- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Testing Credit Card Utilization Thresholds

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Testing Credit Card Utilization Thresholds

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

@Anonymous wrote:

If you go to Experian or whatever you’re going to see they are rounded to the even dollar as far as the bureau knows, so that’s the information the algorithm gets, but then you have to average them and round up and that’s the number of the algorithm uses.

What do you mean average them? Average the total balances?

FICO® Score 8: EX 788 TU 791 EQ 785 05/09/23

Goal: Was 740 across all bureaus. DONE!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

Right you take all the reported balances which will be even dollars and then you do a sum function in excel and then you also do a sum function on the credit limits. Then you divide the first sum by the second sum.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

Edit removed spoke wrong half-asleep.

There is no average function involved you simply sum the reported (truncated whole number, no cents) balances divided by the sum of the credit limits and then you round up the percentage to the next whole number.

@mowglidude I apologize to you, in my lack of sleep, I don't know where the average function came, from I totally apologize. I think I've corrected the post in this thread. Ill go back and check further. I profusely apologize, forget everything I said about average they should be sums.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

Today another card posted from 59% individual UT to 0% UT and my score increased another 12 points, to 761 EX FICO 8 today. That is after a 15 point gain yesterday. Nice! My aggregate UT went from 29.48% yesterday to 24.59% today. I'm encouraged to see my scores when the next 3 accounts post in the coming week.

FICO® Score 8: EX 788 TU 791 EQ 785 05/09/23

Goal: Was 740 across all bureaus. DONE!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

Another card posted from 67% individual UT, down to 27% and my aggregate UT dropped from 24.01% to 17.4%. My score went from 761 - 775 today, a 14 point gain on EX FICO 8.

FICO® Score 8: EX 788 TU 791 EQ 785 05/09/23

Goal: Was 740 across all bureaus. DONE!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

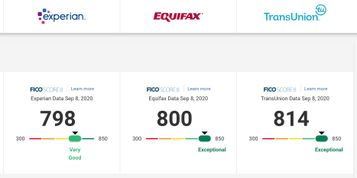

Oh happy day! Another three cards posted today, one from 67% individual UT, down to 0% and one from 66% to 27% individual UT. I also had a 1% individual UT go down to 0% UT, if that matters. My aggregate UT dropped from 17.4% to 10.61%. My score went from 775 - 798 EX FICO 8, another 23 point gain. I also pulled TU and EQ FICO 8 reports today after 30 days. EQ FICO 8 score went from 702 on Aug 7th, to 800 today, a 98 point gain in the last 30 days. TU FICO 8 went from 708 on Aug 7th, to 814 today, a 106 point gain. Both EQ and TU still have not posted the 67% to 0% card. I am pretty happy thus far. Next test coming up will be to post aggregate UT going below the 8.9% threshold and see where my score goes from there. Stay tuned.

FICO® Score 8: EX 788 TU 791 EQ 785 05/09/23

Goal: Was 740 across all bureaus. DONE!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Testing Credit Card Utilization Thresholds

@mowglidude wrote:Oh happy day! Another three cards posted today, one from 67% individual UT, down to 0% and one from 66% to 27% individual UT. I also had a 1% individual UT go down to 0% UT, if that matters. My aggregate UT dropped from 17.4% to 10.61%. My score went from 775 - 798 EX FICO 8, another 23 point gain. I also pulled TU and EQ FICO 8 reports today after 30 days. EQFICO 8 score went from 702 on Aug 7th, to 800 today, a 98 point gain in the last 30 days. TU FICO 8 went from 708 on Aug 7th, to 814 today, a 106 point gain. Both EQ and TU still have not posted the 67% to 0% card. I am pretty happy thus far. Next test coming up will be to post aggregate UT going below the 8.9% threshold and see where my score goes from there. Stay tuned.

Congratulations ![]()

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682