- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Top score on a dirty scorecard

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Top score on a dirty scorecard

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Top score on a dirty scorecard

I know that FICO 8 scores top out at 850. I have 2 30 day lates on EQ and EX the most recent is Feb 2014., 1 on TU from Aug 2012.

What do you think is the highest score that can be achieved with 1 or 2 30 days lates on a report?

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Top score on a dirty scorecard

At least 770, but probably higher if all other factors are completely topped out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Top score on a dirty scorecard

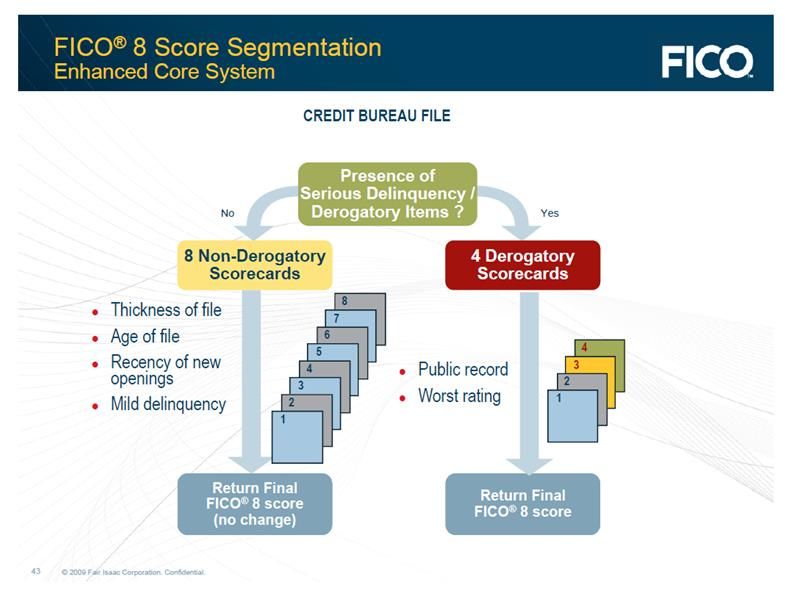

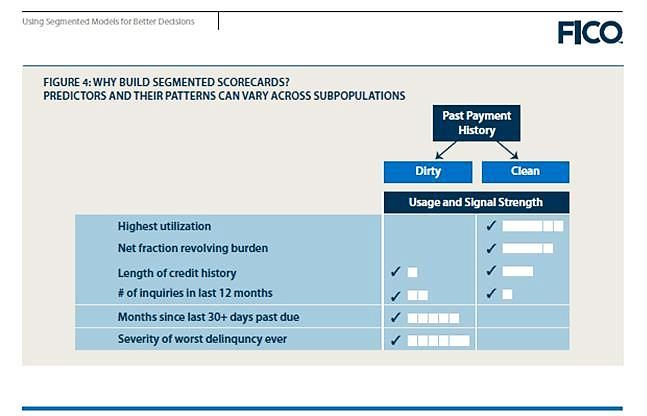

I'll allow Thomas Thumb or some other scoring theorist to comment, but strictly speaking, if the only derogs that a person has are two Day 30 lates, that is actually not a dirty scorecard in FICO 8. I.e. the person has not been shunted from one of the 8 "clean" scorecards to one of the 4 "dirty" scorecards.

How serious do the derogs have to be to get shunted? I am less clear on that, but I am 99.9% sure they have to be worse than a couple Day 30 lates.

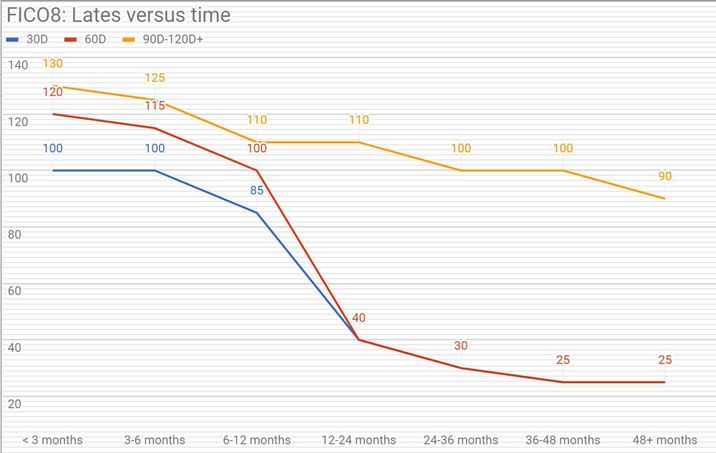

Our OP may simply mean "What's the highest score a person can get who has only a couple Day 30 lates?" The answer there may be "pretty darn high" since FICO 8 softens the effects of Day 30 lates when they get old enough. With a perfect profile otherwise it might easily be in the 810s or so, though TT, BBS and others can comment better.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Top score on a dirty scorecard

A good point regarding clean vs dirty scorecards is brought up by CGID above. I've never been fully clear on 30 day and 60 day lates regarding scorecard assignment (clean vs dirty). I always was sure 100% that an isolated 30 day late would not move someone into a dirty scorecard and I think there was speculation that the same was true of a single 60 day late. As far as multiples, once you move to 2 of either I am not clear on how they are viewed. I believe that TT would be best qualified to comment on this.

