- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Utilization

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

@Anonymous wrote:SJ, I know we've agreed to disagree on the installment loan payoff penalty in the past, but I'm curious about your statement above regarding revolvers. How would you suggest the FICO algorithm verify revolving credit use if not a single balance is present?

They can tell from the report that an account was active even though its reported balance is zero. If they wanted to use recent activity as a factor they could easily include that in their algorithm.

Even the abbreviated report we get from MyFICO has "last activity" as a separate item.

So please don't tell me the reason for requiring an open balance has to do with knowing that the account was active.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

@Thomas_Thumb wrote:

@Anonymous wrote:Really feel they need to tweek the algorithms in the scoring system. Wife has had a credit score of 850 with 1% utilization. Just recently she paid off her balance on last credit card making her utilization 0%. Result? 14 point drop in FICO score! Based on these results I'm assuming in order to obtain a perfect FICO score you must have a balance left on at least one of your credit cards to stick at 1%. Wow.

If your wife uses one or more credit cards each month she can just let charges report naturally on monthly statements and just pay the reported statement balance(s) in full each month. That's what I do and it keeps things simple.

Of course utilization has a point in time impact on score as does # of accounts reporting balances. If the score drop causes heart burn, it's an easy fix. Allow a statement balance to report or change # cards reporting balances.

T_T there's nothing in OP's original post to suggest that he does not already know that the penalty was for having no balance, and that it could be avoided by having a balance. He's saying that the algorithms should be changed.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

@SouthJamaica wrote:

Even the abbreviated report we get from MyFICO has "last activity" as a separate item.

AMEX doesn't report that little tidbit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

@SouthJamaicaEven the abbreviated report we get from MyFICO has "last activity" as a separate item.

I've never looked at a report from MF, but am looking at my hard copy TU report right now and don't see anything that says "last activity" or something similar anywhere on it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

@Anonymous wrote:Really feel they need to tweek the algorithms in the scoring system. Wife has had a credit score of 850 with 1% utilization. Just recently she paid off her balance on last credit card making her utilization 0%. Result? 14 point drop in FICO score! Based on these results I'm assuming in order to obtain a perfect FICO score you must have a balance left on at least one of your credit cards to stick at 1%. Wow.

It appears you don't necessarily have to report a balance on Classic Fico 8 or Classic Fico 9 (see below) to have an 850 score. It is interesting to note that the reason statement mentions "no balance" not "no activity". Fico reports do have a section for DOLA but, the reason statement mentions balances.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

@Anonymous wrote:

@SouthJamaicaEven the abbreviated report we get from MyFICO has "last activity" as a separate item.

I've never looked at a report from MF, but am looking at my hard copy TU report right now and don't see anything that says "last activity" or something similar anywhere on it.

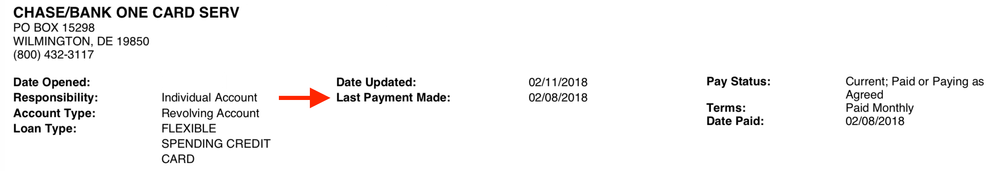

On TransUnion, the date of the "last payment made" is noted. Equifax calls this "date of last payment." Experian lists the dates monthly payments have been made, going back two years.

This info is included for all my cards except AMEX.

Screen cap from TU report, obtained from annualcreditreport.com:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

I completely agree that the algorithms are completely screwed. I have credit limits totaling 68K on 3 credit cards with a zero balance. I charged $11 on one card and my scores dropped by 5 points and FICO calls that 100% utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

Thanks Heaven. We should bear in mind that the data Heaven is describing are trended data, which were not available until years after FICO 8 was released. Even when FICO 9 was being developed, the actual submission of TD was spotty (many creditors not doing it) and therefore could not be relied on by developers. (And as Heaven observes some are still not.)

I still think the most reasonable assumption is that the All Zero Penalty is just a legacy from a time when there wasn't a good way to assess whether a person was using his credit cards at all. Nobody has been a bigger cheerleader for the golden age of TD than me, where all kinds of things would get changed (including FICO's emphasis on ultralow utilization and its failure to distinguish revolvers from transactors). But until TD submission becomes nearly universal and the developers have time to build it in to the next models, and then those models actually get used, I expect we will still need to show a small balance on one card.

PS. One reason to believe the Legacy theory is that I haven't heard a good alternative. Cause FICO is stupid or cause FICO sucks or cause FICO hates me strike me as unlikely.

A more sophisticated theory (though it has an Illuminati consiracy feel to it) is that FICO is in bed with all the big banks, and has agreed to structure its models so that it will punish customers who aren't paying the banks a lot of interest. The problem with that is that all you need to do to avoid the All Zero penalty is report a $5 balance on one card -- and you don't have to pay a penny of interest even on that. So the Illumanati theory seems to fail there, whereas the Legacy theory explains that fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

@CGID....Once trended data is actually commonly used, I think it would be naive to not think CC issuers will use the trended data to identify who the strict transactors are. The CC industry commonly refers to us transactors as deadbeats, and would be happy to lose our business. Truth is transactors are just not as profitable for them, if profitable at all. They might never admit it publicly, but their preference for reasonably responsible revolvers is real, and I kind of dread trended utilization data ever being commonly used. I have not payed a cent in credit card interest in 20 years, and recieve a couple hundred in rewards almost every year. No way the CC issuers recoup that from swipe fees alone. If too many customers do as I do, annual fees will make a come back in a big way. The issuers count on human nature leading their customers to become revolvers, at least in part.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization

@AnonymousI completely agree that the algorithms are completely screwed. I have credit limits totaling 68K on 3 credit cards with a zero balance. I charged $11 on one card and my scores dropped by 5 points and FICO calls that 100% utilization.

If you went from all $0 balances to reporting an $11 balance, your scores would not drop 5 points. In fact, they'd likely increase 15-20 points since you now are showing revolving credit use. Taking a $0 balance card to $11 also isn't 100% utilization, so I'm not quite sure what gave you that idea?