- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Scratching my head over reason codes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Scratching my head over reason codes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

@Anonymous wrote:

TU and EX mortgage also include the completely unrealistic reason code of "You've made heavy use of revolving credit" (given my actual reported util of slightly under 1%). All my revolving accounts are plain credit cards: no charge cards, no AU accounts, no cards with big CLs, etc.

Since those older score models used number and not percentage of accounts, maybe they use number and not percentage of utilization. Back in 1998, maybe a $5000 balance was considered too high regardless of credit limits, but today if you have $500,000 in credit, a $5000 won't break 1% util?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

@Anonymous wrote:

How many accounts do you have showing a balance? (Including installment accounts.)

I have no installment accounts. However, my gas/electric company reports monthly, and it always shows a balance. I have my open gas/electric account on Experian and two accounts on TransUnion (one open, one closed). Although the company says it reports to all three bureaus, Equifax doesn't include it.

I'll dig up all of the reason codes when I have a little more time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

Have you considered overpaying your utility bill one month to see if it will NOT report a balance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

Hi ABCD. The possibility that some FICO models might look partly at raw dollar values in addition to percentage utilization (for revolving balances) has been discussed before on the forum.

The wording of the reason code I am talking about seems to clearly imply % utilization rather than dollar values, however, since it says I have made heavy use of my available credit.

I will have my total dollar value (for CC debt) lowered from $1200 to something like $100 the next time my mortgage score is pulled. I'll let you know if that reason code changes. (I also hope to have my total number of accounts reporting a balance brought down to 1 revolving and 2 installation -- it's currently at 2+2=4.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

Maybe if your CLs add up to whatever amount the old scoring systems couldn't handle, it just dropped them or cut them up in how it deals with calculating utilization percentage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

@Anonymous wrote:

I remember back in the day that FICO couldn't handle accounts with high credit limits....

Maybe if your CLs add up to whatever amount the old scoring systems couldn't handle, it just dropped them or cut them up in how it deals with calculating utilization percentage.

Well it is certainly true that credit limits over a certain size are dropped from total credit limit in the utilization calculation, at least in the older models. That's definitely known to occur. But that you have to have a big CL on a card for that to happen. People have done a lot of testing for that and it looks like 35k would be the smallest that happens (for earlier models).

And that's why I ruled that out as a possible explanation in my case. All my CLs are < 29k. And only one is > 24k.

Bear in mind too that my utilization was < 1%. I just carefully reviewed the report again and its was even lower than what I told you. A total CC debt of $963 with a total CL of about 120k. By any conceivable standard that is a tiny use of available revolving credit, even if a model capped out one's total CL at (say) 50k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

@Anonymous wrote:Interesting that TT has only seen this reason code (too many accounts with balances) on EQ. Our OP saw it on both EQ and TU mortgage (FICO 04). Even more striking, I received it on both EQ and EX mortgage (thus in my case two different models, FICO 04 EQ and FICO 98 EX).

If the old models are looking partly at the actual integer number of accounts showing a balance (four in my case) it makes sense. If they are looking purely at percentage of accounts showing a balance it is silly, since the overwhelming majority of my open accounts are showing $0.

My three mortgage scores are:

EQ = 782 (ceiling 818)

TU = 796 (ceiling 839)

EX = 775 (ceiling 844)

I include the maximum ceiling achievable in the model to indicate that all of my scores are a good distance away from being perfect, which I know might be a confounder (as Revelate observes) when looking at squirrely reason codes.

TU and EX mortgage also include the completely unrealistic reason code of "You've made heavy use of revolving credit" (given my actual reported util of slightly under 1%). All my revolving accounts are plain credit cards: no charge cards, no AU accounts, no cards with big CLs, etc.

CGID - My TU and EX Fico 04 and EX Fico 98 scores have not dropped below 800 - thus no reason statements to share. I did have EX Fico 98 Auto industry option drop below 850 a couple times and TU Fico 04 Bankcard. The top statement on EX 98 Auto was "You've made heavy use of available revolving credit".

A fresh look at my updated table continues to show EQ Fico 04 as much more sensitive to #/% cards reporting than either TU or EX. However, with Fico 8 Bankcard enhanced, TU shows more sensitivity to #/% cards reporting than EQ. EX is least sensitive.

I attribute the statement to my AMEX at 100% B/HB. Aggregate credit card utilization was under 3%. On 7/23, 2 of 5 revolvers were reporting small balances + the AMEX at 100%. On 8/6 only the AMEX was reporting a balance, still at 100% B/HB. [note the 4th reason statement "there are no recent balances on your revolving credit accounts." - That's because the AMEX is actually NOT a revolver.]

My findings, summarized in a prior post, relate to how the models treat my profile relative to all accounts reporting balances. EX and TU are rather subdued relative to EQ.

See prior post for a detailed table showing # cards reporting balances along with associated Fico scores. It clearly shows EQ Fico 04 sensitivity.