My original reply that 770+ would be possible was based on the belief that a dirty scorecard was assigned to such a profile with multiple minor delinquencies. If they in fact don't result in a dirty scorecard, I could definitely see 790-800+ being a possibility.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Top score on a dirty scorecard

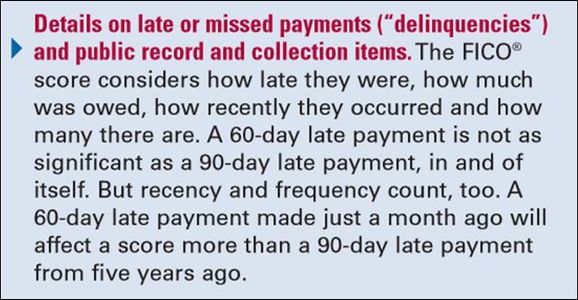

Regarding the question of how high can your score be if you are on a dirty scorecard?

- It depends on how much dirt you have. Not all dirty scorecards have the same score range. There are four dirty scorecards. The worst two scorecards may have an upper bound limit of 680. The least severe has an upper boundy in the 765 to 775 range.

All clean scorecards do not have the same boundries either. Some go to 850 while other clean scorecards may have upper bounds of 820 or 780 depending on the scorecard. There is no way to pin this down because scorecard assignments are not revealed in reports.

Multiple 30 day lates may result in a dirty scorecard assignment based on various posts. However, Fico does indicate a file with a mild delinquency can be assigned to a clean scorecard - particularly if isolated. Mild is generally described as a 30 day late although a 60 day late may conditionally fall in this category.

Age and QTY of mild delinquencies also come into play in scorecard asignment. A new 30 day late may result in allocation of a profile to a dirty scorecard if it has additional recent 30 day lates on file. However, if the file was clean and has no prior lates on record a new 30 day late would shift the file to a lower tier clean scorecard - not a dirty scorecard. If addition of another 30 day late were to cause reassignment to a top tier dirty scorecard; I suspect it would get re-assigned to a lower tier clean scorecard after 12 months if no additional delinquencies occur.

Best I can tell a single recent 60 day late translates to a dirty scorecard. Beyond that it's mostly guesswork. Two competing viewpoints are:

1) As long as the file has the 60 day late on record, it will be assigned a dirty scorecard

2) The file has the potential to move into a lower tier clean scorecard after 24 months.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Top score on a dirty scorecard

30D on FICO 8 is scored in the top 8 pretty scorecards.

60D on FICO 8 is in the bottom 4 derogatory scorecards; might be an age component as TT alludes to, I wasn't tracking my old TU closely when I just had the 60D late in there but I think I didn't get the major reason code shift until that account was excluded.

More to the point though, when I just recently picked up a 60D on TU I went back to reason codes I haven't seen since my tax lien got whacked; also my more recent 30D on EX/EQ do not report serious derogatory whereas my 60D on TU does.

These were my TU FICO 8 reason codes from 4/2018 with a 30D late from 10/2015

- SCORE FACTORS

- The following represents the factors most impacting your FICO Score

- Number of accounts with delinquency.

- Length of time accounts have been established.

- Length of time revolving accounts have been established

That last one is nowhere to be found on derogatory scorecards.

TU FICO 8 Score was 782: and this was with a >80% installment loan utilization and I know I'm dropping points there. No inquiries, no CFA, low revolving... with pretty installment utilization I'm confident could've gotten it above 800, and quite likely as the late continued to age there's a non-zero chance I would've moved up too. Maybe even my AAOA getting to whatever the next breakpoint is (5 years I suspect) I might've picked up some points there too.

Right now I'm sitting at 741 on EX FICO 8 with the same installment utillization and AAOA, but with a CFA on this account, and a 30D late from 4/2018 with this reason code.

