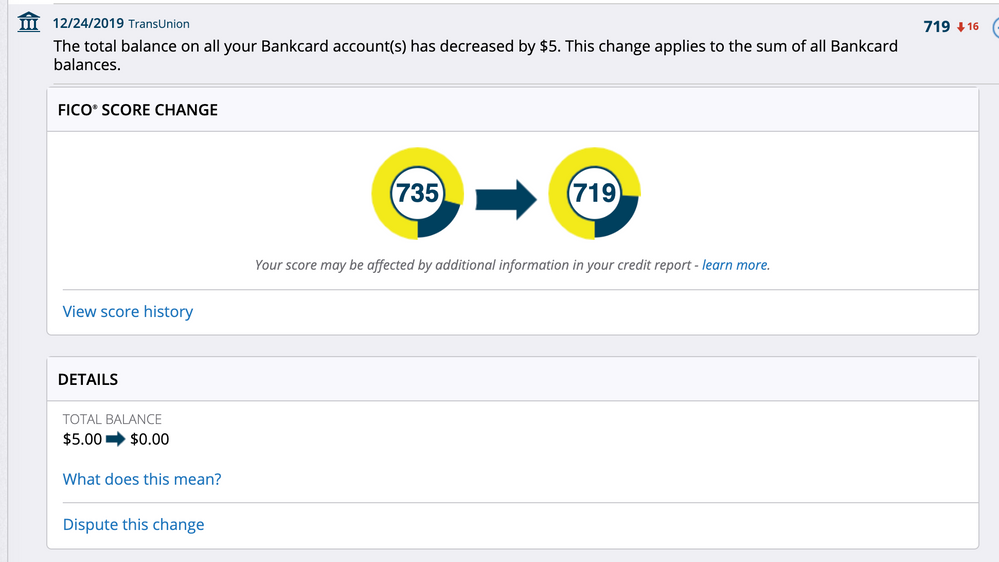

Just before Christmas, my TU score went down about 14 points, for no apparent reason. I got an alert saying that my score had changed "for a reason not tracked by MyFICO alerts." I thought it was weird, but it didn't bother me, because I think my scores are unrealistically high anyway. I actually wish they'd go down to reflect my actual odds of being approved for stuff. Still, it was puzzling.

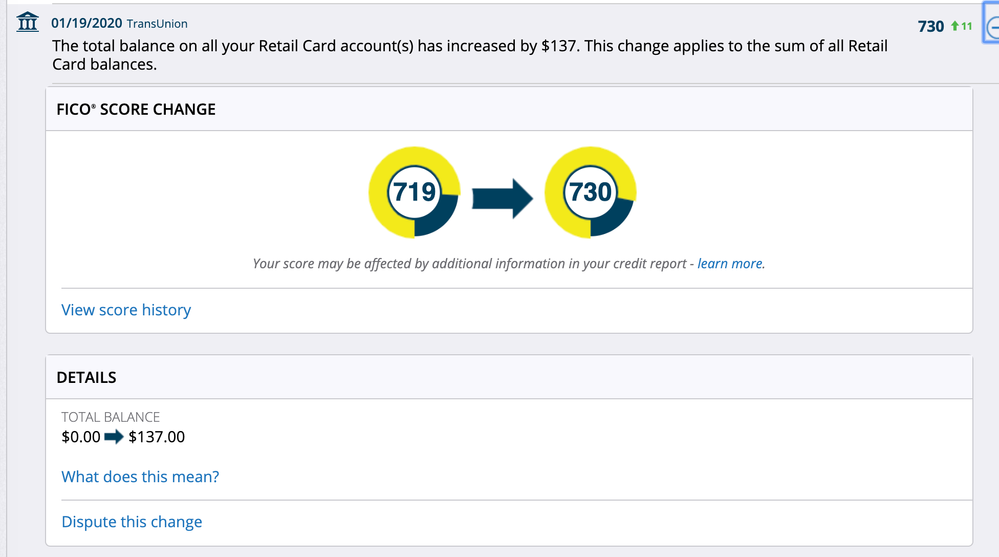

Today, the opposite happened - my TU score pretty much regained the points it lost in December, again for no apparent reason.

See screenshots below. If anything, the alert suggests it should have gone up in December and gone down now, but it did the opposite. I am sure there are reasons, but I don't know how to figure the reasons out.

There are no X factors that would give an obvious answer. My balances have fluctuated a bit, but nothing significant (and generally opposite of what you'd expect with the score). No new accounts have appeared on TU for several months. The Apple Card is new, but hasn't appeared on TU yet. I did get one HP for Apple on Dec. 25, which is after the December drop. There was no further drop due to the HP.

Any likely culprits for these fluctuations? I understand that my profile is pretty weird, so I might have weird factors that don't apply to most people (heavy credit-seeking and numerous inquiries), but I don't see an obvious way those factors would be in play in these specific score changes.

Thanks!

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scores changing for reasons that don't generate alerts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scores changing for reasons that don't generate alerts

Total bankcard or credit cards went from $5 to $0. Loss points. Then a month later one of the cards reported a balance. You got points back.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scores changing for reasons that don't generate alerts

Total balance of $0 could be the issue, but let me add a couple of details to see if they are compatible with the theory.

