- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- The $2 credit trick tested and proven. It really f...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

Have you heard of the $2 trick or $3 trick if you use a Discover Card.

The premise is that it's better to leave $2 on one Visa/MC/AMEX/Retail store card credit card or $3 on a Discover card (leaving it on your highest limit credit card is the best case scenario) then to have a $0 revolving debt balance showing on all credit cards. The theory is by doing this you will maximize every last drop of points that you can squeeze out of the dark credit underlord known as the FICO scoring model.

Since I have daily real FICO 08 pulls with CCT and I'm about to go on my first major and targeted app spree I wanted to make sure I look as close to perfect to all the lenders I'm going after and CLI requests that I will be asking for.

My Experian score was 761 on 11/27 and I had a 5.7% UTI with a $7,351 debt balance on one credit card, then on 11/28 I had 0% UTI with $0 debt balance (paid card off) and my score plummeted down 10pts to 751 on a perfectly clean report.

No AAoA change, no oldest tradeline age change, no inquiries added or fell off, no other balances reported or changed, no positive accounts aged off. The only change was my one card reporting $0 instead of $7,351. Talk about how screwed up FICO is.

Then minutes ago I was hoping my $35K Lowe's account (my highest credit limit card) would report the $3.32 I purposely left on their and viola it's back up 12pts from yesterday. I's my highest score ever on Experian.

761 ==> 751 ==> 763

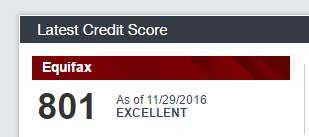

My Equifax.com score also went up 15pts and it's my first 800 score on Equifax (I hit a FAKO 800 score on Credit Sesame who pulls TU on 7/26). ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

I'm not understanding what this "trick" is. Are you trying to convey something new or are you giving the usual "let 1 card report a small balance" advice that we read about on here frequently? I thought that the Discover "trick" you were referring to was if you leave a very small balance with them (maybe $2) that they wipe it clean to $0 at the end of the cycle so over the course of the year one could save $24. I guess I'm unclear as to what Discover has to do with it, as one could leave a small balance on essentially any revolver, no?

I also tend to disagree with your statement on how screwed up FICO is. Assuming you have no cards reporting a balance, you aren't using your revolving credit at all in the eyes of the scoring algorithm so that's what points are lost. It's the same premise as paying off an installment loan and losing points. When I was very new to understanding how scoring works I found this to be bogus, but I now completely understand it and think it makes sense that if one isn't using their credit (revolver, installment) they shouldn't get more points than someone that is using it currently but extremely responsibly (nearly paid off).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

I think the title and the information doesn't match. The post has very good data.

- if all cards are reporting $0, your score will go down

- if one card has a higher balance, your score is not maxed

- if only one card reports $2, $3, you get max scoring

- if only one card reports $1, it may get reported as $0, lowering your score.

It doesn't mean that if the card reported $10 or more, it will get less than max score. That's why I think the title is a little off but the information is very good, proof that the score drops if all cards are at $0 and max score if only 1 card report a low balance ($2 or more).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

@Anonymous wrote:Have you heard of the $2 trick or $3 trick if you use a Discover Card.

The premise is that it's better to leave $2 on ONE Visa/MC/AMEX/Retail store card credit card or $3 on a Discover card (leaving it on your highest limit credit card is the best case scenario) then to have a $0 revolving debt balance showing on all credit cards. The theory is by doing this you will maximize every last drop of points that you can squeeze out of the dark credit underlord known as the FICO scoring model.

Since I have daily real FICO 08 pulls with CCT and I'm about to go on my first major and targeted app spree I wanted to make sure I look as close to perfect to all the lenders I'm going after and CLI requests that I will be asking for.

My Experian score was 761 on 11/27 and I had a 5.7% UTI with a $7,351 debt balance on one credit card, then on 11/28 I had 0% UTI with $0 debt balance (paid card off) and my score plummeted down 10 pts to 751 on a perfectly clean report.

No AAoA change, no oldest tradeline age change, no inquiries added or fell off, no other balances reported or changed, no positive accounts aged off. The only change was my one card reporting $0 instead of $7,351. Talk about how screwed up FICO is.