You recently missed a payment or had a derogatory indicator reported on your credit report: not entirely sure when this one goes away will have to look back through some old TU reports but ultimately this is going to depress my score for a while, but my guess is I get back up to 780 within 2 years, and by that time I might've passed an installment utilization breakpoint, and in 4 years my CFA drops off and I should be beyond any new account penalties from the Tesla financing at that point. We'll see but I'm guessing I can break 800 in the 4, and maybe 810 or even 820 though I think this one would be a stretch without hammering my mortgage... I'm pretty confident in the 800 in 4 years estimate though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Top score on a dirty scorecard

If you reach 800 that means you are no longer on a dirty scorecard with the aged 60 day late; not that a dirty scorecard can reach 800 - IMO ![]()

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Top score on a dirty scorecard

Reading all the replies here brings up another question for me. In the past couple of months I had 2 120 day lates drop off of CR. So I am pretty certian I am on a dirty scorecard. Since they are no longer there would I move to a new score immediatly or would it take some time for that to happen. Since I just dropped 120 day lates I assume if I moved it would be to a slightly higher dirty scorecard and not a clean one.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Top score on a dirty scorecard

@Thomas_Thumb wrote:If you reach 800 that means you are no longer on a dirty scorecard with the aged 60 day late; not that a dirty scorecard can reach 800 - IMO

Hah!

Actually I doubt I can reach 800 with a 60D late, but I was looking at the 30D on EQ / EX and thinking once I get mostly pretty besides that late and whatever my unfortunate installment utilization is at, I can break 800 and if the installment breakpoints are reached maybe even 820.

You may be right on the age component, I can't do this with FICO 8 because I'm missing a score update somewhere between the tax lien falling off and the 60D being excluded; however, I got some 1B reports and while the FICO 8 base sucks, I can try on FICO 04 and maybe FICO 8 AU.

Actually, yeah TLDR: specifically compare the first and last entries with tax lien and subsequently 60D late - there's reason codes on the FICO 8 BC which don't exist in any of the others... and note the revolving history complaint with an old 60D late, which suggests it might be in the top 8 as well. Not conclusive, as in the serious deliquency one at the bottom it may just be pushed off the list with whatever utilization issue I had at the time, but it explicitly was not there on FICO 04 with the tax lien.

So there could be an age component to the 60D late, tied to that serious deliquency reason code.

FICO 04:

60D old, 30D new, with tax lien:

- 1. You have a public record and/or collection on your credit report.

- 2. You recently missed a payment or had a derogatory indicator reported on your credit report.

- 3. You have a short credit history

60D old, 30D new, no tax lien (lates were on two different accounts):

- 1. You opened a new credit account relatively recently.

- 2. You have one or more accounts showing missed payments or derogatory indicators.

- 3. You have not established a long revolving and/or open-ended account credit history.

- 4. You have a short credit history.

30D new, no tax lien:

- 1. You opened a new credit account relatively recently.

- 2. You have not established a long revolving and/or open-ended account credit history.

- 3. You have a short credit history.

- 4. You recently missed a payment or had a derogatory indicator reported on your credit report

FICO 8 BC:

60D old, 30D new, with tax lien:

- 1. You have a public record and/or collection on your credit report.

- 2. You have a short credit history.

- 3. You have no recent activity from an auto loan.

- 4. You recently missed a payment or had a derogatory indicator reported on your credit report

60D old, 30D new, no tax lien:

- 1. You have one or more accounts showing missed payments or derogatory indicators.

- 2. You have a short credit history.

- 3. You have not established a long revolving and/or open-ended account credit history.

- 4. The remaining balance on your mortgage or non-mortgage installment loans is too high.

30D new, no tax lien:

- 1. You have one or more accounts showing missed payments or derogatory indicators.

- 2. You have a short credit history.

- 3. You have not established a long revolving and/or open-ended account credit history.

- 4. The remaining balance on your mortgage or non-mortgage installment loans is too high.

Score shifts on all of these, but compare to brand spanking new 60D

FICO 04:

- You recently missed a payment or had a derogatory indicator reported on your credit report.

- You have a short credit history.

- You have a serious delinquency (60 days past due or greater) or derogatory indicator on your credit report.

- You've made heavy use of your available revolving credit.

FICO 8 AU:

- You recently missed a payment or had a derogatory indicator reported on your credit report.

- You have a short credit history.

- You have a serious delinquency (60 days past due or greater) or derogatory indicator on your credit report.

- You have no recent activity from an auto loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Top score on a dirty scorecard

@MakingProgressReading all the replies here brings up another question for me. In the past couple of months I had 2 120 day lates drop off of CR. So I am pretty certian I am on a dirty scorecard. Since they are no longer there would I move to a new score immediatly or would it take some time for that to happen. Since I just dropped 120 day lates I assume if I moved it would be to a slightly higher dirty scorecard and not a clean one.

It would depend on the remaining negative items you have on your CR... severity of it/them, age, number of them, etc.