- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Utilization vs. AAoA

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Utilization vs. AAoA

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

@Anonymous wrote:AZEO stands for "all zero except one." It's a good strategy for squeezing out every extra point in the 40 days prior to an important credit application (or any time you are wanting to get some extra points). The understanding is that the remaining card will report a small balance. AZEO does not help you build a higher score long term.

The SS loan technique is described here:

It's for people with no open installment loans.

That SS loan technique is fascinating. I had thought of doing something similar myself -- getting a loan to give me an open installment but I dismissed the idea thinking I'd end up paying a bunch of interest that would outweigh the value to my score. But that method is far more sophisticated than what I thought up. But, as I said, since a car loan is looming for me in about 20 months, I think I'll skip it.

Nevertheless, great write-up, CreditGuy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

@Anonymous wrote:If you are concerned about creditors beginning to incorporate trended data into their decisions, the best thing you can do there is to make sure you never carry a balance. I.e. if a card reports a balance, be sure to pay it in full in the three weeks following the statement date.

If trended data begin to be used, it will be to identify people who carry CC balances -- such people are called "revolvers" and have been shown to be far greater risks for default and serious delinquency. This is contrast to people who always pay in full -- these people are called Transactors. TD will stretch back for the previous 24 months, so start establishing yourself as a transactor ASAP.

I'm not overly concerned about trended data but it is something I want to keep in mind just in case FICO goes the way of future Vantage. Regardless, though I do sometimes have small balances they rarely go over 3 ish percent. Since I got these new cards 4 months ago I have been paying in full. I just have the older one that needs paying down.

How much do you think a low balance like 3-5% really effects the score? Particularly like in my case -- someone with a young, thin file.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

@rmduhon wrote:

@WhiteCleats Those things SouthJamaica mentioned aren't sensitive to utilization in and of themselves. But if your mom maxed her card out, unlikely as it may be, your overall utilization might only be 19%, but you'll get penalized for having a maxed card on your reports. And that penalty could be a big one.

Yeah, really good point. Something else to consider.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

@WhiteCleats wrote:

How much do you think a low balance like 3-5% really effects the score? Particularly like in my case -- someone with a young, thin file.

A 3%-5% balance won't adversely impact score at all. Anything in the 1%-8.9% range is ideal and will maximize your FICO scores. The only time this may not be true is if you have over 50% of your cards reporting a balance. So, using an example of someone with exactly 3 credit cards, they'd want to allow 1 of them to report a small balance in the 1%-8.9% range. 1 of 3 is 33%. 0 reporting balances would result in a big score hit. 2 of them reporting balances would be 67% of cards and possibly result in a slight ding, and 3 of them reporting balances would be 100% which could also result in a slight ding. 1 of 3 in this example would be ideal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

@Anonymous wrote:

@SouthJamaica wrote:One never actually knows what score will be used. I only recently learned about FICO's 'telecommunications' score, of which I had never heard -- not even on this forum -- which is apparently used by cell phone companies and the like.

Are you certain that this score is made by FICO (and that it is a model different from the major models we are familar with, e.g. FICO 8 Classic etc.)?

No I'm not

Also do you happen to know what CRA database is used for the score? Is it NCTUE?

Here is a telecom scoring model made by Equifax, called the Exchange Risk Score:

http://www.equifax.com/pdfs/corp/EFS_1025_Exchange_risk_score_0539-10.pdf

It draws its data from NCTUE apparently.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

@SouthJamaica wrote:

@Anonymous wrote:

@SouthJamaica wrote:One never actually knows what score will be used. I only recently learned about FICO's 'telecommunications' score, of which I had never heard -- not even on this forum -- which is apparently used by cell phone companies and the like.

Are you certain that this score is made by FICO (and that it is a model different from the major models we are familar with, e.g. FICO 8 Classic etc.)?

No I'm not

Also do you happen to know what CRA database is used for the score? Is it NCTUE?

Here is a telecom scoring model made by Equifax, called the Exchange Risk Score:

http://www.equifax.com/pdfs/corp/EFS_1025_Exchange_risk_score_0539-10.pdf

It draws its data from NCTUE apparently.

OP - The below is a little off topic but, wanted to clarify source for some other scoring models and note other Fico "behind the scene" consumer scores

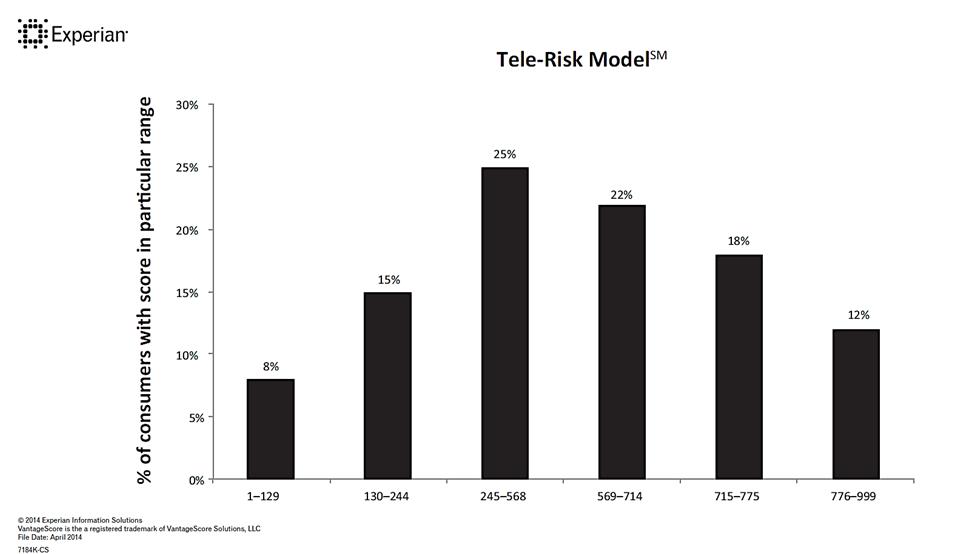

The Experian Tele-Risk and Telecommunications, energy and Cable Risk scoring models are sourced from VantageScore solutions.