Then minutes ago I was hoping my $35K Lowe's account would report the $3.32 I purposely left on their and viola it's back up 12pts from yesterday and it's my highest score ever on Experian.

761 ==> 751 ==> 763

My Equifax.com score went up 15pts and my first 800 score.

I would be interested to know what a balance $7351 represented in terms of the card's utilization. Specifically if it was over 30% or over 50%. Can you update with that information?

Best I can tell it would be one of the below percentages. Based on your comments, it probably was not the Lowes $35k CL card

| 35000 | 21.0% |

| 25000 | 29.4% |

| 15000 | 49.0% |

| 10000 | 73.5% |

| 9000 | 81.7% |

I generally contend that a card reporting a balance of 20% to 29% while maintaining overall utilization below 9% would score the same as a card reporting a balance in the 1% to 9% range while maintaining overall utilization below 9%. In other words, I don't believe there is a negative threshold under 30% on Fico 08 for individual card utilization.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

So the argument here is that one card reporting a balance of $2 or $3 somehow results in greater points gained over the card reporting say $5 or $6? I'm just struggling to figure out what this new "trick" is. We've always heard of letting 1 card report a small balance... so now we're basically trying to determine if there's a threshold for that one small balance? People have argued in the past that 1%-9% utilization results in the same score... then some suggested perhaps a 5% midpoint. I have not heard of a threshold between 0% and 1% though as my understanding was that all balances over $0 (as long as they are reported) results in the account as being seen as utilized 1%.

I think it's also important to mention that more accounts reporting balances does not necessarily lower score. For my profile, it doesn't matter if I let 1 card report a small balance or all of my cards report a small balance - my score doesn't change. The only time it does change is if none of my cards report a balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

There are a variety of things that could translate to a trivial 2 point change between $7351 reporting on one card and $3.32 on a different card. As I recall SJ reported a 2 point shift crossing over the 30% threshold for a card. Mostly curious on the details of this situation.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

@Anonymous wrote:So the argument here is that one card reporting a balance of $2 or $3 somehow results in greater points gained over the card reporting say $5 or $6? I'm just struggling to figure out what this new "trick" is. We've always heard of letting 1 card report a small balance... so now we're basically trying to determine if there's a threshold for that one small balance? People have argued in the past that 1%-9% utilization results in the same score... then some suggested perhaps a 5% midpoint. I have not heard of a threshold between 0% and 1% though as my understanding was that all balances over $0 (as long as they are reported) results in the account as being seen as utilized 1%.

I think it's also important to mention that more accounts reporting balances does not necessarily lower score. For my profile, it doesn't matter if I let 1 card report a small balance or all of my cards report a small balance - my score doesn't change. The only time it does change is if none of my cards report a balance.

It's nothing new. An alleged credit card guru on another forum promoted it for some time. I'm in a good position to test it myself over the coming months. I don't expect it to amount to much of anything over keeping a larger 1% balance, or even a less than 9% balance on one card, but I will keep an open mind and use the scientific method as best I can, and see what happens.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

Also something I'm unclear on is what Discover has to do with this. The OP suggested that this trick may only be possible using a Discover card? Why would that be the case if so?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

It's said that Discover will report anything under $3 as 0%. Any other card would be fine with $2. Doesn't need to be a Discover..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The $2 credit trick tested and proven. It really freaking works and makes a BIG difference!

Yes, what has been said by many others on here and the other major credit forum is if you leave less than $3 on a Discover Card when trying this technique it will round down to zero the same way if you leave less than $2 on any other credit card besides Discover.

@Thomas_Thumb

The one credit card was at 49% ($7,351) before it was paid down to $0. I read a lot of your posts on testing since I do a lot of it myself. Thanks for chiming in.

@anyone else that lacks basic reading comprehension.

Nowhere in the subject line or the body of this post did I say this was a "new" trick or even use the word "new". I simply shared my data points and experience after using finally getting to use this technique that I learned on the two credit boards years ago.

The post was also shared for newbies on the board that may have not heard or read about this technique yet.