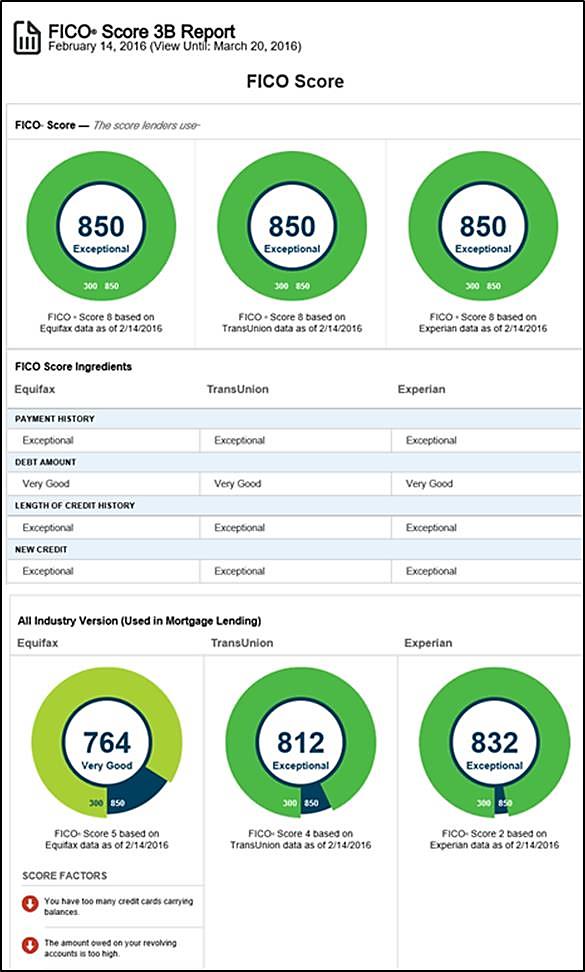

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

What's B/HB? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

It is balance/high balance. With no preset spending limit charge cards, Fico 98 looks at current statement balance as a ratio to highest balance shown in the accounts spending history. That is used to calculate a psuedo % utilization. However, a true charge card has 1 month pay in full terms, it is not a revolving account. Revolvers allow carryover of balances as long as a minimum payment is made.

Fico 04 and Fico 8 recognize that B/HB is not a utilization and don't factor it in. For example, I could charge $35k on my NPSL charge card although HB shows $1997. So, in reality a $1997 charge is only a fraction of the credit that AMEX would be willing to extend me on my charge card.

If you get a credit report, you will see a field that is called "high balance". That field is shown for all accounts whether credit or charge cards.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Scratching my head over reason codes

Here’s the full list of reason codes. I also included my March scores and reasons.

May 2017

Card 1: Balance $1,325 / Limit $21,200 (7% util.)

Card 2: Balance $873 / Limit $10,000 (9% util)

Card 3: Balance $0 / Limit $5,000 (0% util)

Card 4: Balance $0 / Limit $4,000 (0% util)

Card 5: Balance $0 / Limit $2,800 (0% util)

Card 6: Balance $0 / Limit $2,700 (0% util)

———————

Total: Balances $2,198 / Limits $45,700 (5% util.)

Equifax (798)

You opened a new credit account relatively recently.

You have a short credit history.

You have too many credit accounts with balances.

You've recently opened too many new credit accounts.

TransUnion (763)

You opened a new credit account relatively recently.

You have not established a long revolving credit history.

You have no recent activity from a non-mortgage installment loan.

You have too many credit accounts with balances.

Experian (788)

You've recently been looking for credit.

You have a short credit history.

You've made heavy use of your available revolving credit.

You've recently opened too many new credit accounts.

April 2017

Card 1: Balance $0 / Limit $15,000 (0% util.)

Card 2: Balance $414 / Limit $10,000 (5% util)

Card 3: Balance $12 / Limit $5,000 (1% util)

Card 4: Balance $0 / Limit $4,000 (0% util)

Card 5: Balance $0 / Limit $2,800 (0% util)

Card 6: Balance $0 / Limit $2,700 (0% util)

Card 7: Balance $0 / Limit $10,300 (0% util)

Card 8: Balance $0 / Limit $4,000 (0% util)

———————

Total: Balances $426 / Limits $53,800 (1% util.)

Equifax (798)

You opened a new credit account relatively recently.

You have a short credit history.

You have too many credit accounts with balances.

You've recently opened too many new credit accounts.

TransUnion (767)

You opened a new credit account relatively recently.

You have not established a long revolving credit history.

You have no recent activity from a non-mortgage installment loan.

You have too many credit accounts with balances.

Experian (798)

You've recently been looking for credit.

You have a short credit history.

You've recently opened too many new credit accounts.

March 2017

Card 1: DIDN’T EXIST

Card 2: Balance $0 / Limit $10,000 (0% util)

Card 3: Balance $23 / Limit $5,000 (1% util)

Card 4: Balance $0 / Limit $4,000 (0% util)

Card 5: Balance $0 / Limit $2,800 (0% util)

Card 6: Balance $0 / Limit $2,700 (0% util)

Card 7: Balance $0 / Limit $10,300 (0% util)

Card 8: Balance $0 / Limit $4,000 (0% util)

———————

Total: Balances $23 / Limits $38,800 (1% util.)

Equifax (803)

Because your score is high, negative score factors present with your score are less relevant and therefore not provided.

TransUnion (783)

You opened a new credit account relatively recently.

You have not established a long revolving credit history.

You have no recent activity from a non-mortgage installment loan.

You've recently been looking for credit.

Experian (807)

Because your score is high, negative score factors present with your score are less relevant and therefore not provided.