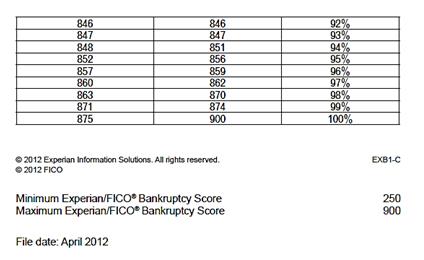

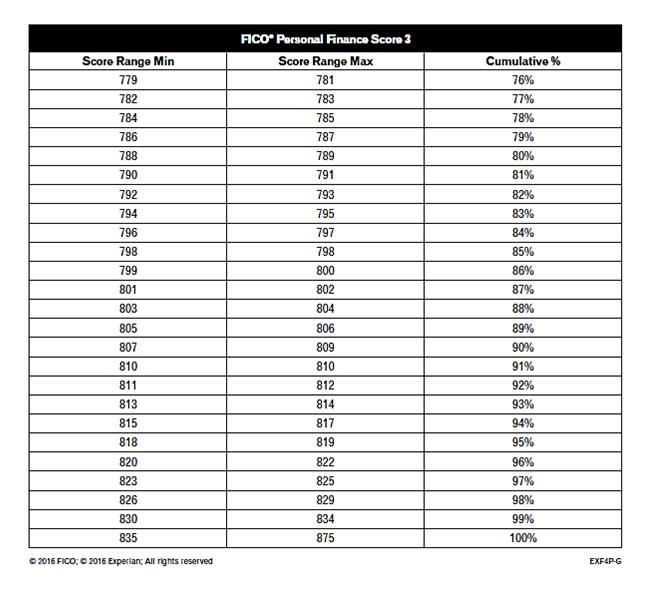

The Experian Fico Bankruptcy score which I pasted a complete score table on in another post is, as the name implies, a Fico model. There are other Fico models as well (Examples: Experian Fico Personal Finance Score and Fico Score XD)- which are not available directly to the consumer.

The Experian Bantruptcy Watch score that has been discussed in other threads is not Fico. It appears to be Experian's own model but could be 3rd party sourced through VantageScore.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

@WhiteCleats wrote:

@Anonymous wrote:AZEO stands for "all zero except one." It's a good strategy for squeezing out every extra point in the 40 days prior to an important credit application (or any time you are wanting to get some extra points). The understanding is that the remaining card will report a small balance. AZEO does not help you build a higher score long term.

The SS loan technique is described here:

It's for people with no open installment loans.

That SS loan technique is fascinating. I had thought of doing something similar myself -- getting a loan to give me an open installment but I dismissed the idea thinking I'd end up paying a bunch of interest that would outweigh the value to my score. But that method is far more sophisticated than what I thought up. But, as I said, since a car loan is looming for me in about 20 months, I think I'll skip it.

Nevertheless, great write-up, CreditGuy!

Many people choose to implement the SSL technique as a precursor to getting that first important loan (car or home typically). This way they get a 30 point boost, and that can help them secure best rates with the loan they actually care about. You'll lose that bonus once the new loan reports, but you'll have secure the best terms possible which is what you were aiming for.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

@Anonymous wrote:

A 3%-5% balance won't adversely impact score at all. Anything in the 1%-8.9% range is ideal and will maximize your FICO scores.

So that I'm clear, utilization between 1%-8.9% is actually better than 0% utilization in terms of score?

The only time this may not be true is if you have over 50% of your cards reporting a balance. So, using an example of someone with exactly 3 credit cards, they'd want to allow 1 of them to report a small balance in the 1%-8.9% range. 1 of 3 is 33%. 0 reporting balances would result in a big score hit. 2 of them reporting balances would be 67% of cards and possibly result in a slight ding, and 3 of them reporting balances would be 100% which could also result in a slight ding. 1 of 3 in this example would be ideal.

In my specific situation I have 4 cards. The majority of the time only one reports a balance and I'm working on paying that down. It's currently at 16% utilization. The other 3 are paid in full. Occasionally I carry a balance on a second card but it's paid in full soon after that. So in my worst case scenario I have 50% of my cards with a balance and total utilization is under 9%. Is any of that dinging my score? Would the best thing be to never allow more than 1 card to report a balance? Or, am I over thinking this and it doesn't matter until I'm apping for a car?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization vs. AAoA

@Anonymous wrote:

Many people choose to implement the SSL technique as a precursor to getting that first important loan (car or home typically). This way they get a 30 point boost, and that can help them secure best rates with the loan they actually care about. You'll lose that bonus once the new loan reports, but you'll have secure the best terms possible which is what you were aiming for.

GREAT idea. I'm going to get on that like yesterday so I can have as much payment history as possible when I app for the car. Thank you so much!