1 - At all points, the card on which I am an AU has reported a balance. So if you count that the same as my cards, there was never a time when my bank cards collectively had a $0 balance. But if AU cards do not count in that measure, that fits the theory.

2 - My Gold Card reported a balance of $26 on Jan. 4, but I only got the points back on TU today. If charge cards do not count in this measure, that fits the theory.

Thanks!

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scores changing for reasons that don't generate alerts

@KJinNC wrote:Total balance of $0 could be the issue, but let me add a couple of details to see if they are compatible with the theory.

1 - At all points, the card on which I am an AU has reported a balance. So if you count that the same as my cards, there was never a time when my bank cards collectively had a $0 balance. But if AU cards do not count in that measure, that fits the theory.

2 - My Gold Card reported a balance of $26 on Jan. 4, but I only got the points back on TU today. If charge cards do not count in this measure, that fits the theory.

Thanks!

Right on both counts actually; AU cards don't count for everyone; actually the all zeroes test is the most elegant way of determining whether an AU counts or not.

Amex charge cards are not included at least for FICO 8/9 in the number of accounts (revolvers for those two on my data set) with balances calculation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scores changing for reasons that don't generate alerts

Also, I realized after my last post that the score change that I illustrated was on TransUnion, which does not include the AU card. It's on EQ and EX but not on TU. However, I had similar December falls and January increases on the other two, they just weren't as easy to illustrate. They all fell on the same day, but EQ and EX rose sooner than TU.

I guess I'll chalk it up to $0 balance. (I wonder why MyFICO doesn't give that as a reason?)

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scores changing for reasons that don't generate alerts

As Rev said, you just demonstrated that your AU does not count for version eight and nine. But at least it still counts for the mortgage scores.

Be aware that if your AU card(s) did count, it would also trigger the no revolving balance penalty when it hits zero, independently of your own accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scores changing for reasons that don't generate alerts

@KJinNC wrote:Just before Christmas, my TU score went down about 14 points, for no apparent reason. I got an alert saying that my score had changed "for a reason not tracked by MyFICO alerts." I thought it was weird, but it didn't bother me, because I think my scores are unrealistically high anyway. I actually wish they'd go down to reflect my actual odds of being approved for stuff. Still, it was puzzling.

Today, the opposite happened - my TU score pretty much regained the points it lost in December, again for no apparent reason.

See screenshots below. If anything, the alert suggests it should have gone up in December and gone down now, but it did the opposite. I am sure there are reasons, but I don't know how to figure the reasons out.

There are no X factors that would give an obvious answer. My balances have fluctuated a bit, but nothing significant (and generally opposite of what you'd expect with the score). No new accounts have appeared on TU for several months. The Apple Card is new, but hasn't appeared on TU yet. I did get one HP for Apple on Dec. 25, which is after the December drop. There was no further drop due to the HP.

Any likely culprits for these fluctuations? I understand that my profile is pretty weird, so I might have weird factors that don't apply to most people (heavy credit-seeking and numerous inquiries), but I don't see an obvious way those factors would be in play in these specific score changes.

Thanks!

On 12/24 you did not get an alert saying that 'your score had changed for a reason not tracked by MyFICO alerts.' You got an alert saying that your bankcard balances, according to TU data, had decreased by $5. Additionally, the alert indicated that your TU FICO 8 score had gone down 16 points.

On 1/19 you got an alert saying that your bankcard balances, according to TU data, had increased by $137. Additionally, the report indicated that your TU FICO 8 score had gone down 11 points.

There was no cause and effect between any of these events.

So far I have absolutely zero information as to what might have caused the score increase and score decrease. I would need to know what was in your reports before the change and after. You have given us no information with which to work.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scores changing for reasons that don't generate alerts

In December, I did get the "for a reason not tracked by MyFICO alerts" language or similar. It's not in that screenshot, but I saw it somewhere, probably in the app. Bear in mind that this happened on all three CRs and I'm only showing a desktop screenshot from TU. If I put literally all info about my credit report in this thread, it would be rather lengthy, and I think we'd come to the same conclusion: it's probably due to $0 balance on all of my credit cards (excluding AU and charge) in December, and non-$0 balance in January.

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scores changing for reasons that don't generate alerts

@KJinNC wrote:Also, I realized after my last post that the score change that I illustrated was on TransUnion, which does not include the AU card. It's on EQ and EX but not on TU. However, I had similar December falls and January increases on the other two, they just weren't as easy to illustrate. They all fell on the same day, but EQ and EX rose sooner than TU.

I guess I'll chalk it up to $0 balance. (I wonder why MyFICO doesn't give that as a reason?)

All zeroes isn't one of the alertable triggers.

When we're talking TU you generally get things on balance changes and score changes. The nice thing about the TU service (at least when I had it and don't think it's changed) is one that second class you get full reason codes and that's the only place I'm aware of that's the case for FICO 8.

If you'd gotten that you would've seen something like "no revolving activity" as one of them probably, but being a balance change it doesn't come up like that.

Frankly there's a ton of things which can change the score which isn't an alert in any CMS... which is why we often see people saying WTH when really it was something else entirely and not the alerted reason which caused the score change.